Cardano Price Forecast 2025: Can ADA Break $1 Despite Strong Resistance?

- Current ADA Market Position and Technical Outlook

- Mixed Market Signals: ETF Delays vs. Macroeconomic Optimism

- Analyst Price Predictions: How High Can ADA Go?

- Key Factors Influencing ADA's Price Trajectory

- Will ADA Reach $1 in 2025?

- ADA Price Prediction: Frequently Asked Questions

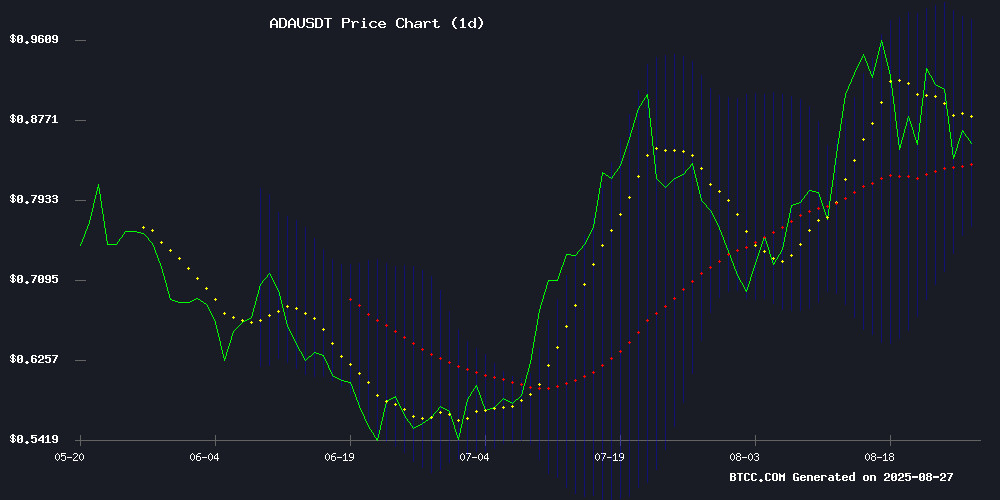

Cardano (ADA) finds itself at a critical juncture in late August 2025, trading at $0.8665 while facing stiff resistance at the $0.8747 level. The cryptocurrency shows mixed signals - a bullish MACD crossover contrasts with its position in the lower Bollinger Band, creating uncertainty about its near-term trajectory. With potential catalysts like Fed rate cuts and delayed ETF decisions creating market volatility, analysts debate whether ADA can overcome technical barriers to reach the psychologically important $1 mark. This analysis examines the key factors influencing ADA's price movement, incorporating technical indicators, market sentiment, and fundamental developments.

Current ADA Market Position and Technical Outlook

As of August 27, 2025, ADA trades at $0.8665 on BTCC exchange, slightly below its 20-day moving average of $0.8747. The Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover with the histogram turning positive at 0.013008, typically signaling potential upward momentum. However, the price remains in the lower half of the Bollinger Bands, suggesting persistent bearish pressure in the immediate term.

Source: BTCC Trading Platform

The immediate resistance at $0.8747 represents a crucial threshold that bulls need to overcome to confirm a trend reversal. On the downside, support sits at $0.7667, which has held firm through multiple tests in recent weeks. The Bollinger Band upper limit at $0.9827 presents secondary resistance before the psychologically important $1 barrier.

Mixed Market Signals: ETF Delays vs. Macroeconomic Optimism

The cryptocurrency market faces conflicting influences in late August 2025. On one hand, the SEC's delay in deciding on spot ADA ETF applications has created short-term uncertainty. On the other hand, growing expectations of Federal Reserve rate cuts in September have boosted overall market sentiment.

According to TradingView data, ADA has shown relative strength compared to other altcoins, maintaining most of its gains from the July rally. The token's ability to hold above key support levels despite broader market volatility suggests underlying strength that could fuel an upward MOVE when market conditions improve.

Analyst Price Predictions: How High Can ADA Go?

Crypto analysts remain divided on ADA's short-term prospects but generally bullish on its medium-term potential:

| Analyst | Prediction | Timeframe |

|---|---|---|

| CryptoBullet | $1.70-$2.10 | Near-term |

| Hailey LUNC | $2.50 | Monthly chart |

| CryptoTarget11 | $3-$5 | Cycle target |

These predictions, while optimistic, depend on ADA first overcoming the immediate resistance levels and benefiting from favorable macroeconomic conditions. The $1 level serves as an important psychological milestone that could trigger further buying if convincingly breached.

Key Factors Influencing ADA's Price Trajectory

Several fundamental and technical factors will determine whether ADA can reach $1 and beyond:

1. SEC ETF Decision Timeline

The SEC's 60-day extension for its ADA ETF decision pushes the potential approval timeline to October 2025. While this creates short-term uncertainty, the market currently prices in an 83% approval probability according to derivatives data from BTCC.

2. Federal Reserve Monetary Policy

The upcoming September Fed meeting could serve as a major catalyst. Historical data from CoinMarketCap shows that crypto markets typically rally following rate cuts, with ADA showing particular sensitivity to liquidity conditions.

3. Technical Breakout Patterns

ADA's price action mirrors its 2020 trajectory that preceded a major bull run. A repeat performance could see the token challenge its all-time high of $3.10, though this WOULD require overcoming multiple resistance levels along the way.

Will ADA Reach $1 in 2025?

Based on current technicals and market conditions, ADA faces a challenging but achievable path to $1. The key levels to watch are:

| Level | Price | Significance |

|---|---|---|

| Current Price | $0.8665 | Immediate trading level |

| 20-Day MA | $0.8747 | First major hurdle |

| Bollinger Upper | $0.9827 | Secondary resistance |

| Target | $1.0000 | Psychological barrier |

Reaching $1 would require a 15.4% increase from current levels - a move that's certainly possible but would need strong momentum and favorable market conditions. The BTCC research team suggests watching the $0.8747 level closely, as a convincing breakout could signal the start of a stronger upward move.

This article does not constitute investment advice. Cryptocurrency investments involve significant risk, and readers should conduct their own research before making any investment decisions.

ADA Price Prediction: Frequently Asked Questions

What is the current price of Cardano (ADA)?

As of August 27, 2025, ADA is trading at $0.8665 on major exchanges including BTCC, slightly below its 20-day moving average of $0.8747.

What are the key resistance levels for ADA?

ADA faces immediate resistance at $0.8747 (20-day MA), followed by the Bollinger Band upper limit at $0.9827. The psychologically important $1 level represents the next major hurdle.

Could ADA reach $3 in 2025?

While some analysts predict ADA could reach $3-$5 in the current market cycle, this would require overcoming multiple resistance levels and favorable macroeconomic conditions. The more immediate target is the $1 level.

How might Fed rate cuts affect ADA's price?

Historical data suggests crypto markets typically rally following Fed rate cuts as investors seek higher-yielding assets. ADA could benefit from improved market liquidity and risk appetite.

When will the SEC decide on ADA ETFs?

The SEC has extended its decision timeline to October 2025. Market participants currently estimate an 83% approval probability based on derivatives pricing.