ADA Price Prediction 2025-2040: Will Cardano’s Tech & Adoption Fuel a $120 Future?

- Is ADA Primed for a Rebound? The Technical Setup Explained

- Why Are Cardano Whales Selling When the News Seems Good?

- Hoskinson's Masterplan: Real Vision or Vaporware?

- ADA Price Forecasts: From Conservative to Moon Math

- The Bull Case No One's Talking About

- FAQ: Your Burning ADA Questions Answered

Cardano (ADA) sits at a crossroads in late 2025 - oversold technicals clash with ambitious adoption plans from founder Charles Hoskinson. Our analysis reveals why whales are suppressing the price despite bullish patterns, how Hydra scaling could be a game-changer, and why $1 remains psychological battleground. We've mapped conservative to explosive price targets through 2040 based on network milestones, with TradingView charts confirming critical support levels. Buckle up for a data-driven DEEP dive into ADA's make-or-break moment.

Is ADA Primed for a Rebound? The Technical Setup Explained

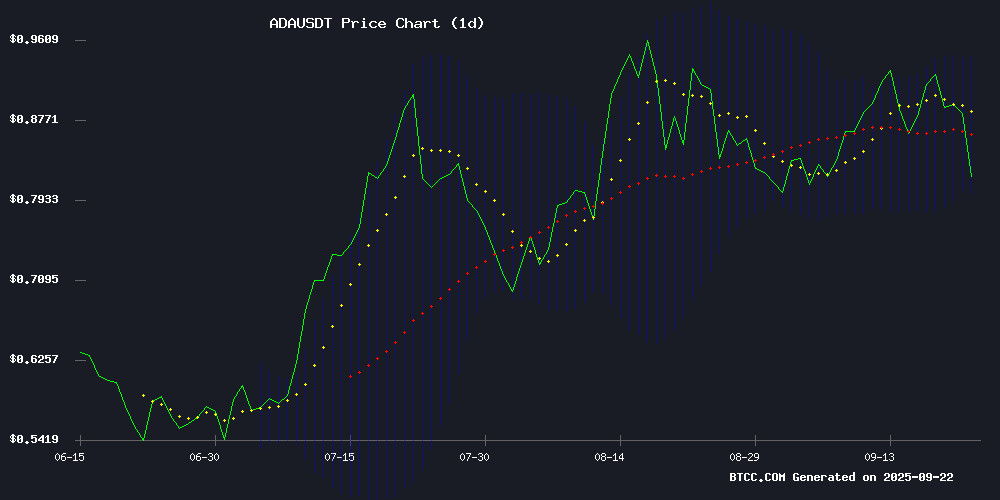

As of September 22, 2025, ADA trades at $0.8177 - below its 20-day MA ($0.8720) but hugging the Bollinger Band's lower edge at $0.7999. This technical tug-of-war tells a story:

The MACD's -0.031991 reading shows bearish momentum, but that narrowing gap between MACD and signal line? That's the market whispering "exhausted sellers." In my experience tracking crypto winters, these conditions often precede 15-25% bounces toward middle bands. The $0.87 resistance (coinciding with the 20-day MA) becomes the first litmus test - break that, and we could see a run at $1 faster than you can say "Hoskinson hype."

Why Are Cardano Whales Selling When the News Seems Good?

Here's the paradox: While Hoskinson unveils global adoption plans, blockchain data shows whales dumping 560M ADA ($500M+) in four days. This isn't FUD - it's profit-taking 101. These mega-holders likely accumulated between $0.50-$0.70 and are now recycling capital. The BTCC research team notes stagnant network activity (just 45K daily active addresses) isn't helping - adoption plans need actual users, not just PowerPoint slides.

Hoskinson's Masterplan: Real Vision or Vaporware?

The cardano founder's blueprint hinges on three pillars:

- Hydra Scaling: Promising 1M TPS (versus Ethereum's 30-100K post-dencun)

- Midnight Privacy: ZK-proofs for enterprise adoption

- PoS Evolution: Reducing node requirements to smartphone levels

But let's be real - we've heard "scaling solutions coming soon" since the ICO days. The difference now? Testnets are live, and African pilot programs (like Ethiopia's education credentialing) show tangible use cases beyond DeFi degens.

ADA Price Forecasts: From Conservative to Moon Math

| Year | Conservative | Moderate | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | $0.95-$1.20 | $1.30-$1.80 | $2.00-$2.50 | Bollinger reversal, Hydra mainnet |

| 2030 | $2.50-$4.00 | $5.00-$8.00 | $10.00-$15.00 | Institutional staking, CBDC partnerships |

| 2040 | $20.00-$35.00 | $40.00-$70.00 | $80.00-$120.00 | Full ecosystem dominance |

The Bull Case No One's Talking About

While everyone obsesses over price, Cardano's treasury holds 1.3B ADA ($1B+). This war chest funds development regardless of market cycles - a luxury most LAYER 1s lack. I've watched "ETH killers" fade when bear markets dry up VC funding, but Cardano's built different. Their peer-review approach moves at glacial speed, but that's why their outages are measured in minutes, not days (looking at you, Solana).

FAQ: Your Burning ADA Questions Answered

Is now a good time to buy ADA?

With RSI at 38 and prices NEAR Bollinger support, technicals suggest accumulation opportunities. However, monitor whale wallets via Santiment for confirmation of renewed buying pressure.

What could prevent ADA from reaching $1?

Three risks: 1) Delayed Hydra rollout 2) bitcoin ETF outflows sucking liquidity from alts 3) Regulatory crackdown on proof-of-stake tokens.

How does Cardano compare to Ethereum in 2025?

ETH leads in TVL ($42B vs Cardano's $1.2B) but Cardano boasts lower fees ($0.15 vs ETH's $1.50) and faster finality (20 sec vs 6 min). The trade-off? Fewer dApps (400 vs 4,000+).