ETH Price Prediction 2025: Can Ethereum Hit $5,000 as Institutions Pile In While Supply Shrinks?

- Ethereum Technical Analysis: Bullish or Bearish?

- Institutional Demand vs. Profit-Taking: Who's Winning?

- Ecosystem Developments: Beyond Price Speculation

- Ethereum Supply Dynamics: The Corporate Factor

- ETH Price Outlook: What's Next?

- Is Ethereum a Good Investment in 2025?

- Ethereum Price Prediction FAQs

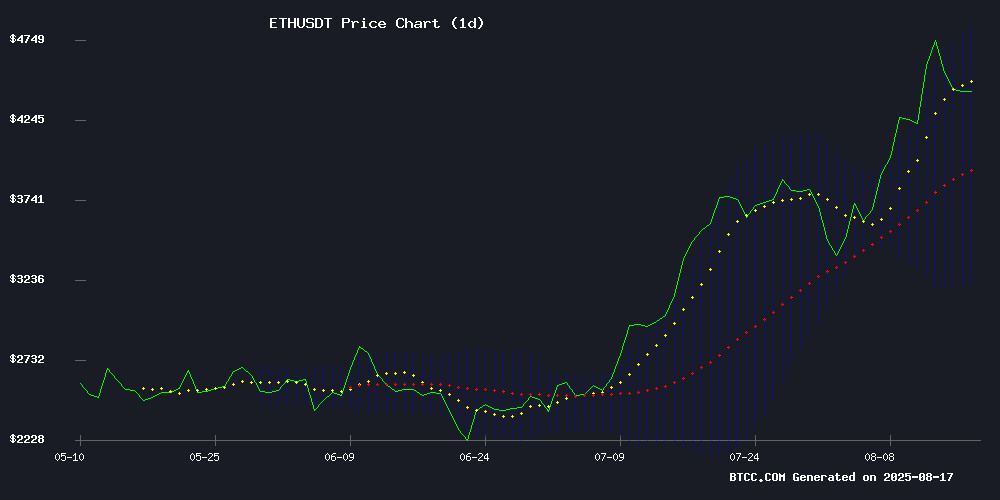

Ethereum (ETH) is showing remarkable strength in August 2025, trading at $4,467 with bullish technical indicators and growing institutional interest. The cryptocurrency has maintained a 10% buffer above its 20-day moving average while Bollinger Bands signal increasing volatility. On-chain data reveals a fascinating tug-of-war between corporate accumulation and profit-taking by early investors. This article dives deep into ETH's price action, institutional movements, and ecosystem developments that could propel it toward the psychological $5,000 barrier.

Ethereum Technical Analysis: Bullish or Bearish?

As of August 17, 2025, ETH/USDT is trading at $4,467.93 on BTCC, comfortably above its 20-day MA of $4,028.38. The MACD histogram shows narrowing bearish momentum (-165.74) as the fast line (-405.37) converges toward the slow line (-239.63). Bollinger Bands paint an interesting picture - with $4,847.25 as immediate resistance and the middle band ($4,028.38) serving as strong support.

"The price holding above the 20MA while MACD shows decelerating downward momentum suggests smart money is accumulating at these levels," noted a BTCC market analyst. "A decisive close above the upper Bollinger Band could trigger accelerated buying toward $5,000."

Institutional Demand vs. Profit-Taking: Who's Winning?

The on-chain narrative reveals competing forces:

| Bullish Factors | Bearish Factors |

|---|---|

| Corporate treasuries holding 1.8% of circulating supply | Ethereum Foundation-linked $33.25M sale |

| 92,899 ETH ($412M) withdrawn from Kraken | Dormant ICO wallet moving $1.48M ETH |

| Exchange reserves at 12-month lows | SharpLink Gaming's $103.4M quarterly loss |

Interestingly, Bitmine Immersion Technologies leads corporate holders with 0.95% of ETH's total supply, while SharpLink Gaming holds 728,804 ETH ($3.2B) despite operational struggles.

Ecosystem Developments: Beyond Price Speculation

Two major developments are expanding Ethereum's utility:

- Base's Gaming Push: Coinbase's L2 network is advocating for on-chain gaming economies, with Base lead Jesse Pollak arguing that platforms like Fortnite could unlock billions in value through true digital ownership.

- Ronin's Strategic Pivot: The Axie Infinity blockchain is migrating to Ethereum as an L2 solution, aiming to expand its Web3 and NFT capabilities beyond gaming.

These moves come as Ethereum's on-chain volume approaches historic highs at $12.93 billion, demonstrating growing network utility beyond speculative trading.

Ethereum Supply Dynamics: The Corporate Factor

Public companies now control significant portions of ETH's circulating supply, creating new market dynamics:

- Post-Merge issuance mechanics create a balance between validator rewards and fee burns

- Corporate accumulation could amplify supply crunches during deflationary periods

- Since the transition to proof-of-stake, net supply has grown by 454,300 ETH

CoinMetrics warns this institutional embrace carries risks like leverage buildup and capital allocation challenges when companies use equity raises to fund crypto acquisitions.

ETH Price Outlook: What's Next?

Standard Chartered Bank recently revised its 2025 ETH price target to $7,500, with a long-term bullish case suggesting $25,000 by 2028. The current technical setup suggests:

- $4,028 as potential new floor

- $4,800 as key resistance (just 6% below 2021 ATH)

- $5,000 as psychological barrier

Market participants are watching for either a decisive breakout above resistance or a breakdown below $4,200 support to determine ETH's next major move.

Is Ethereum a Good Investment in 2025?

Ethereum presents a compelling case based on three key metrics:

| Metric | Current Value | Implication |

|---|---|---|

| Price vs 20MA | +10.9% premium | Healthy correction buffer |

| Institutional Activity | $33M+ movements | Whale accumulation patterns |

| On-Chain Volume | Near historic highs | Network utility expansion |

This article does not constitute investment advice. Always do your own research before making investment decisions.

Ethereum Price Prediction FAQs

What is Ethereum's price prediction for 2025?

Analysts are divided but generally bullish, with Standard Chartered Bank predicting $7,500 by year-end. The $5,000 level appears achievable if current institutional accumulation continues while supply remains constrained.

Why is Ethereum's price rising?

Three key factors: 1) Institutional accumulation by corporate treasuries, 2) Shrinking exchange supply (reserves at 12-month lows), and 3) Growing ecosystem utility through L2 solutions like Base and Ronin.

What are the risks to Ethereum's price?

Potential risks include: 1) Profit-taking by early investors (like the $33.25M ethereum Foundation sale), 2) Corporate leverage issues, and 3) Competition from other smart contract platforms.

How does Ethereum's current price compare to its all-time high?

As of August 2025, ETH is trading around $4,467, just 9% below its November 2021 all-time high of $4,878.

What's driving institutional interest in Ethereum?

Institutions are attracted to ETH's dual role as both a reserve asset and yield generator, especially after its transition to proof-of-stake which created predictable staking rewards.