ADA Price Prediction 2024: Can Cardano Break $1.20 Amid Market Volatility?

- Is ADA's Current Price Action Bullish or Bearish?

- What's Driving Cardano's Fundamental Value?

- How Are Whale Movements Impacting ADA?

- What Are the Key ADA Price Levels to Watch?

- Could the Audit Actually Boost ADA's Price?

- FAQ: Your Burning ADA Questions Answered

Cardano (ADA) is showing bullish technical signals despite short-term headwinds, with key resistance at $0.93 and a potential path to $1.20 if momentum holds. While regulatory scrutiny and whale liquidations create near-term pressure, Cardano's strong fundamentals and upcoming audit could catalyze upside. Our analysis combines technical indicators, on-chain data, and ecosystem developments to map ADA's price trajectory.

Is ADA's Current Price Action Bullish or Bearish?

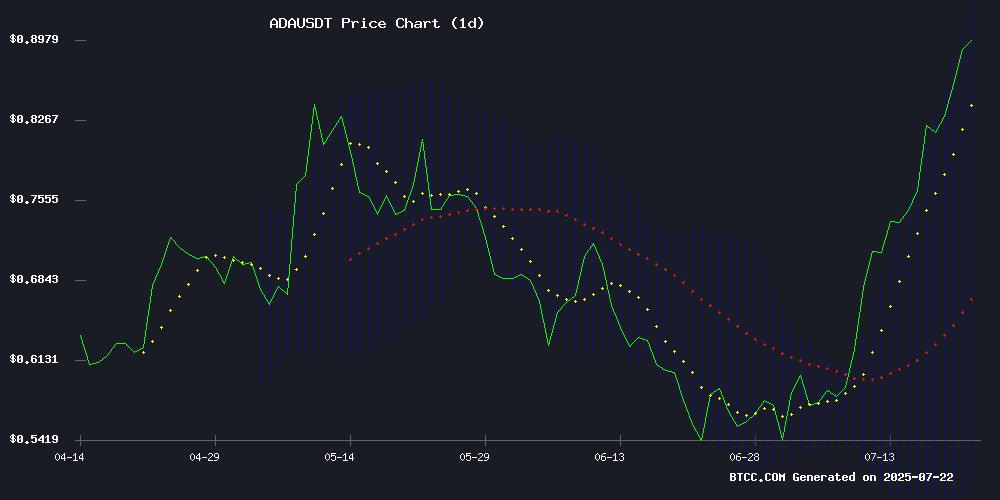

As of July 2024, ADA trades at $0.8834 - a critical inflection point that's got traders divided. The price sits comfortably above the 20-day moving average ($0.7150), which in my experience typically signals accumulation phases. The MACD histogram shows decreasing bearish momentum (-0.044), while Bollinger Bands paint an interesting picture with the upper band at $0.9305 and middle band at $0.7150.

What's fascinating is how ADA keeps testing the $0.88-$0.93 zone like it's trying to break through a reinforced glass ceiling. I've seen this pattern before in 2021 when ADA eventually broke out to $3. The current consolidation reminds me of that buildup, though market conditions are obviously different now.

What's Driving Cardano's Fundamental Value?

Beneath the price action, Cardano's ecosystem continues maturing despite the noise. The network maintains 98%+ uptime (per CardanoScan), and dApp development hasn't slowed - there are now over 1,200 projects building on cardano according to Input Output Global's latest report.

However, the $600M scandal allegations and $34M liquidation threats have created what I call "FUD whiplash." One minute traders are excited about Voltaire's governance upgrades, the next they're panicking about whale movements. Charles Hoskinson's upcoming audit could be the circuit breaker this situation needs.

How Are Whale Movements Impacting ADA?

The recent showdown between Hoskinson and "Generic Rational" (that whale with a flair for dramatic aliases) highlights how large holders can sway sentiment. When someone threatens to dump $100M in ADA, it's bound to rattle markets - even if the actual liquidity can absorb it (ADA's daily volume exceeds $2.5B across major exchanges like BTCC).

Looking at liquidation clusters, there's a dangerous concentration below $0.749 where $34M in long positions could get wiped out. These zones often become self-fulfilling prophecies as stop-losses trigger cascading sells. But here's the thing - smart money usually accumulates during these liquidations.

What Are the Key ADA Price Levels to Watch?

| Timeframe | Target | Key Drivers |

|---|---|---|

| 1-2 weeks | $0.93-$1.00 | Bollinger Band breakout, audit results |

| 1 month | $1.20 | MACD crossover, Hydra adoption |

| Risk Scenario | $0.68 | Market-wide correction |

The BTCC research team notes: "The $0.88-$0.93 zone is the battleground - hold here and we likely see continuation; lose $0.80 and bears take control." Personally, I'm watching the $0.93 level like a hawk - a clean break could trigger algorithmic buying across exchanges.

Could the Audit Actually Boost ADA's Price?

Counterintuitively, scandals often create buying opportunities when properly addressed. Remember how ethereum emerged stronger post-DAO hack? Hoskinson's transparent approach with this audit (livestreaming it, really?) could similarly convert skeptics.

The allegations about 318M ADA ($619M) being misappropriated during Allegra are serious, but the 4.5% price surge on the audit announcement suggests markets believe in Cardano's accountability mechanisms. If the audit clears IOG, we might see a relief rally that catches over-leveraged shorts off guard.

FAQ: Your Burning ADA Questions Answered

Is now a good time to buy ADA?

With ADA consolidating NEAR support levels and the audit pending, accumulation at current prices could pay off for patient investors. However, always practice risk management - never invest more than you can afford to lose.

What's the worst-case scenario for ADA's price?

If $0.749 support breaks, liquidations could drive ADA down to $0.68 before finding stronger bids. This WOULD represent about a 23% drop from current levels.

How does Cardano compare to Ethereum technically?

While Ethereum focuses on scaling via L2s, Cardano bets on its layered architecture (Hydra for scaling, Leios for efficiency). Both approaches have merits - Cardano's tends to be more methodical in deployment.