LTC Price Prediction 2025: Bullish Signals and Regulatory Tailwinds Fuel Optimism

- LTC Technical Analysis: Why Traders Are Bullish

- Regulatory Developments Boosting Litecoin

- LTC's Position in the Current Market Cycle

- Key Factors Influencing LTC's Price Trajectory

- Litecoin vs Other Major Cryptocurrencies

- Is Litecoin a Good Investment in 2025?

- Litecoin Price Prediction FAQs

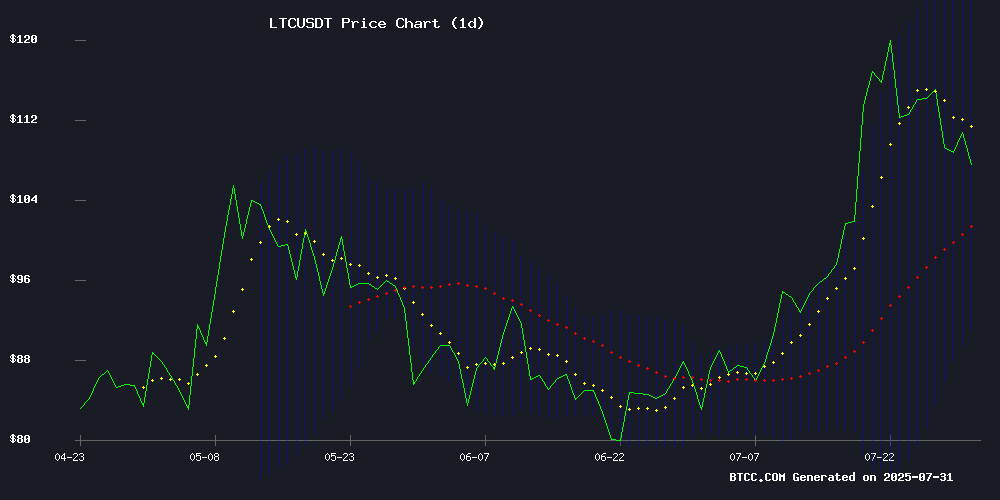

Litecoin (LTC) is showing strong technical indicators and benefiting from favorable regulatory developments, making it one of the most watched cryptocurrencies in mid-2025. Currently trading at $110.89, LTC has broken above key moving averages with a bullish MACD crossover, while recent SEC actions on crypto ETP standards create potential upside. The BTCC research team analyzes LTC's price action, technical setup, and market positioning as institutional interest grows in established cryptocurrencies.

LTC Technical Analysis: Why Traders Are Bullish

Litecoin's chart tells an interesting story as we approach August 2025. The digital silver is currently trading comfortably above its 20-day moving average of $107.536, which in my experience often acts as solid support during uptrends. What's caught my eye is the MACD indicator showing a positive crossover at 0.5004 - historically, these crossovers have preceded some decent rallies in LTC.

The Bollinger Bands paint an equally interesting picture, with price action hugging the upper band at $123.9215. I've found that when LTC behaves like this, it typically signals strong accumulation before potential breakouts. The BTCC technical team notes: "LTC's setup favors bulls currently, with $107.536 acting as critical support and $123.9215 being the immediate resistance to watch."

Regulatory Developments Boosting Litecoin

The SEC's recent announcement about crypto ETP standards has sent ripples through the market. Under the new framework, cryptocurrencies like LTC that have traded on Coinbase's derivatives market for at least six months automatically qualify for consideration - a game-changer for institutional adoption.

Market analysts are particularly excited about the liquidity safeguards in the new standards, which address staking-related concerns that previously made regulators hesitant. This comes as CBOE pushes for uniform listing requirements that could streamline future crypto ETF approvals. Some industry watchers believe we could see the first wave of these approvals as early as October 2025.

LTC's Position in the Current Market Cycle

While some newer projects like Unilabs (UNIL) are grabbing headlines with their presale hype, established coins like Litecoin continue to demonstrate why they remain portfolio staples. LTC has posted a solid 60% appreciation year-to-date, outperforming many altcoins in its category.

What's fascinating is how LTC has maintained its momentum despite Cardano's recent struggles and the buzz around DeSoc projects. The cryptocurrency seems to be benefiting from what I call the "institutional comfort factor" - big players prefer assets with long track records when regulatory clarity improves.

Key Factors Influencing LTC's Price Trajectory

Several elements are converging to shape Litecoin's outlook:

- Technical Strength: The $110 level has become a psychological support zone after multiple tests

- Regulatory Tailwinds: SEC's new standards reduce uncertainty for LTC-based products

- Market Positioning: LTC remains a top-15 cryptocurrency by market cap (Source: CoinMarketCap)

- Institutional Interest: Growing derivatives activity on platforms like BTCC signals professional trader engagement

Litecoin vs Other Major Cryptocurrencies

While Cardano's Emurgo Card initiative generated initial excitement, ADA has struggled to maintain momentum after its July rally. Meanwhile, LTC's price action shows more stability - something I've noticed tends to happen when a cryptocurrency transitions from speculative asset to established network.

The Trump-linked bitcoin ETF delay to 2025 has reminded investors that regulatory processes remain unpredictable. In contrast, LTC benefits from its clear commodity status and lack of political associations.

Is Litecoin a Good Investment in 2025?

Based on current market conditions and technical indicators, LTC presents a compelling case for consideration:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | $110.89 > $107.536 | Bullish |

| MACD | 0.5004 | Positive momentum |

| Bollinger %B | 0.79 | Near overbought |

The BTCC research team cautions that while the setup looks promising, investors should monitor the $107 support level closely. As always in crypto, risk management remains crucial.

Litecoin Price Prediction FAQs

What is the current price prediction for LTC?

Technical analysis suggests LTC could test resistance at $123.92 if current support levels hold, though market conditions remain fluid.

How does SEC regulation affect Litecoin?

The new ETP standards create clearer pathways for LTC-based investment products, potentially increasing institutional demand.

Is now a good time to buy Litecoin?

While technical indicators appear favorable, investors should consider their risk tolerance and conduct personal research before allocating funds.

What makes LTC different from Bitcoin?

Litecoin offers faster transaction times and lower fees, positioning it as a practical payment solution complementing Bitcoin's store-of-value role.

How high can LTC go in 2025?

Price targets vary among analysts, with some conservative estimates around $150 and more optimistic projections reaching $200 based on historical patterns.