September Sees Massive ETF Inflows Flooding Gold and Bitcoin Markets | US Crypto Update

Capital pours into traditional and digital safe havens as investors seek shelter.

Market Movements

Exchange-traded funds tracking both gold and bitcoin recorded substantial inflows throughout September. The parallel surge highlights how institutional money continues diversifying across asset classes despite market uncertainties.

Gold's longstanding reputation as a store of value now shares stage with bitcoin's digital scarcity proposition. Both assets attracted significant capital allocations as investors positioned portfolios for potential economic turbulence.

Wall Street's latest embrace of crypto exposure through regulated vehicles signals maturation beyond speculative trading. Though traditional finance veterans still can't decide whether bitcoin belongs in the commodities or currency aisle.

The synchronized inflows reveal how modern portfolio construction increasingly blends analog and digital assets. Even if Wall Street still charges those juicy management fees for the privilege of buying what anyone can hold themselves.

Crypto News of the Day: Gold Outshines Bitcoin as ETF Inflows Signal Shifting Market Trends

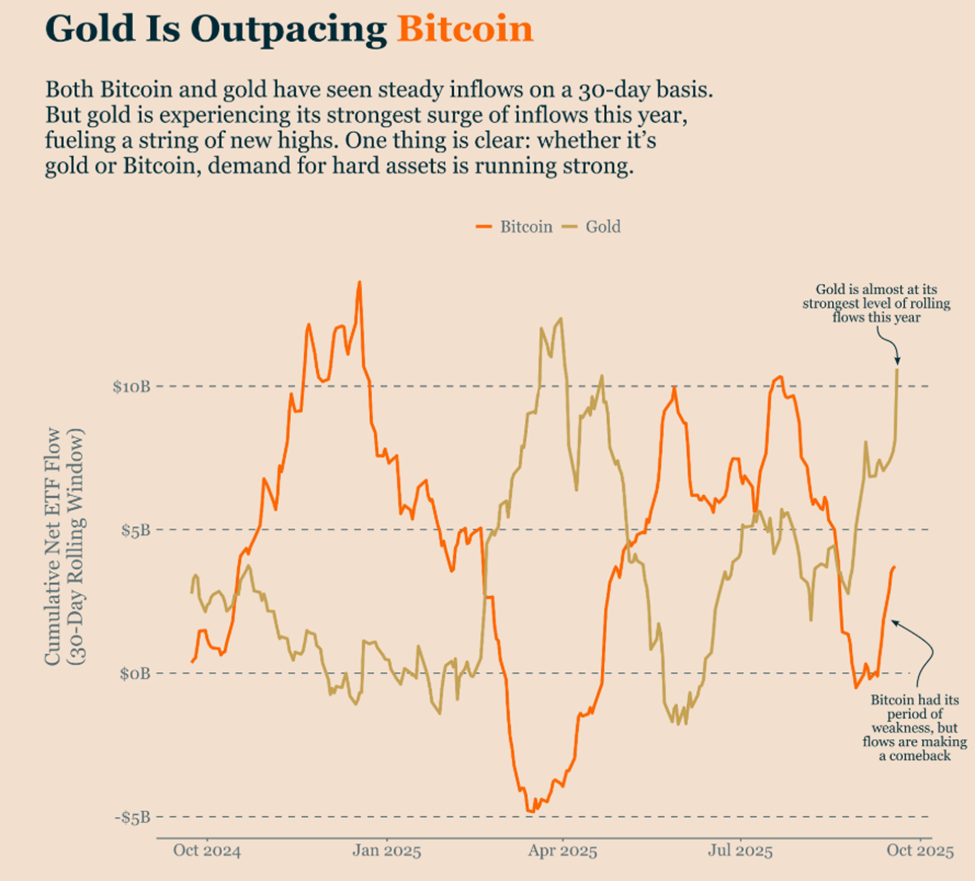

September has been marked by surging ETF inflows into both Gold and Bitcoin. However, gold is stealing the spotlight.

On a 30-day rolling basis, inflows into gold funds are outpacing bitcoin ETFs, with gold nearing its strongest yearly gain.

Experts highlight the growing demand for hard assets like gold and Bitcoin, noting that the trend could continue as the Federal Reserve signals more rate cuts ahead.

“Gold is outpacing Bitcoin…close to its strongest surge of the year, fueling a run of new highs…with the Fed signaling more rate cuts ahead, the trend is likely to continue,” wrote ecoinometrics, a popular account on X.

It aligns with a recent US crypto News publication that indicated that Fed rate cuts could push Bitcoin to $145,000.

Amid the optimism, Deutsche Bank sees Bitcoin joining gold on central bank balance sheets by 2030, as indicated in the previous US Crypto News publication.

The yellow metal has repeatedly set fresh highs, reflecting a sharp rise in investor demand for hard assets as the Federal Reserve signals more rate cuts.

Meanwhile, experts also note the divergence between the two inflation hedges. While Bitcoin’s momentum has cooled after a wave of liquidations, gold’s rally has accelerated.

Gold doesn't stop

Bitcoin comes back pic.twitter.com/XFCItgPHfX

Gold as Collateral in a Shaken Crypto Market

However, not everyone sees this as positive for crypto. Gold advocate Peter Schiff argued that gold’s recent outperformance is a warning sign for Bitcoin holders.

“From 2011 until 2024, gold bugs watched Bitcoiners get rich… Now gold bugs are getting rich while Bitcoin trades sideways. Soon, gold bugs will get even richer as Bitcoiners go broke,” wrote Schiff.

Yet crypto analyst Benjamin Cowen pushed back with perspective. Even if gold’s rally were to multiply tenfold relative to Bitcoin, he noted, it WOULD still be down 99.96% against BTC over the long term.

If Gold rallied 10x against Bitcoin from here, it would still be down 99.96% against Bitcoin. pic.twitter.com/z5fiaMSCfI

— Benjamin Cowen (@intocryptoverse) September 22, 2025This comparison shows how much ground gold would have to make up to rival Bitcoin’s historic performance.

The gold surge comes just as crypto investors grapple with the largest long liquidation event of 2025.

Following the Fed’s first rate cut in nine months, Bitcoin, Ethereum, and other digital assets saw prices plunge unexpectedly, exposing over-leveraged traders.

Kevin Rusher, founder of real-world asset (RWA) lending platform RAAC, said the wipeout should be a wake-up call.

“Seemingly out of nowhere, we have just seen the biggest crypto long liquidation event of the year – right after the Federal Reserve announced its first rate cut in nine months. The sell-off came unexpectedly, like a freak storm, and caught many crypto bulls entirely by surprise,” Rusher said in a statement to BeInCrypto.

He argued that gold’s parallel rally highlights the importance of stability in turbulent markets.

According to Rusher, assets like gold provide the firepower to take advantage of falling prices during major liquidation events.

Despite the setback, the crypto market remains near its all-time high, only about 5% below peak capitalization.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Crypto whales panic-sold and suffered heavy losses amid September market chaos.

- House Republicans urge the SEC to implement Trump’s Bitcoin 401(k) order.

- Bitcoin’s breaking point: BTC below this price would signal a bear market.

- From MrBeast to CZ: Aster’s breakout month draws whales and influencers.

- Ethereum top holders slash holdings, sparking $4,000 breakdown fears.

- Solana hits breaking point as liquidations surge, long-time holders exit.

- Why Pi Network crashed: Leverage, liquidity, and lost community trust.

- Arthur Hayes: Bitcoin to hit $250,00 by year-end on a wave of liquidity.

- Upbit flags UXLINK trading warning token as hacker gains mint role.

Crypto Equities Pre-Market Overview

| Company | At the Close of September 22 | Pre-Market Overview |

| Strategy (MSTR) | $335.93 | $338.10 (+0.65%) |

| Coinbase (COIN) | $331.95 | $334.25 (+0.69%) |

| Galaxy Digital Holdings (GLXY) | $33.69 | $34.55 (+2.55%) |

| MARA Holdings (MARA) | $18.35 | $18.46 (+0.60%) |

| Riot Platforms (RIOT) | $17.50 | $17.70 (+1.16%) |

| Core Scientific (CORZ) | $17.17 | $17.32 (+0.87%) |