Bitcoin’s Road to $200K in 2025: Technical Signals and Market Catalysts Align

- Bitcoin's Technical Setup: Accumulation or Breakdown?

- Institutional Winds: How BlackRock's Move Changes the Game

- The HODL Phenomenon: What Cooling Exchange Flows Really Mean

- Macroeconomic Crosscurrents: Why 2026 Might Be the New 2024

- The $200K Equation: Path and Probability

- Emerging Wildcards: Quantum Computing and Geopolitics

- Frequently Asked Questions

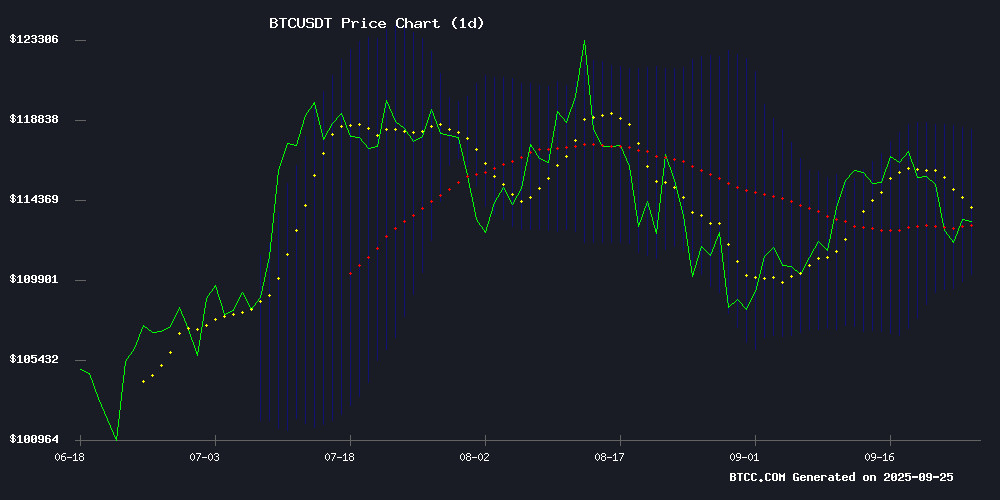

As we approach Q4 2025, bitcoin stands at a critical juncture - trading at $109,349 while showing signs of both consolidation and potential breakout. This analysis combines technical indicators, institutional developments, and macroeconomic factors to assess BTC's path to $200,000. With BlackRock's ETF moves, cooling exchange flows, and emerging cup-and-handle patterns, the stage might be set for Bitcoin's next major rally - if key resistance levels break.

Bitcoin's Technical Setup: Accumulation or Breakdown?

BTC currently trades below its 20-day MA ($114,055) but shows intriguing technical signals. The MACD at -1,455 displays weakening momentum, yet the narrowing gap suggests potential reversal. More importantly, BTC's position NEAR the Bollinger lower band ($109,494) historically marks accumulation zones. "We're seeing textbook consolidation," notes the BTCC analyst team. "A sustained hold above $109K could trigger upward momentum toward the middle band at $114K, with $118K as the next resistance." The chart below illustrates this critical juncture:

Source: TradingView

Institutional Winds: How BlackRock's Move Changes the Game

BlackRock's $12.5T Bitcoin Premium Income ETF filing represents a watershed moment. Unlike their existing $87B IBIT product, this covered-call strategy ETF targets yield-seeking institutional investors. Bloomberg's Eric Balchunas notes it's structured under the '33 Act - a deliberate move to appeal to traditional finance. "This isn't just another crypto product," says a Wall Street trader who requested anonymity. "It's BlackRock planting their flag firmly in crypto income generation." Approval could trigger the next institutional wave, though timing remains uncertain.

The HODL Phenomenon: What Cooling Exchange Flows Really Mean

Centralized exchange activity tells a fascinating story. After peaking earlier this year, gross flows have plummeted, with Flow Activity Pressure at just 9 - firmly in "HODL mode" territory. Analyst Axel Adler interprets this as investors shifting from speculative trading to long-term positioning. Historically, such periods precede major upward moves. The numbers speak volumes:

| Metric | Previous Peak | Current (Sept 2025) |

|---|---|---|

| CEX Inflows | $2.1B daily | $890M daily |

| FLOW Pressure | 47 | 9 |

Macroeconomic Crosscurrents: Why 2026 Might Be the New 2024

The traditional 4-year Bitcoin cycle appears to be extending. Raoul Pal points to corporate debt maturities (4-5.4 years) and sustained high rates as key drivers. This creates an unusual situation where Bitcoin's halving rhythm (last was April 2024) might not align neatly with price peaks. "We're seeing the business cycle slow globally," explains a Goldman Sachs macro strategist. "For crypto, this means potential delayed but possibly amplified moves when liquidity conditions eventually ease."

The $200K Equation: Path and Probability

Reaching $200,000 from current levels requires an 83% appreciation. The roadmap involves several key milestones:

- Break and hold above $114K (20-day MA)

- Clear $118K (Bollinger upper band)

- Sustain through $123K resistance

- BlackRock ETF approval catalyst

- Macro liquidity improvements

The BTCC research team suggests watching the cup-and-handle formation - a pattern that previously preceded BTC's major rallies in 2017 and 2020. "Technical setups align favorably," they note, "but macroeconomic patience will be required."

Emerging Wildcards: Quantum Computing and Geopolitics

IBM's Starling quantum project (targeting 2029) raises long-term questions about Bitcoin's cryptography, though markets currently view this as a distant concern. More immediately, Ukraine's $1B in annual crypto transactions demonstrates digital assets' growing role in conflict economies. Meanwhile, Ohio's Bitcoin tax payments and UK political chatter about reserves show accelerating institutional acceptance.

Frequently Asked Questions

What's the most important technical level for Bitcoin right now?

The $109,000 support level is critical in the short term. A sustained break below could signal deeper correction, while holding above maintains the bullish consolidation pattern.

How significant is BlackRock's new Bitcoin ETF filing?

Extremely. Their $12.5T AUM gives any product instant credibility, and the covered-call strategy specifically targets conservative institutional investors seeking yield.

Why are analysts talking about 2026 instead of 2024 for the next cycle peak?

Extended corporate debt maturities and persistent high interest rates are stretching traditional business cycles, which appears to be impacting crypto market timing as well.

Is quantum computing an immediate threat to Bitcoin?

Not according to current market pricing. IBM's 2029 target gives the ecosystem years to develop quantum-resistant solutions if needed.

What's the single biggest catalyst for reaching $200K?

A combination of BlackRock ETF approval coinciding with Fed rate cuts WOULD likely provide the strongest momentum, though technical breakouts could also spark momentum trades.