The Calm Before the Crypto Storm? Bitcoin Volatility Hits 22-Month Low

Bitcoin's wild ride hits unprecedented pause as volatility plunges to levels not seen in nearly two years.

The Great Compression

Trading bands squeeze tighter than a Wall Street banker's bonus expectations. Price action flatlines while institutional money lurks in the shadows—accumulating during the silence.

Market Mechanics on Mute

Derivatives markets show unusual restraint. Options traders park ambitions as spot volumes thin to whisper levels. Even leverage traders dial back risk—for now.

Historical Precedents Scream

Past volatility contractions consistently preceded explosive moves. The 22-month calm mirrors pre-bull market conditions where patience got rewarded explosively.

Traditional Finance's Nervous Glance

While Bitcoin sleeps, legacy markets twitch at every inflation print. Gold bugs and bond traders watch crypto's stability with uneasy curiosity—wondering when the digital dam breaks.

This unnatural peace won't last. Markets abhor vacuums more than hedge funds hate admitting Bitcoin was right all along.

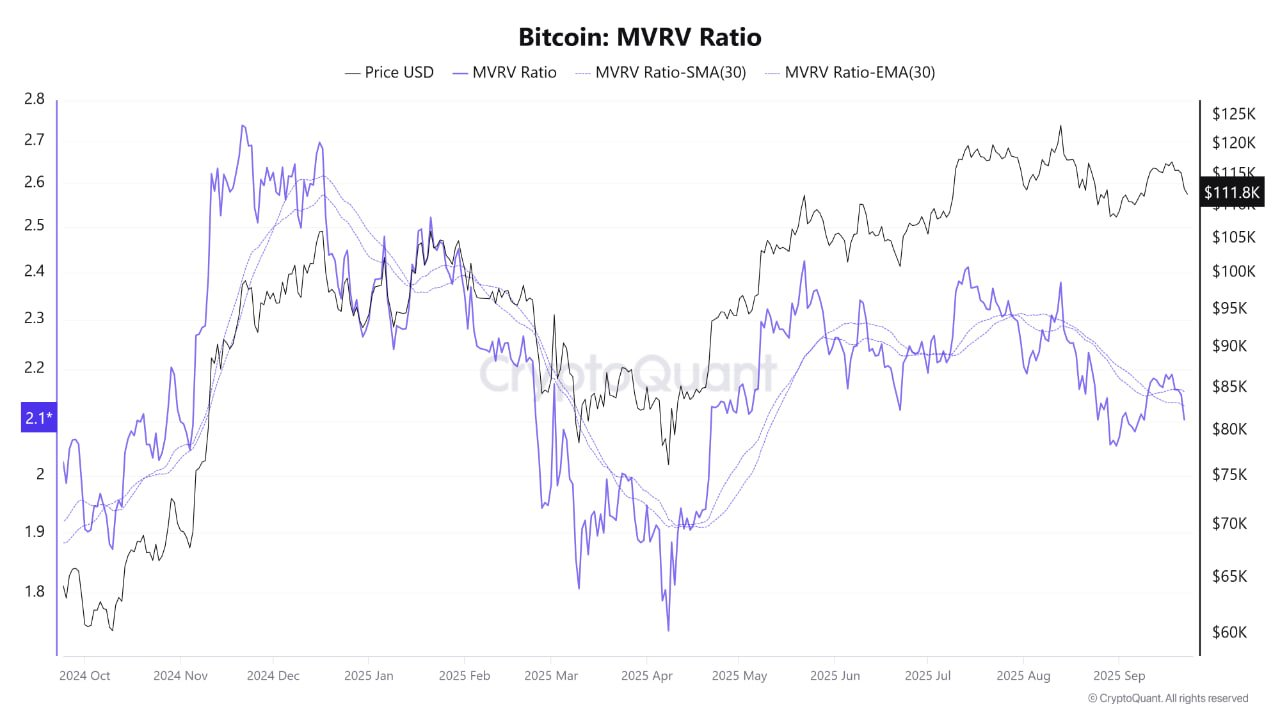

MVRV Ratio Suggests a ‘Wait-and-See’ Approach

Analyst ‘XWIN Research Japan’ pointed out that Bitcoin’s Market Value to Realized Value (MVRV) ratio is at a neutral position of around 2.1. An MVRV of 2.1 indicates that investors are neither seeing major losses nor excessive profits.

This price level is unlikely to trigger a wave of panic selling or natural profit-taking. The analyst explained that in such periods, a “wait-and-see” attitude tends to dominate the market.

This quiet sentiment is further supported by the continued decline in the total balance of Bitcoin held on exchanges, which suggests a weakening of selling pressure. Historically, a decrease in exchange holdings has been a prelude to a supply shortage when demand suddenly surges. XWIN Research Japan suggests that the market may now be experiencing the “calm before the storm.”

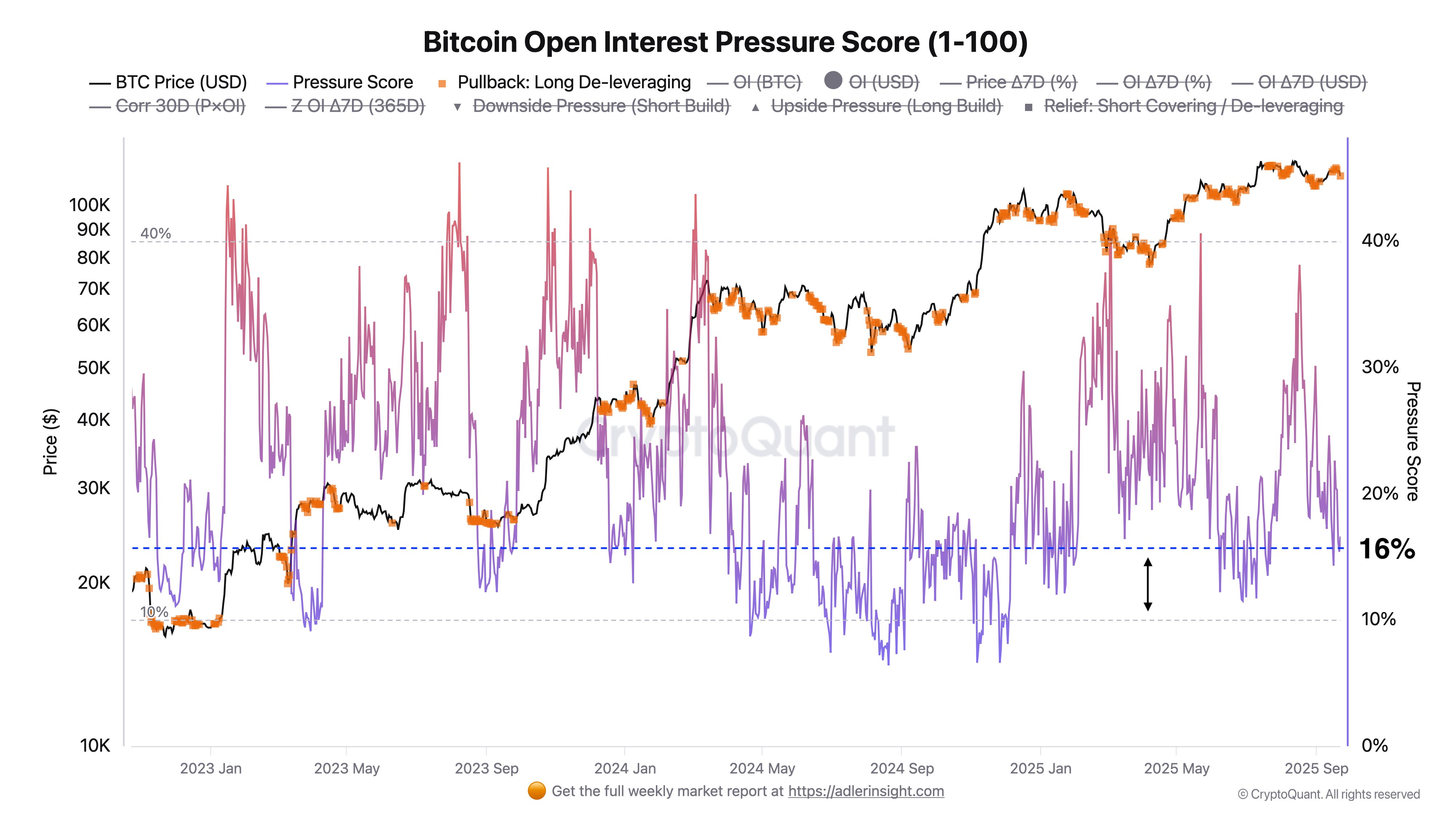

Open Interest: The Key to the Next Move

Another analyst, ‘Axel Adler Jr’, that the recent sharp price drop caused Bitcoin’s open interest to fall by 16%. This suggests that leverage is now at a low level following a recent deleveraging of long positions.

Axel Adler Jr argues that the future price path of bitcoin depends on which direction open interest (OI) begins to accumulate. If long positions increase below a resistance level, the risk of another leverage-driven drop increases. Conversely, if short positions increase during a downturn, the probability of an upward move via a short squeeze rises.

The analyst believes a clear directional signal will emerge when the risk of leverage accumulation/pressure rises above 40% or when it drops to a 10% leverage depletion level, signaling a potential reversal.