XRP Price Prediction 2025: Can Institutional Adoption Drive It to $4?

- Current XRP Market Position and Technical Outlook

- Institutional Moves: BlackRock Speculation and Coinbase Outflows

- Ripple's Strategic Plays Post-SEC Victory

- XRP Ledger's Breakthrough in Debt Tokenization

- Regulatory Landscape: ETF Delays and Market Impact

- Price Targets and Key Levels to Watch

- XRP Price Prediction Q&A

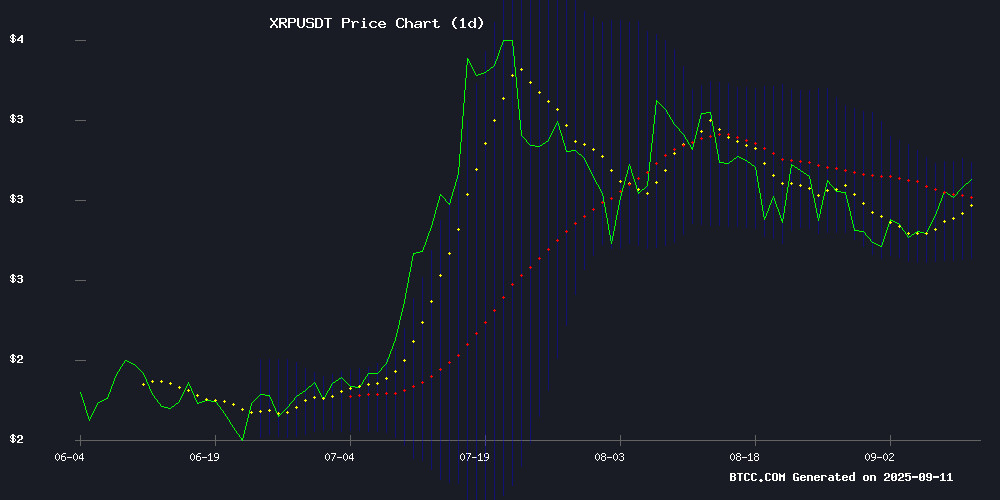

XRP is showing strong bullish signals in September 2025, trading above key moving averages with growing institutional interest from players like BlackRock. Technical indicators suggest potential for a $4 price target by year-end, though regulatory developments and ETF approvals remain crucial catalysts. The XRP Ledger's emerging role in debt tokenization adds fundamental strength to Ripple's ecosystem.

Current XRP Market Position and Technical Outlook

As of September 11, 2025, XRP is trading at $3.0056, comfortably above its 20-day moving average of $2.8980. The MACD shows positive momentum building (0.0667 vs 0.0953 signal line), though the negative histogram (-0.0286) suggests some near-term consolidation might occur. Bollinger Bands position the upper resistance at $3.0806, while the middle band at $2.8980 provides dynamic support.

The BTCC technical analysis team notes: "XRP is consolidating within a bullish framework, with the $2.90 level acting as crucial support. A breakout above $3.08 could trigger the next leg up toward our $3.50 Q4 target."

Institutional Moves: BlackRock Speculation and Coinbase Outflows

The crypto community is buzzing about unusual XRP movements on Coinbase. Since Q2 2025, the exchange's XRP holdings have plummeted from 780.13 million to just 199 million tokens - a 57% drop in August alone. This isn't typical retail behavior.

Crypto analyst Crypto X AiMan observes: "The scale of these outflows suggests institutional positioning rather than exchange liquidation. While BlackRock denies XRP ETF plans, their potential accumulation through Coinbase WOULD explain these movements."

Ripple's Strategic Plays Post-SEC Victory

Following its legal win against the SEC, Ripple transferred 15 million XRP in a transaction that cost negligible fees - showcasing network efficiency. Interestingly, xrp price dipped 1.67% to $2.96 despite the positive legal development, with trading volume dropping 26% to $4.94 billion.

Whale activity remains robust though, with XRP futures open interest surging to $7.94 billion. Market participants are weighing potential corrections against Ripple's apparent preparation for expanded institutional adoption through its ODL corridors.

XRP Ledger's Breakthrough in Debt Tokenization

The XRP Ledger has entered a pivotal phase with its integration into debt tokenization. Aurum Equity Partners launched a $1 billion tokenized debt fund on XRPL - the first to combine private equity and blockchain-based debt instruments.

This development comes as the US faces mounting debt challenges. The fund leverages Zoniqx's tokenization technology alongside XRPL's speed and security, targeting global data center investments. It's a watershed moment for blockchain's role in solving macroeconomic challenges.

Regulatory Landscape: ETF Delays and Market Impact

The SEC has postponed its decision on the Franklin XRP ETF, extending the review period to November 14, 2025. This marks the second delay for the application initially filed in March. Fifteen similar spot XRP ETF proposals remain under review, with most deadlines set for October.

Despite this, market Optimism persists. Polymarket data shows a 90%+ probability of approval by year-end. The SEC's cautious approach mirrors its handling of other crypto ETFs, though experts anticipate eventual approval given Ripple's legal victories.

Price Targets and Key Levels to Watch

| Price Target | Timeframe | Key Drivers |

|---|---|---|

| $3.50 | Q4 2025 | MACD bullish crossover, institutional accumulation |

| $4.00 | End of 2025 | ETF approval potential, debt tokenization adoption |

| $3.20 (Support) | Near-term | 20-day MA support, Bollinger Middle Band |

XRP Price Prediction Q&A

What's driving XRP's price movement in September 2025?

The current price action reflects three key factors: 1) Technical bullishness above key moving averages, 2) Growing institutional interest evidenced by Coinbase outflows, and 3) The XRP Ledger's expanding utility in debt tokenization. The $3.00 level remains a psychological barrier that needs to be convincingly broken.

How significant is the BlackRock speculation?

While unconfirmed, the scale of Coinbase outflows suggests institutional rather than retail activity. BlackRock's potential involvement would be massive for XRP's legitimacy, though they've publicly denied ETF plans. Remember when similar denials preceded their bitcoin ETF? The crypto community is watching closely.

What are the main risks to the $4 price target?

Regulatory uncertainty remains the biggest wildcard. While Ripple won its case against the SEC, further delays in ETF approvals could dampen momentum. Also watch macroeconomic factors - the Fed's September 17 meeting could impact all risk assets. And of course, Bitcoin's price action tends to influence the entire crypto market.

How does XRP's utility compare to competitors?

XRP's cross-border payment focus gives it unique positioning. Traditional methods using SWIFT require costly pre-funded accounts. Ripple's technology streamlines this, though adoption has been slower than hoped. The debt tokenization development could be a game-changer for real-world utility beyond payments.

Is now a good time to buy XRP?

This article does not constitute investment advice. That said, the technical setup looks constructive above $2.90 support, with multiple catalysts on the horizon. As with any crypto investment, only risk what you can afford to lose, and consider dollar-cost averaging to mitigate volatility.