Ethereum Price Prediction 2025: Technical Breakout Looms as Institutions Stack ETH

- Is Ethereum Primed for a Major Breakout?

- Institutional Accumulation vs. Retail Outflows

- Key Factors Influencing ETH Price Action

- ETH Price Targets and Probabilities

- Risks to Watch

- Ethereum Price Prediction FAQs

Ethereum (ETH) is showing strong bullish signals in August 2025, trading comfortably above key moving averages despite some bearish technical indicators. Institutional players like SharpLink Gaming are accumulating ETH aggressively, with one company amassing 740,760 ETH worth $537 million. Technical analysis suggests potential upside to $4,500-$4,800 if current support holds, though regulatory uncertainty and whale movements create volatility. The ETH ecosystem continues expanding with Polygon hitting $1.25B TVL and Japan launching its first licensed stablecoin on Ethereum.

Is Ethereum Primed for a Major Breakout?

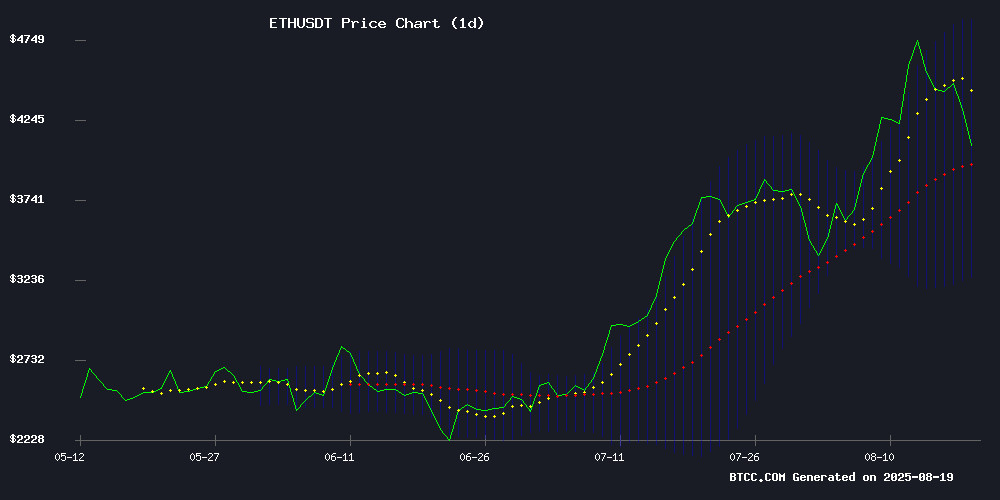

As of August 19, 2025, ETH is trading at $4,176.22, holding firmly above its 20-day moving average of $4,072.87. This positioning suggests underlying strength despite the MACD showing bearish momentum at -421.08 versus -303.13. The narrowing spread between these values hints at a potential trend reversal.

Source: BTCC

Bollinger Bands analysis shows the current price sitting between the middle ($4,072.87) and upper band ($4,887.38), indicating room for upward movement before reaching overbought territory. "The price position relative to the moving average suggests buyers remain in control despite recent volatility," notes a BTCC market analyst.

Institutional Accumulation vs. Retail Outflows

The market presents a fascinating dichotomy - while retail investors and some whales are exiting, institutions are doubling down on ETH positions:

| Institutional Activity | Retail Activity |

|---|---|

| SharpLink Gaming adds 143,593 ETH | $148M ETH moved to exchanges |

| Wynn takes 25X leveraged long | ETF outflows hit $196.6M |

| Corporate holdings up 68.4% since 2024 | Validator exit queue hits $3.9B |

This institutional accumulation appears to be offsetting retail outflows, creating an interesting supply dynamic. SharpLink Gaming's massive $537 million ETH war chest now totals 740,760 ETH, making them one of the largest corporate holders.

Key Factors Influencing ETH Price Action

Several fundamental developments are shaping Ethereum's price trajectory:

1. Layer 2 Ecosystem Growth

Polygon has surged to its highest TVL this year at $1.25 billion, with 43% growth year-to-date. The network is seeing $2.77 billion in stablecoin activity and recently led all competitors in 24-hour inflows at $12 million.

2. Regulatory Developments

Japan's first licensed stablecoin issuer JPYC has chosen ethereum as one of its launch platforms. The firm projects $34 million annual profits per $6.8 billion issued, with reserves exceeding 101% of stablecoin value held in Japanese government bonds.

3. Technical Patterns

ETH appears to be completing a double three Elliott Wave pattern after its August rally. Key levels to watch include the $3,895-$4,156 Fibonacci zone where institutional buyers have historically stepped in.

ETH Price Targets and Probabilities

Based on current technicals and fundamentals, here are potential scenarios:

| Price Target | Probability | Key Drivers |

|---|---|---|

| $4,500 | High | Institutional buying, technical breakout |

| $4,800 | Medium | Bollinger upper band, ETF inflows |

| $5,200+ | Low | Requires broader crypto rally |

The $4,000 level has emerged as critical support, with accumulating bids at $4,400 suggesting strategic dip-buying rather than panic selling.

Risks to Watch

While the outlook appears bullish, several risks could derail ETH's momentum:

- Whale movements - $148M recently moved to exchanges

- Validator exit queue at record $3.9B

- Regulatory uncertainty around CLARITY Act

- Leveraged positions like Wynn's 25X long (liquidation at $4,152)

Ethereum Price Prediction FAQs

What is Ethereum's current price?

As of August 19, 2025, Ethereum is trading at $4,176.22 according to TradingView data.

Is Ethereum a good investment in 2025?

While institutions appear bullish with corporate holdings up 68.4% since 2024, retail investors should consider their risk tolerance given the volatility.

What's the highest ETH could go in 2025?

Technical analysis suggests $4,800 is a plausible target if current support holds, though $5,200+ WOULD require broader market participation.

Why are institutions buying Ethereum?

Companies like SharpLink Gaming cite Ethereum's potential as "global financial infrastructure" and are attracted by both capital appreciation and staking rewards.

What are the key support levels for ETH?

The $4,000 level is critical, with the $3,895-$4,156 Fibonacci zone being a major area of institutional interest.