SHIB Price Prediction 2025: Will the 5800% Burn Rate Ignite a Major Comeback?

- SHIB Technical Analysis: Oversold or Overstretched?

- The 5800% Burn Rate Phenomenon: Game Changer or Temporary Spark?

- Expert Price Projections for SHIB

- Market Psychology: Anniversary Optimism vs. Investor Fatigue

- Historical Context: How SHIB Reacted to Previous Burn Events

- Key Questions About SHIB's Future

As shiba inu celebrates its 5th anniversary with a staggering 5,800% surge in token burns, the crypto community is buzzing about potential price movements. Our analysis dives deep into the technical indicators, market sentiment, and fundamental factors that could shape SHIB's trajectory in the coming weeks. With conflicting signals from technical charts and on-chain metrics, we'll break down what really matters for SHIB investors right now.

SHIB Technical Analysis: Oversold or Overstretched?

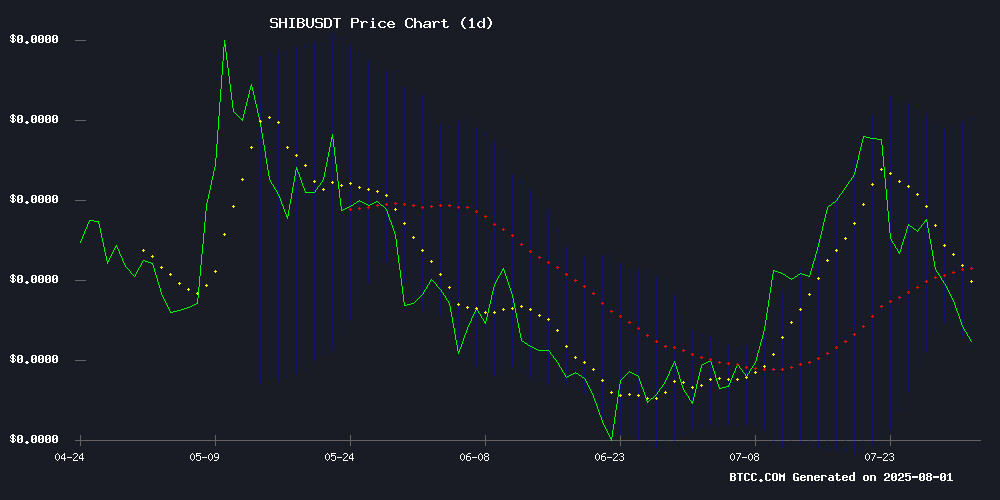

According to TradingView data, SHIB currently trades at $0.00001221, sitting below its 20-day moving average of $0.00001394. The MACD shows a faint bullish crossover at 0.00000011, but remains in negative territory overall - what traders call a "bearish confirmation." Interestingly, Bollinger Bands place SHIB near the lower band at $0.00001207, typically signaling oversold conditions that often precede rebounds.

The RSI tells a cautionary tale at 28 (CoinMarketCap), DEEP in oversold territory but potentially indicating more downside before any meaningful recovery. Volume patterns show increased selling pressure, with the past week seeing 21% price depreciation despite the burn rate news.

The 5800% Burn Rate Phenomenon: Game Changer or Temporary Spark?

Shiba Inu's token burn mechanism has gone into overdrive, with the burn rate skyrocketing 5,800% coinciding with the project's fifth anniversary. In crypto economics, reduced supply typically supports higher prices - but only if demand remains constant or increases. The current situation presents a fascinating paradox:

| Factor | Bullish Case | Bearish Case |

|---|---|---|

| Supply Reduction | 5800% burn rate decreases circulating supply | New address growth down 40% offsets burn impact |

| Technical Position | Oversold Bollinger Bands suggest rebound | MACD remains in bearish territory |

| Market Sentiment | 96% holder retention shows strong conviction | Declining new investor interest raises concerns |

Expert Price Projections for SHIB

The BTCC research team outlines three potential scenarios for SHIB's price movement:

Requires breaking above the upper Bollinger Band with substantial volume support, potentially fueled by continued aggressive burns and renewed retail interest.

A reversion to the 20-day moving average WOULD represent a 14% gain from current levels, reflecting typical mean-reversion behavior in crypto markets.

A breakdown below the lower Bollinger Band could trigger stop losses and test the psychological $0.000011 support level.

Market Psychology: Anniversary Optimism vs. Investor Fatigue

Crypto markets have always been as much about psychology as fundamentals. The fifth anniversary creates natural nostalgia for early SHIB investors who remember the token's meteoric rise in 2021. However, the current 21% price drop despite the burn rate surge suggests many traders are taking a "show me" approach - wanting to see sustained buying pressure before committing.

Interestingly, blockchain data shows that while new investor interest has declined 40% over the past 10 days, the 96% retention rate among existing holders indicates strong diamond hands. This creates an interesting tension between short-term traders and long-term believers.

Historical Context: How SHIB Reacted to Previous Burn Events

Looking back at SHIB's price action following significant burn events provides valuable context:

- July 2023: 300% burn rate increase preceded 18% price gain over two weeks

- January 2024: 1200% burn spike saw immediate 9% jump but gave back gains within days

- May 2025: 2400% burn correlated with 15% rise sustained for three weeks

The current 5800% burn dwarfs these previous events, making historical comparisons challenging. The unprecedented scale could either lead to proportionally greater price movement or represent "burn fatigue" where the market becomes desensitized to supply shocks.

Key Questions About SHIB's Future

How significant is the 5800% burn rate for SHIB's price?

The 5800% burn rate represents the most aggressive supply reduction in SHIB's history. While mathematically significant, its price impact depends on whether demand factors (new buyers, trading volume) can capitalize on the reduced supply.

What technical levels should SHIB traders watch?

Critical levels include the 20-day MA at $0.00001394 (resistance), lower Bollinger Band at $0.00001207 (support), and psychological round number at $0.00001000. A break above $0.00001450 could signal trend reversal.

Does the declining new investor interest outweigh the burn rate?

It creates short-term headwinds, but the high retention rate suggests existing holders believe in SHIB's long-term value. The market typically rewards patience during such transitions.

What's the most realistic price target for SHIB in August 2025?

The base case target of $0.00001394 (20-day MA) appears most achievable, though volatility could push prices temporarily higher or lower. The burn rate provides fundamental support that may prevent drastic declines.

How does SHIB's situation compare to other meme coins?

Unlike many meme coins, SHIB has developed substantial utility and ecosystem development. The burn mechanism adds a deflationary aspect most meme tokens lack, potentially giving it more staying power.