ETH Price Prediction 2025: Why $5,000 Is Within Reach as Bullish Signals Converge

- Technical Indicators: The Case for $5,000 ETH

- Fundamental Factors Supporting the Rally

- Market Sentiment and Psychology

- Institutional Activity: A Game Changer?

- Network Fundamentals: Beyond Price

- Potential Roadblocks to $5,000

- Historical Context: Learning From Past Cycles

- The Road Ahead: What to Watch For

- ETH Price Prediction: Frequently Asked Questions

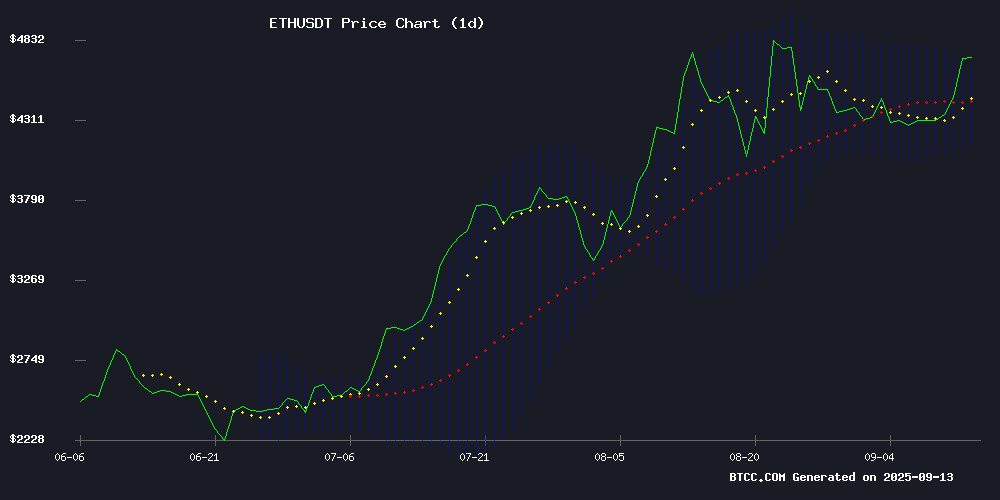

Ethereum's price action in September 2025 presents a compelling case for a potential breakout to $5,000, with technical indicators and fundamental factors aligning in rare harmony. As of September 14, 2025, ETH trades at $4,639.99, testing critical resistance levels while enjoying strong institutional support and dwindling exchange supplies. This perfect storm of bullish signals suggests the path to $5,000 may be clearing faster than many anticipated.

Technical Indicators: The Case for $5,000 ETH

Ethereum's current technical setup paints an optimistic picture. The cryptocurrency is testing the upper Bollinger Band at $4,654.64 while maintaining solid support above the 20-day moving average at $4,408.65. The MACD shows bullish momentum despite a slight negative histogram, suggesting underlying strength in the market.

"The convergence of price NEAR the upper Bollinger Band suggests potential for a breakout if buying pressure sustains above $4,650," notes the BTCC research team. Historical patterns indicate that when ETH maintains this technical configuration, it often precedes significant upward movements.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $4,639.99 | Testing Resistance |

| 20-day MA | $4,408.65 | Support |

| Upper Bollinger | $4,654.64 | Key Resistance |

| MACD | 79.03 | Bullish |

Fundamental Factors Supporting the Rally

The fundamental backdrop for ethereum appears equally promising. Exchange supply has hit yearly lows, with the Ethereum Exchange Supply Ratio (ESR) plummeting to 0.14 - its lowest level this year. This reduction in available supply coincides with significant institutional accumulation totaling $342 million in recent weeks.

What's particularly interesting is how this accumulation pattern differs from previous cycles. Institutions aren't just buying ETH - they're moving it off exchanges at an unprecedented rate. Four newly created wallets withdrew 78,229 ETH ($342 million) from Kraken within just 10 hours on September 12, according to Lookonchain data.

Market Sentiment and Psychology

Market psychology plays a crucial role in any price movement, and Ethereum currently benefits from several positive sentiment indicators. The $5,000 level represents a major psychological barrier, but reduced selling pressure and growing institutional interest create favorable conditions for a breakthrough.

"Reduced selling pressure combined with strong institutional interest creates favorable conditions for ETH to test higher levels," observes the BTCC analysis team. "The $5,000 psychological barrier appears increasingly achievable given current momentum."

This sentiment is reflected in derivatives markets as well, with ETH futures open interest reaching new highs while funding rates remain relatively stable - a combination that suggests healthy speculation without excessive leverage.

Institutional Activity: A Game Changer?

The institutional landscape for Ethereum has evolved dramatically in 2025. Institutional holdings have nearly doubled since April, now representing 6.5-6.7 million ETH. This growth coincides with WisdomTree's launch of its tokenized private credit fund on Ethereum and Stellar, signaling growing mainstream acceptance.

What's fascinating is how institutions are approaching ETH differently than in previous cycles. Rather than short-term trading, we're seeing longer-term positioning through staking and custody solutions. The recent whale activity - where one investor realized $73 million in profits after a three-year staking strategy - exemplifies this shift toward more sophisticated crypto asset management.

Network Fundamentals: Beyond Price

Ethereum's value proposition extends far beyond price speculation. Network activity has reached record levels, with transaction volumes across DeFi and LAYER 2 solutions hitting new highs. This "dual momentum" from both capital inflows and network utility creates a uniquely strong foundation for price appreciation.

At EthTokyo 2025, Vitalik Buterin emphasized ambitious scaling targets, including a bold 10x scaling goal for Ethereum. These technical developments, combined with growing adoption in Asia and beyond, suggest Ethereum's fundamentals may be strengthening even faster than its price.

Potential Roadblocks to $5,000

While the path to $5,000 appears clear, several challenges remain. Supply pressures loom at current levels, particularly between $4,700 and $4,800. A daily close above $4,800 WOULD significantly increase the likelihood of reaching $5,000, but rejection at these levels could see a retracement toward $4,400 support.

Market structure now hinges on whether ETH can absorb selling pressure at this technical inflection point. The upcoming Federal Reserve rate decision on September 20 adds another layer of complexity, though historical patterns suggest rate cuts tend to favor risk assets like Ethereum.

Historical Context: Learning From Past Cycles

Examining Ethereum's historical performance provides valuable context for current price action. The cryptocurrency has demonstrated remarkable resilience since its 2022 lows, with the current cycle showing characteristics of both the 2017 and 2021 bull markets - but with greater institutional participation.

One notable difference in 2025 is the maturity of Ethereum's ecosystem. With staking yields, DeFi applications, and institutional products like WisdomTree's private credit fund, ETH now offers multiple value propositions beyond simple speculation. This diversification of use cases may contribute to more stable price appreciation compared to previous cycles.

The Road Ahead: What to Watch For

Several key indicators will determine whether ETH can reach and sustain $5,000:

- Sustained trading above $4,650 resistance

- Continued institutional accumulation patterns

- Exchange supply remaining constrained

- Healthy derivatives market conditions

- Network activity maintaining current levels

While technical analysis provides valuable short-term signals, Ethereum's long-term trajectory will likely depend on its ability to maintain this delicate balance of technical strength, fundamental growth, and positive market sentiment.

ETH Price Prediction: Frequently Asked Questions

What is the current ETH price prediction for 2025?

Based on current technical indicators and market conditions, ETH has a strong probability of reaching $5,000 in 2025. The cryptocurrency is testing key resistance levels while maintaining solid support, with fundamental factors like reduced exchange supply and institutional accumulation supporting further upside.

What are the key technical levels to watch for ETH?

The immediate resistance to watch is $4,654.64 (upper Bollinger Band), followed by $4,800. Support levels include $4,408.65 (20-day MA) and $4,300-$4,400 (recent accumulation zone). A daily close above $4,800 would significantly increase the likelihood of reaching $5,000.

How does institutional activity affect ETH's price?

Institutional activity has become a major driver of ETH's price in 2025. Recent accumulation of $342 million worth of ETH and growing participation in staking and custody solutions suggest institutions are taking longer-term positions, which typically leads to more stable price appreciation.

What fundamental factors support ETH's price growth?

Key fundamental factors include record-low exchange supply (ESR at 0.14), growing network activity (record DeFi and Layer 2 volumes), institutional product development (like WisdomTree's tokenized fund), and Ethereum's ongoing technical improvements (including scaling solutions).

What could prevent ETH from reaching $5,000?

Potential obstacles include rejection at current resistance levels ($4,650-$4,800), unexpected macroeconomic developments (like hawkish Fed policy), or network issues. However, current conditions suggest these risks are relatively contained.