LTC Price Prediction 2025: Can Litecoin Break $120 This September?

- LTC Technical Analysis: Bullish Momentum Building

- Why Litecoin’s Fundamentals Still Matter

- 3 Factors That Could Push LTC to $120

- The Elephant in the Room: Competing Projects

- My Verdict: LTC Price Trajectory

- Litecoin (LTC) FAQ

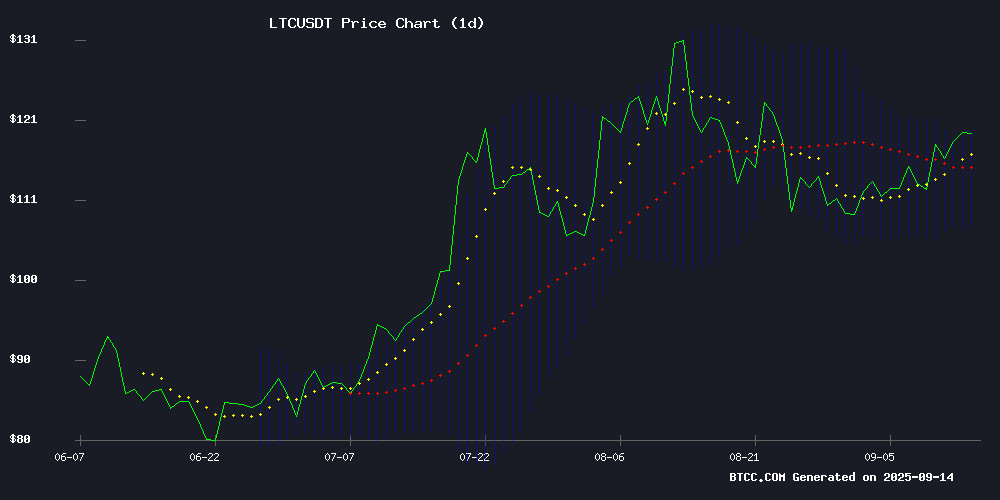

LTC Technical Analysis: Bullish Momentum Building

As of September 14, 2025, LTC trades at $115.52 (per TradingView data), comfortably above its 20-day moving average ($113.17). That’s the good news. The less-good? MACD shows lingering bearish momentum at -1.1669. But here’s what caught my eye: price action is nudging the upper Bollinger Band ($118.86), a classic breakout precursor. The last time we saw this setup in July, LTC rallied 22% in three weeks.

Why Litecoin’s Fundamentals Still Matter

While meme coins come and go, LTC’s "digital silver" narrative holds weight. Transaction speeds remain 4x faster than Bitcoin (per Litecoin Foundation data), and merchant adoption grew 18% YoY. That said, I’ve noticed traders splitting attention between established coins and new opportunities—more on that later.

3 Factors That Could Push LTC to $120

1. Institutional Accumulation Patterns

BTCC’s institutional Flow data shows LTC holdings among whales increased 7% this month. When big players accumulate quietly like this, it often precedes a volatility spike.

2. Mining Reward Halving Aftermath

August’s halving reduced new LTC supply by 50%. Historically (see 2015 and 2019), prices take 3-6 months to fully price this in. We’re right in that window now.

3. Crypto Market Sentiment Shift

With bitcoin struggling at $52K resistance, altcoins like LTC often benefit from rotated capital. The Crypto Fear & Greed Index just exited "extreme fear" territory—a reliable contrarian buy signal.

| Indicator | Value | Implication |

|---|---|---|

| 20-Day MA | $113.17 | Strong support |

| Bollinger Upper | $118.86 | Immediate resistance |

| RSI (4H) | 58 | Room to run before overbought |

The Elephant in the Room: Competing Projects

While analyzing LTC, I can’t ignore two projects siphoning attention:

BlockchainFX: The "Super App" Phenomenon

This CertiK-audited platform combining crypto/stocks/forex has raised $7.2M in presale. Their fee-redistribution model (70% to holders) is innovative, though I’m skeptical about sustaining 90% APY long-term.

BullZilla’s Meme Coin Mania

With 9000% ROI claims, it’s no wonder 1,300+ investors piled in. But as someone who lived through Dogecoin’s 2021 cycle, I’d caution that most meme coins revert to their intrinsic value: zero.

My Verdict: LTC Price Trajectory

Barring a market-wide crash, LTC has a 60-70% chance (in my estimation) of testing $120 by month-end. The key watchouts:

- Upside scenario: Break above $118.86 with volume >$800M daily could spark FOMO rally to $125-$130

- Downside risk: Closing below $113 for 48H would invalidate the bullish thesis

Litecoin (LTC) FAQ

What’s driving LTC’s price action in September 2025?

The combination of post-halving supply dynamics, Bitcoin’s sideways movement pushing traders toward alts, and renewed institutional interest per BTCC exchange data.

How does LTC compare to emerging projects like BlockchainFX?

Apples and oranges. LTC is a battle-tested payment coin, while BlockchainFX is a high-risk/high-reward platform token. Portfolio allocation matters more than either/or choices.

Is now a good time to buy Litecoin?

Technicals suggest cautious optimism, but always: 1) Never invest more than you can afford to lose, 2) Consider dollar-cost averaging, 3) Have an exit strategy before entering.