BTC Price Prediction November 2025: Will Bitcoin Break Resistance or Test Support?

- Where Does Bitcoin Stand Technically in November 2025?

- What's Driving Bitcoin's Mixed Market Sentiment?

- How Are Corporate Bitcoin Strategies Performing?

- What Regulatory Developments Could Impact BTC?

- Is Bitcoin Still Acting as Digital Gold?

- What Are the Psychological Impacts of Crypto Trading?

- How High Could Bitcoin Go in November 2025?

- Frequently Asked Questions

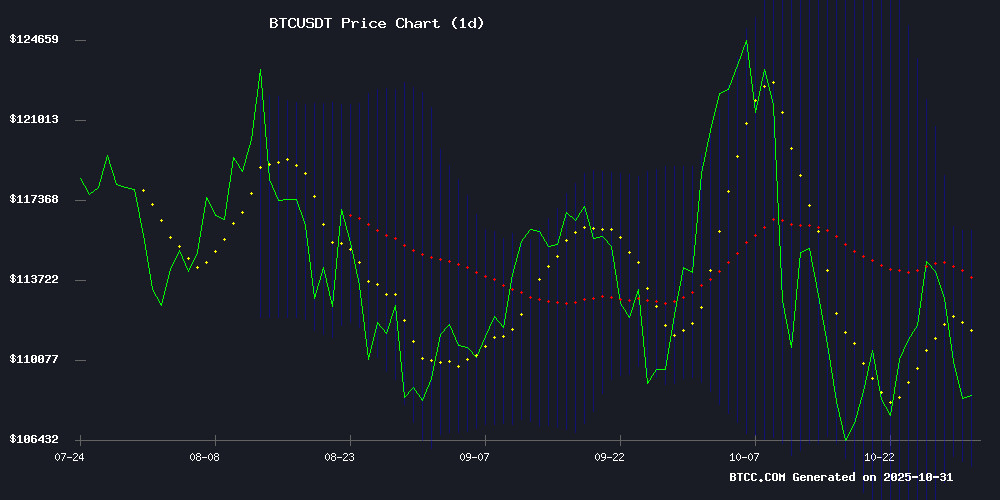

Bitcoin enters November 2025 at a critical technical juncture, trading just below its 20-day moving average while showing signs of consolidation. The cryptocurrency currently faces a tug-of-war between bearish short-term momentum and strong institutional fundamentals. Our analysis examines the key levels to watch, market sentiment drivers, and whether BTC is poised for a year-end rally or deeper correction. With regulatory developments, corporate treasury strategies, and macroeconomic factors all influencing price action, we break down what traders need to know for November's trading.

Where Does Bitcoin Stand Technically in November 2025?

As of November 1, 2025, bitcoin trades at $109,606.65 - slightly below the psychologically important 20-day moving average of $110,650.64. The MACD histogram shows bearish momentum with a reading of -2,095.20, suggesting short-term pressure. However, the Bollinger Bands (ranging from $105,355.80 to $115,945.49) indicate we're in a consolidation phase rather than a strong downtrend.

Key levels to watch:

- Resistance: $110,650 (20-day MA) followed by $115,945 (upper Bollinger Band)

- Support: $105,355 (lower Bollinger Band) then $100,000 psychological level

What's Driving Bitcoin's Mixed Market Sentiment?

The current market presents a fascinating dichotomy between regulatory concerns and institutional strength. On the negative side:

- Russia considering year-round Bitcoin mining bans in energy-strained Siberian regions

- Global banking regulators reassessing crypto capital requirements

- $870 million liquidated from crypto markets in late October

Counterbalancing these are several bullish factors:

- Tether's record $10B+ profits and $6.8B excess reserves

- Stable on-chain metrics showing holder resilience

- Institutional inflows stabilizing after October's volatility

How Are Corporate Bitcoin Strategies Performing?

MicroStrategy's Q3 earnings revealed both the promise and challenges of corporate Bitcoin strategies. While the company reported $3.9 billion in unrealized Bitcoin gains, its premium over BTC holdings collapsed to just 1.3%. Analysts from Cantor Fitzgerald, TD Cowen, and Maxim Group all slashed price targets, reflecting concerns about:

| Metric | Status | Implication |

|---|---|---|

| BTC Price Appreciation | Slowing | Reduced treasury strategy effectiveness |

| Capital Issuance | Weaker | Limited funds for additional BTC purchases |

| Investor Premium | 1.3% (down from 2%) | Decreased market confidence |

What Regulatory Developments Could Impact BTC?

The Basel Committee on Banking Supervision is reconsidering its 2022 framework that imposed restrictive 1,250% risk weights on crypto assets. This potential shift comes as:

- Stablecoins gain traction in global payments

- Major economies push back against overly conservative rules

- Institutions demand clearer crypto custody guidelines

Meanwhile, Singapore's seizure of $106 million in assets tied to alleged crypto fraud kingpin Chen Zhi highlights ongoing regulatory scrutiny in Asia.

Is Bitcoin Still Acting as Digital Gold?

Despite recent volatility, Bitcoin's 2025 performance (+53%) continues to outpace spot Gold (+35%), maintaining its "digital gold" narrative. The cryptocurrency has shown remarkable resilience with five straight years of >50% gains (excluding 2022's bear market). Key metrics suggest:

- Institutional interest remains strong despite short-term outflows

- Historical November-December performance tends to be positive

- Global instability continues to drive demand for alternative assets

What Are the Psychological Impacts of Crypto Trading?

A National Library of Medicine study of 11,177 participants found crypto traders experience:

- Higher stress levels than traditional investors

- Increased anxiety and perceived loneliness

- Addictive behaviors similar to gambling

This underscores the importance of risk management and emotional discipline when trading volatile assets like Bitcoin.

How High Could Bitcoin Go in November 2025?

Based on current technicals and fundamentals, we see three potential scenarios:

- Bullish Breakout: Clearing $110,650 could target $116,000 (upper Bollinger Band) then $124,680 (CoinCodex projection)

- Rangebound: Continued consolidation between $105,355 and $115,945

- Bearish Breakdown: Losing $105,355 support could test $100,000 then $90,000

The BTCC research team notes that while short-term momentum appears bearish, Bitcoin's institutional adoption and historical resilience provide longer-term bullish potential.

Frequently Asked Questions

What is Bitcoin's current price and key levels?

As of November 1, 2025, Bitcoin trades at $109,606.65. Key levels to watch are resistance at $110,650 (20-day MA) and support at $105,355 (lower Bollinger Band).

Is Bitcoin in a bull or bear market?

Bitcoin shows characteristics of both - bearish short-term momentum but bullish longer-term fundamentals. The cryptocurrency remains up 53% year-to-date despite recent pullbacks.

How are corporate Bitcoin strategies performing?

MicroStrategy's Bitcoin treasury strategy shows signs of strain, with its premium over BTC holdings collapsing to 1.3% from over 2% previously. However, the company still holds substantial unrealized gains.

What are the main risks to Bitcoin's price?

Key risks include regulatory developments, macroeconomic conditions, mining restrictions in Russia, and potential loss of the $105,355 support level.

Could Bitcoin reach new highs in 2025?

While possible, Bitcoin WOULD need to overcome significant resistance levels first. The upper Bollinger Band at $115,945 and psychological resistance at $120,000 would need to be cleared.