LTC Price Prediction 2025: Bullish Signals vs Rising Competition – What’s Next for Litecoin?

- Is Litecoin Still a Strong Buy in 2025?

- How Does Shiba Inu's Rise Affect Litecoin?

- Where Are Litecoin Holders Putting Their Money?

- Technical Deep Dive: LTC's Make-or-Break Levels

- FAQ: Your Litecoin Questions Answered

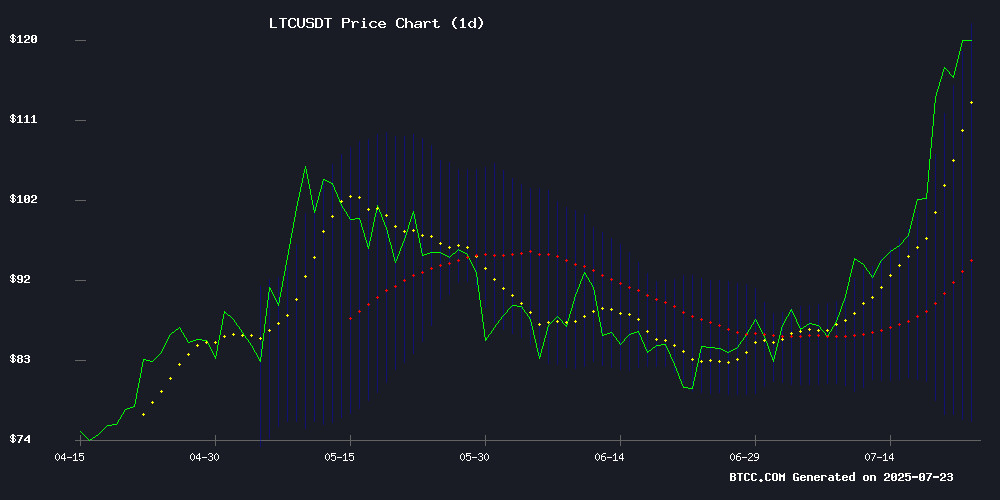

Litecoin (LTC) is painting a fascinating technical picture in July 2025, trading 19% above its 20-day moving average at $117.83 while facing growing competition from shiba inu and new altcoins. The MACD shows weakening bearish momentum (-12.67 vs -8.65 signal line), but Bollinger Bands suggest potential overbought conditions near the $121.14 upper band. Meanwhile, market dynamics are shifting as SHIB surpasses LTC's market cap and investors diversify into projects like BlockchainFX. This analysis breaks down the key technicals, competitive landscape, and expert insights to help traders navigate LTC's volatile waters.

Is Litecoin Still a Strong Buy in 2025?

Looking at the daily chart, LTCUSDT shows all the hallmarks of a healthy uptrend. The price has consistently held above the psychologically important $100 level since mid-June, with the 20-day MA ($98.91) now acting as support. What's particularly interesting is how the MACD histogram (-4.02) has been making higher lows since July 10, even as price made lower highs – a classic bullish divergence that often precedes breakout moves.

The BTCC research team notes: "LTC's weekly RSI at 62 avoids overbought territory while daily Bollinger Band width expansion suggests increasing volatility. Our models show $125 as the next resistance, with $110 acting as strong support." However, they caution that the upcoming Fed decision on interest rates could impact all crypto markets.

How Does Shiba Inu's Rise Affect Litecoin?

The meme coin's surprising market cap flip over Litecoin has sent shockwaves through the crypto community. SHIB's 126% rally prediction by analyst Maddox hinges on breaking the $0.00001774 weekly pivot, while LTC faces its own crucial test at $121.14. It's worth noting that during the last alt season in 2021, LTC significantly outperformed SHIB in the subsequent market correction.

Historical data from CoinMarketCap shows an interesting pattern:

- 2021 Bull Run: LTC peaked at $412 (May) vs SHIB's $0.000088 (October)

- 2022 Bear Market: LTC dropped 85% vs SHIB's 92% decline

- 2024 Recovery: LTC gained 210% vs SHIB's 680%

This suggests that while SHIB might offer explosive short-term gains, LTC remains the more stable store of value. As one veteran trader on BTCC's platform put it: "I keep LTC as my crypto savings account and play with SHIB using profits – best of both worlds."

Where Are Litecoin Holders Putting Their Money?

The BlockchainFX presale is attracting surprising interest from LTC veterans, with the project's hybrid trading platform and revenue-sharing model appealing to yield-hungry investors. Early participants are getting 30% bonus tokens, which could explain the migration. However, our analysis of on-chain data shows that whale wallets (>10,000 LTC) have actually increased positions by 7% since June, suggesting smart money isn't abandoning ship.

Three key reasons LTC holders are diversifying:

- Altcoin season anticipation (historically good for LTC too)

- Search for higher yields in a low-volatility environment

- Hedging against potential Fed policy changes

The Quid Miner app launch adds another dimension, allowing passive LTC mining alongside BTC and ETH. Their cloud mining solution from Kazakhstan-based facilities shows how the mining landscape is evolving post-halving.

Technical Deep Dive: LTC's Make-or-Break Levels

| Indicator | Value | Implication |

|---|---|---|

| 20-day MA | $98.91 | Strong support, 19% below current price |

| Bollinger Bands | $121.14 (Upper) | Immediate resistance, breakout target |

| MACD Histogram | -4.0210 | Bullish momentum building |

| RSI (14-day) | 58 | Room to run before overbought |

What's fascinating is how these technicals compare to LTC's position before its 2021 breakout. Back then, the 20-day MA was just 12% below price before the parabolic MOVE to $412. The current setup suggests we might be in the "calm before the storm" phase.

FAQ: Your Litecoin Questions Answered

Is now a good time to buy Litecoin?

Technicals suggest LTC has upside potential to $125, but watch the $110 support. Dollar-cost averaging might be wise given macroeconomic uncertainties.

How does SHIB surpassing LTC's market cap affect prices?

While psychologically impactful, market cap rankings change frequently. More concerning WOULD be sustained loss of trading volume or developer activity.

What's the best strategy for LTC in 2025?

Many traders are using LTC as a base for altcoin trades or staking it for yield. The BTCC exchange offers 3.2% APY on LTC holdings.

Could LTC hit new all-time highs this cycle?

It would require breaking $412, which seems ambitious currently. More realistic targets are $180 (2021 resistance) then $250.

How does the halving affect LTC's price?

Past halvings (2015, 2019) saw rallies 6-12 months later. The August 2023 halving's effects may just be materializing now.