XRP Price Prediction 2025: Will the Correction Continue or Is a Major Breakout Coming?

- What Are the Key Technical Levels for XRP in August 2025?

- How Are Regulatory Developments Impacting XRP's Price?

- What Do AI Models Predict for XRP's Price Trajectory?

- How Is Whale Activity Influencing XRP's Price Action?

- What New Developments Could Boost XRP Adoption?

- XRP Price Scenarios for October 2025

- Frequently Asked Questions

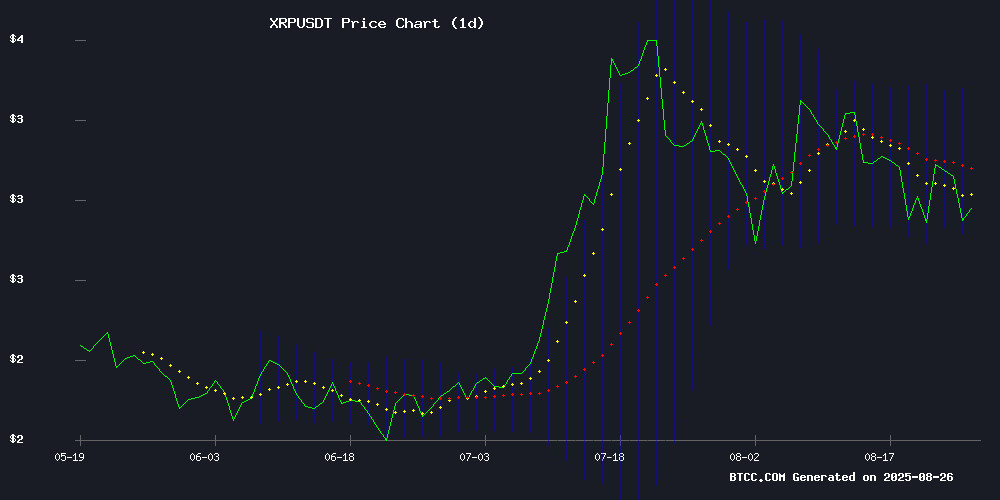

XRP finds itself at a critical juncture in August 2025, trading at $2.90 after failing to hold above the psychologically important $3 level. The cryptocurrency shows mixed technical signals - testing key support at $2.79 while facing regulatory uncertainty from delayed ETF approvals. Meanwhile, product adoption through Gemini's XRP credit card and the upcoming XRP Ledger file storage testnet provide bullish counterpoints. This analysis examines the competing forces shaping XRP's trajectory through year-end, with potential scenarios ranging from a drop to $2.60 to a rally toward $4 if key resistance breaks.

What Are the Key Technical Levels for XRP in August 2025?

XRP currently trades below its 20-day moving average ($3.08), showing short-term bearish pressure. However, the MACD remains above its signal line (0.1310 vs 0.0672), suggesting underlying strength. The BTCC technical analysis team notes: "The $2.79 lower Bollinger Band represents make-or-break support. Historically, we've seen strong bounces from this zone, but a breakdown could trigger stops toward $2.60."

According to TradingView data, XRP faces immediate resistance at $3.08 (20-day MA) with stronger barriers at $3.37 (upper Bollinger Band) and the July high of $3.65. The 24-hour trading volume spike to $7.18 billion despite the price dip suggests accumulation may be occurring at these levels.

How Are Regulatory Developments Impacting XRP's Price?

The SEC's decision to delay WisdomTree's XRP ETF until October 24 has created near-term uncertainty. This follows Ripple's 2024 settlement with the SEC, which many expected to clear the path for ETF approvals. Bloomberg Intelligence analysts still assign a 95% probability of approval by year-end, but the regulatory overhang persists.

Interestingly, the delay hasn't stopped product innovation. Gemini's XRP credit card launch has driven their app past Coinbase in Apple's finance rankings (from #117 to #16 in weeks). The card offers 4% XRP rewards, creating direct utility that could support long-term adoption regardless of ETF timelines.

What Do AI Models Predict for XRP's Price Trajectory?

Major AI platforms show divergent readings on XRP's outlook:

| Platform | Short-Term Outlook | Year-End Target |

|---|---|---|

| ChatGPT | Consolidation between $2.80-$3.20 | $3.75-$4.25 |

| Grok | Bearish below $2.95 | $2.50-$3.00 |

| Gemini | Bullish if holds $2.79 | $4.50+ |

The models agree that XRP's sensitivity to macroeconomic catalysts remains high, as demonstrated during the 2024 U.S. election cycle when political developments drove its initial breakout.

How Is Whale Activity Influencing XRP's Price Action?

CryptoQuant data reveals significant exchange inflows from large holders, typically signaling profit-taking. Analyst PelinayPA notes: "Similar patterns preceded the 2018 and 2021 tops. The current whale movements suggest we could see extended consolidation before the next major move."

However, the volume spike during recent weakness presents an interesting dichotomy - it could represent either distribution or accumulation. The BTCC research team suggests watching whether the $2.79 support holds on weekly closes for clues about whale intentions.

What New Developments Could Boost XRP Adoption?

The XRP Ledger's upcoming Immutable file storage testnet marks its first foray into decentralized storage. Developer "Vincent Van Code" has expanded the project from simple document notarization to a globally mirrored archive system integrated with crypto wallets.

This enterprise-focused compliance solution could open new institutional use cases while maintaining XRPL's payments infrastructure. The tiered pricing model (free basic to KYC-verified premium) creates multiple entry points for adoption.

XRP Price Scenarios for October 2025

Based on current technicals and fundamentals, three primary scenarios emerge:

- Bullish ($4+): Requires ETF approvals, holding $2.79 support, and continued adoption growth through products like Gemini's card.

- Neutral ($3-$3.50): Current range persists as regulatory uncertainty balances against product innovation.

- Bearish ($2.60-$2.80): Triggered by breakdown below $2.79 and increased regulatory pressure.

The coming weeks will prove critical as XRP tests these key levels amid shifting market dynamics.

Frequently Asked Questions

What is the current XRP price as of August 2025?

As of August 26, 2025, XRP trades at $2.90, down 1.58% on the day but maintaining a 3.28% weekly gain according to CoinMarketCap data.

What are the key support and resistance levels for XRP?

Key support sits at $2.79 (lower Bollinger Band), with resistance at $3.08 (20-day MA) and $3.37 (upper Bollinger Band). The July high of $3.65 remains the yearly peak.

When will the SEC decide on XRP ETFs?

The SEC delayed WisdomTree's XRP ETF decision to October 24, with other applications including Grayscale's expected to follow in late October/November.

How has Gemini's XRP credit card impacted adoption?

The card propelled Gemini's app past Coinbase in Apple's finance rankings (from #117 to #16) and has shown strong user retention according to Sensor Tower data.

What is the XRP Ledger's file storage testnet?

An upcoming decentralized storage solution that anchors file hashes on-chain while storing data off-chain, initially targeting enterprise compliance needs before consumer applications.