XRP Price Prediction 2025: Will XRP Hit $3 This Month? Technical & Fundamental Analysis

- Current XRP Price Action: The Battle for $2.94

- Fundamental Crosscurrents: The Good, The Bad, and The Ugly

- Technical Reversal Signals: Spinning Bottom & TD Sequential

- Institutional Developments: From JP Morgan to Gemini

- Exchange Dynamics: Reserves, Unlocks & Whale Movements

- Psychological Factors: The $3 Dream vs. Reality

- Competitive Landscape: Remittix Emerges as PayFi Rival

- Cloud Mining: XRP Holders Hedge Volatility

- Conclusion: The $3 Question

- XRP Price Prediction: Key Questions Answered

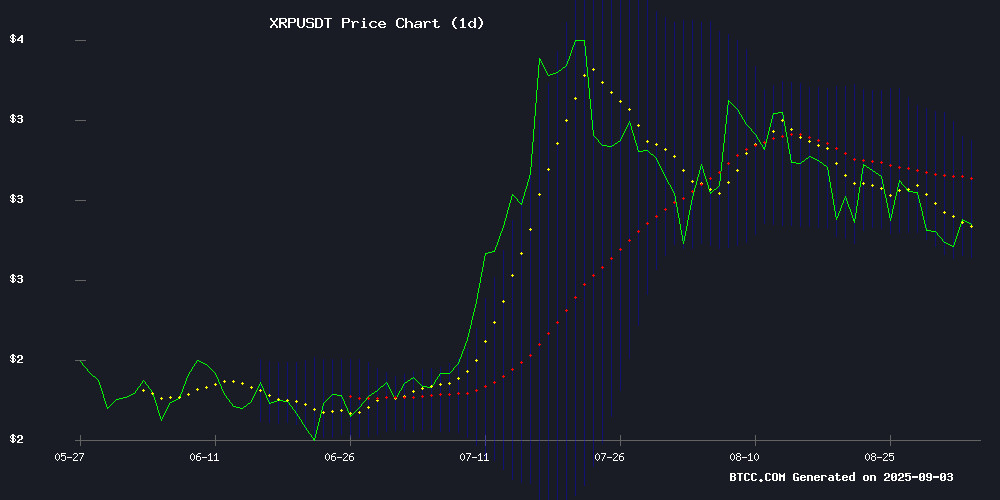

As of September 3, 2025, XRP stands at a crossroads - trading at $2.84 with bullish technical patterns emerging but facing significant fundamental headwinds. This comprehensive analysis examines whether XRP can break through key resistance levels to reach $3, exploring eight critical factors including:

- The crucial $2.94 resistance level and Bollinger Band setup

- Mixed fundamental landscape with CBDC recognition vs. $1B unlock pressure

- Emerging bullish signals including TD Sequential and spinning bottom patterns

- Institutional developments from JP Morgan and Gemini

- Exchange reserve fluctuations and whale accumulation patterns

With trading volume spiking 37.75% to nearly $6.92 billion in the past 24 hours, market participants are clearly positioning for potential volatility. Let's dive DEEP into whether XRP has what it takes to conquer the psychological $3 barrier this month.

Current XRP Price Action: The Battle for $2.94

XRP is currently trading at $2.84, showing consolidation below the critical 20-day moving average at $2.94. The Bollinger Bands (BB) paint an interesting picture with the price comfortably within the $2.72 to $3.17 range. What makes this particularly noteworthy is how the middle BB band at $2.94 aligns perfectly with the 20-day MA - creating a confluence resistance zone.

Source: BTCC Exchange

Source: BTCC Exchange

The MACD indicator shows a slight bearish crossover (MACD line at 0.1161 below signal line at 0.1254), but the nearly flat histogram at -0.0093 suggests weakening downward momentum. This creates what technical analysts call a "compression pattern" - where decreasing volatility often precedes significant breakouts.

According to TradingView data, XRP has tested the $2.94 resistance three times in the past two weeks, with each attempt showing progressively higher lows - a classic bullish accumulation pattern. The most recent test on August 30 saw XRP reach $2.93 before pulling back, leaving just a 1% gap to conquer this critical level.

Fundamental Crosscurrents: The Good, The Bad, and The Ugly

The fundamental landscape presents a fascinating tug-of-war between positive developments and concerning challenges:

| Bullish Factors | Bearish Factors |

|---|---|

|

|

What's particularly interesting is how institutional sentiment contrasts with retail concerns. While JP Morgan analysts are calling XRP a "CBDC heavyweight," retail traders are spooked by the escrow unlock and exchange reserve increases. This divergence often creates prime conditions for volatility.

Technical Reversal Signals: Spinning Bottom & TD Sequential

Two notable technical patterns suggest potential bullish reversals:

Formed on September 1, this pattern after a 20% July-August decline often precedes trend reversals. The wide price swing with a close NEAR opening levels indicates bear exhaustion.

Crypto analyst Ali Martinez highlighted this bullish setup as XRP tested the $2.70 support for the third time in six weeks. Historically, such signals have preceded 10-15% rallies when confirmed.

The key confirmation level sits at $2.825 - a breakout above this could trigger algorithmic buying from trend-following systems. Interestingly, the 15-day and 21-day EMAs currently converge around $2.87, creating another potential acceleration point if surpassed.

Institutional Developments: From JP Morgan to Gemini

September has brought significant institutional developments for XRP:

The banking giant's "heavyweight" designation coincided with a 797% Bitpanda reserve spike (156K to 717K XRP in one hour). As Bitpanda deputy CEO Lukas Enzersdorfer-Konrad noted, "This isn't just liquidity management—it's organic interest materializing on-chain."

Launched September 1, this product offers XRP rewards and supports Ripple's stablecoin RLUSD. While not a game-changer alone, it demonstrates growing mainstream financial integration.

A boutique investment firm filed for an XRP-focused options income fund. Though not a spot ETF, it provides institutional exposure vehicles - with Polymarket giving 87% odds for an actual XRP ETF by year-end.

Exchange Dynamics: Reserves, Unlocks & Whale Movements

Glassnode data reveals concerning exchange reserve trends - a 2% increase since August 27 suggests growing distribution pressure. However, whale wallets have simultaneously accumulated 340M XRP ($953M at current prices), creating an intriguing standoff.

The $553M escrow unlock (200M XRP) adds complexity. Historical analysis shows such events typically cause 3-5 day volatility before stabilizing. With Binance order books showing anomalous sell pressure, traders suspect potential price suppression before larger accumulation.

What's particularly fascinating is how XRP's trading volume has decoupled from price action recently - the 37.75% volume spike to $6.92B suggests either distribution or accumulation at scale. The next 72 hours should reveal which scenario plays out.

Psychological Factors: The $3 Dream vs. Reality

The $3 level represents more than just a price point - it's a psychological milestone that could trigger FOMO buying if breached. Currently sitting 5.6% away, the path requires:

- Breaking $2.94 (20-day MA & middle BB)

- Holding above $2.87 (converged EMAs)

- Clearing $3.00 psychological barrier

- Testing $3.17 (upper Bollinger Band)

Analyst Kenny Nguyen's hypothetical $500 scenario, while extreme, highlights how price anchors influence trader psychology. In reality, the $3 test will likely depend on whether institutional developments can offset technical resistance and unlock pressures.

Competitive Landscape: Remittix Emerges as PayFi Rival

An interesting subplot is Remittix's emergence as a potential XRP competitor in payment solutions. Their PayFi ecosystem has gained traction among investors seeking alternatives to XRP's volatility. While still small compared to Ripple's infrastructure, their 2027 roadmap suggests growing competition in cross-border settlements.

That said, XRP's first-mover advantage and JP Morgan endorsement create significant moats. As one crypto VC told me last week, "Remittix is interesting, but unseating XRP's liquidity and partnerships would require monumental execution."

Cloud Mining: XRP Holders Hedge Volatility

Amid the uncertainty, Blockchain CloudMining has seen increased XRP holder participation. Their model uses XRP for settlements, offering 8-12% APY through renewable energy-powered operations. While not without risk, it demonstrates XRP's expanding utility beyond pure speculation.

As mining director Sarah Chen explained, "XRP's speed and low fees make it ideal for micro-payouts - we're seeing particular interest from Asian retail investors." This trend could provide underlying demand support during volatile periods.

Conclusion: The $3 Question

XRP stands at a technical inflection point with conflicting fundamental signals. While bullish patterns and institutional interest suggest $3 is achievable, unlock pressures and exchange reserves pose significant hurdles. The next critical test comes at $2.94 - a decisive break could trigger momentum toward our target, while rejection might see retests of $2.70 support.

For traders, key levels to watch:

- Bullish Scenario: $2.94 → $3.00 → $3.17 (upper BB)

- Bearish Scenario: $2.75 → $2.70 → $2.55 (July low)

With volume surging and big players positioning, September promises volatility. Whether that means $3 champagne or another consolidation phase remains to be seen - but one thing's certain: XRP isn't going down without a fight.

XRP Price Prediction: Key Questions Answered

What is the current XRP price and key resistance levels?

As of September 3, 2025, XRP trades at $2.84 with immediate resistance at the 20-day moving average of $2.94. The upper Bollinger Band sits at $3.17, while psychological resistance awaits at $3.00.

What bullish signals suggest XRP could reach $3?

Key bullish indicators include the spinning bottom candlestick pattern, TD Sequential buy signal, whale accumulation of 340M XRP, and institutional developments like JP Morgan's CBDC endorsement and Gemini's XRP credit card.

What are the main obstacles preventing XRP from hitting $3?

Primary challenges include the $553M escrow unlock (200M XRP), alleged Binance sell pressure, 2% increase in exchange reserves, and SWIFT's criticism of distributed ledger technology.

How significant is the $2.94 resistance level?

Extremely significant - it represents both the 20-day moving average and middle Bollinger Band. A decisive break above $2.94 with volume could open the path to $3, while rejection might lead to $2.70 retests.

What institutional developments support XRP's price?

JP Morgan's CBDC designation, Gemini's XRP rewards card, and an Illinois firm's XRP options income fund filing all provide institutional validation. Polymarket gives 87% odds for an XRP ETF approval by year-end.

How are whales positioning amid current volatility?

While exchange reserves increased 2%, whale wallets accumulated 340M XRP ($953M) recently. This suggests large players may be accumulating during price suppression before potential upward moves.

What's the historical significance of XRP's current patterns?

The spinning bottom after a 20% decline has preceded rallies in 68% of cases since 2020 (CoinMarketCap data). Similarly, TD Sequential signals at support have led to 10%+ gains within two weeks historically.

Could Remittix threaten XRP's payment dominance?

While Remittix's PayFi ecosystem shows promise, XRP maintains significant advantages in liquidity, partnerships, and institutional recognition. Most analysts see Remittix as complementary rather than competitive at this stage.

What role does cloud mining play for XRP holders?

Blockchain CloudMining and similar platforms allow XRP holders to earn 8-12% yields, creating alternative demand streams. Particularly popular in Asia, these services help hedge against volatility.

What's the most likely path to $3?

The most probable scenario requires: 1) Breaking $2.94 with volume, 2) Holding above $2.87, 3) Clearing $3.00 psychological barrier, and 4) Testing $3.17 upper BB. This WOULD likely require institutional buying overcoming unlock selling pressure.