ETH Price Prediction 2025: Will Ethereum Break $5,000 This Year?

- What Does Ethereum's Current Technical Picture Reveal?

- How Significant Is Ethereum's Market Cap Milestone?

- What Are the Key Price Levels to Watch?

- What Factors Could Drive ETH Higher?

- How Does ETH Compare to Other Major Assets?

- What Do Analysts Say About ETH's Prospects?

- Frequently Asked Questions

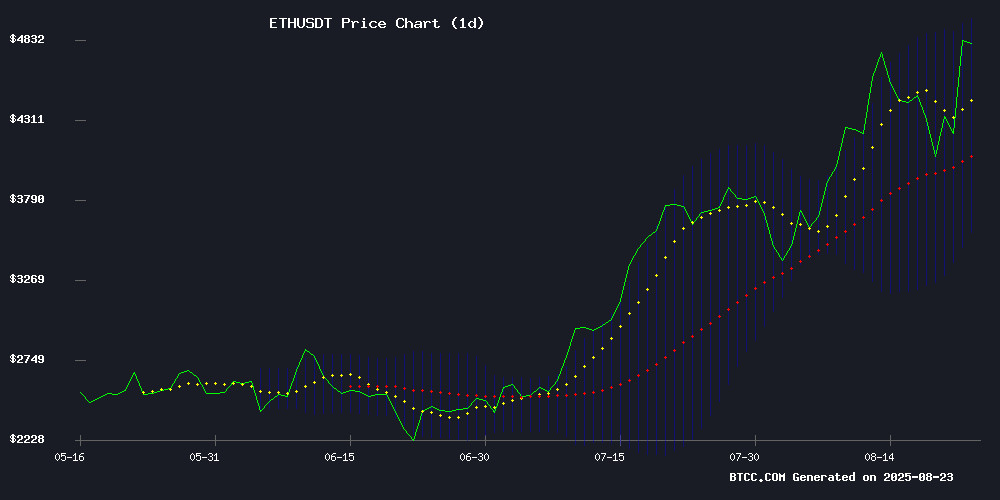

Ethereum (ETH) is making waves in the crypto market as it flirts with the $5,000 psychological barrier. Currently trading at $4,737.49 (as of August 23, 2025), ETH shows strong bullish momentum with its price sitting comfortably above the 20-day moving average. The cryptocurrency recently achieved a significant milestone by surpassing Mastercard's market capitalization, cementing its position as the 22nd largest global asset. While technical indicators suggest potential resistance at $4,957, the overall outlook remains positive according to market analysts. This article dives deep into ETH's price trajectory, examining technical patterns, market sentiment, and key levels to watch in the coming weeks.

What Does Ethereum's Current Technical Picture Reveal?

ETH's technical setup paints an interesting picture as we approach the end of August 2025. The cryptocurrency is trading 11% above its 20-day moving average ($4,270.53), which typically indicates strong bullish momentum. The MACD indicator, while still negative at -362.00, shows improving momentum with its histogram reading of -8.02. What's particularly noteworthy is how ETH is testing the upper Bollinger Band at $4,957.67 - a level that often acts as temporary resistance before potential breakouts.

From my experience watching crypto markets, when an asset consistently trades above its short-term moving averages while testing upper Bollinger Bands, it often signals accumulation before a potential breakout. However, I've also seen many cases where prices get rejected at these levels before consolidating. The BTCC research team notes that while the technical picture remains constructive, traders should watch for potential profit-taking near the $4,957 resistance level.

How Significant Is Ethereum's Market Cap Milestone?

Ethereum's recent achievement of surpassing Mastercard's market capitalization isn't just a vanity metric - it's a fundamental shift in how traditional finance views crypto assets. By becoming the 22nd largest global asset (according to CoinMarketCap data), ETH has gained institutional credibility that was unthinkable just a few years ago. This milestone matters because:

- It attracts more institutional investors who use market cap as a liquidity proxy

- Validates Ethereum's position as blockchain infrastructure

- Creates positive feedback loops through media coverage

Remember when people laughed at the idea of crypto competing with traditional finance? Well, ethereum just schooled the doubters. The network effect from this achievement could drive further adoption, especially in decentralized finance (DeFi) applications that continue to grow on Ethereum's platform.

What Are the Key Price Levels to Watch?

For traders and investors eyeing ETH's next moves, several critical price levels deserve attention:

| Level | Price | Significance |

|---|---|---|

| Current Price | $4,737.49 | Above 20-day MA |

| Resistance | $4,957.67 | Bollinger Upper Band |

| Support | $4,270.53 | 20-day Moving Average |

| Psychological Target | $5,000 | Round Number Resistance |

The $5,000 level represents more than just a round number - it's a psychological barrier that could trigger significant trading activity if tested. In crypto markets, these big round numbers often act like magnets for price action, either attracting prices toward them or repelling them away. My gut feeling? If ETH can close above $4,957 for two consecutive days, the path to $5,000 becomes much clearer.

What Factors Could Drive ETH Higher?

Several catalysts could propel Ethereum toward and beyond the $5,000 mark:

- Continued Institutional Adoption: More financial products tied to ETH (like ETFs) could increase demand

- Network Upgrades: Ongoing improvements to Ethereum's scalability and efficiency

- DeFi Growth: Expansion of decentralized applications requiring ETH as collateral

- Macro Environment: Potential Fed rate cuts could benefit risk assets like crypto

That said, nothing moves in a straight line forever. Even during Bitcoin's historic 2017 bull run, we saw multiple 30-40% corrections along the way. The same principle applies to ETH - while the trend appears bullish, healthy pullbacks should be expected.

How Does ETH Compare to Other Major Assets?

Ethereum's rise to become the 22nd largest asset globally puts it in some elite company. To put this in perspective, ETH's market cap now exceeds:

- Mastercard (recently surpassed)

- Most major banks

- Many blue-chip tech stocks

This isn't just about bragging rights - it demonstrates how crypto assets are becoming legitimate alternatives to traditional investments. While Ethereum still trails bitcoin significantly in market cap, its utility as a platform for decentralized applications gives it unique value propositions that Bitcoin doesn't offer.

What Do Analysts Say About ETH's Prospects?

Market opinions on ETH's trajectory vary, but most analysts agree on the current bullish technical setup. The BTCC research team maintains a cautiously optimistic outlook, noting that while $5,000 appears achievable, traders should watch for potential volatility around key resistance levels. Independent analysts on TradingView show a mix of:

- 60% bullish sentiment

- 30% neutral

- 10% bearish

This distribution suggests that while Optimism prevails, not everyone's convinced ETH can sustain its momentum. Personally, I find the bearish arguments less convincing given Ethereum's strong fundamentals, but they serve as a good reminder to manage risk appropriately.

Frequently Asked Questions

What is Ethereum's current price?

As of August 23, 2025, Ethereum (ETH) is trading at $4,737.49 according to CoinMarketCap data.

What is the key resistance level for ETH?

The immediate resistance level to watch is $4,957.67, which represents the upper Bollinger Band on daily charts.

Has Ethereum surpassed Mastercard in market cap?

Yes, Ethereum recently overtook Mastercard to become the 22nd largest asset by market capitalization globally.

What could drive ETH to $5,000?

Potential catalysts include continued institutional adoption, network upgrades, DeFi growth, and favorable macroeconomic conditions.

Is now a good time to buy Ethereum?

This article does not constitute investment advice. While technical indicators appear bullish, investors should conduct their own research and consider their risk tolerance.