Ethereum Price Prediction 2025: Will ETH Shatter $4,000 Amid Institutional Buying Frenzy?

- Ethereum Technical Analysis: Is This the Start of a Major Rally?

- The Institutional ETH Grab: Who's Buying and Why?

- What's Driving the Institutional ETH Rush?

- Ethereum Price Forecast: How High Can ETH Go?

- FAQ: Your Ethereum Questions Answered

Ethereum is making waves in July 2025 as institutional demand reaches unprecedented levels. With corporate treasuries snapping up $1.65 billion worth of ETH monthly and technical indicators flashing bullish signals, analysts are debating just how high the second-largest cryptocurrency can climb. From SharpLink Gaming's massive accumulation to Peter Thiel's strategic bets, we break down the key factors driving Ethereum's price action and what might come next.

Ethereum Technical Analysis: Is This the Start of a Major Rally?

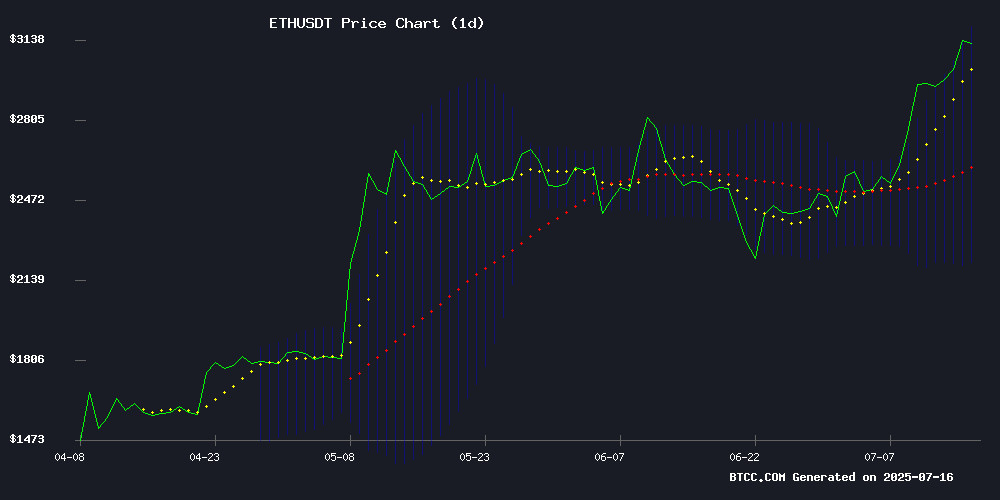

As of July 16, 2025, ethereum trades at $3,179.11 - a critical juncture that has traders on edge. The price currently tests the upper Bollinger Band at $3,205.29 while maintaining strong support at the 20-day moving average of $2,704.38. What's particularly interesting is the MACD histogram showing bearish momentum fading at -99.13, suggesting we might be at an inflection point.

"We're seeing textbook bullish consolidation here," notes a BTCC market analyst. "The combination of institutional accumulation and technical alignment suggests ETH could challenge $3,500-$3,800 in the coming weeks if it decisively breaks through the $3,200 resistance."

The Institutional ETH Grab: Who's Buying and Why?

SharpLink Gaming's $1 Billion Bet

The most jaw-dropping development comes from SharpLink Gaming, which has quietly amassed 310,000 ETH (worth ~$974 million) to become the world's largest corporate holder - surpassing even the Ethereum Foundation's reserves. Their buying spree includes:

- 74,656 ETH purchased July 7-13 at ~$2,852 average

- 24,371 ETH acquired on July 15

- 6,377 ETH just this week

What's remarkable is that 99.7% of their holdings are staked, generating passive yield. With $257 million still in their war chest, this buying frenzy shows no signs of slowing.

Peter Thiel Joins the Party

Meanwhile, PayPal co-founder Peter Thiel's Founders Fund took a 9.1% stake in Ethereum-focused BitMine (BMNR), triggering a 12% stock surge. This follows BitMine's $250 million private placement to build its own ETH treasury, now holding 163,000 ETH.

The $1.65 Billion Monthly Demand Shock

Data shows institutional players collectively bought 550,000 ETH last month alone. "The demand is insane," says crypto entrepreneur Kyle Reidhead. "We could see $2-3 billion monthly inflows soon if this pace continues."

What's Driving the Institutional ETH Rush?

Several structural factors are converging to create this perfect storm:

| Factor | Impact |

|---|---|

| Stablecoin Growth | Increasing demand for ETH as gas fee currency |

| Real-World Asset Tokenization | Institutional use cases expanding rapidly |

| Upcoming Fed Rate Cuts | Potential liquidity injection into risk assets |

| Improved Scalability | Dencun upgrade and L2 ecosystem maturation |

Ethereum Price Forecast: How High Can ETH Go?

Fundstrat's Tom Lee remains particularly bullish, forecasting ETH could surpass $4,000 by late 2025. His thesis rests on three pillars:

- Stablecoin proliferation creating permanent ETH demand

- Institutional treasury strategies going mainstream

- Technical breakout above multi-year resistance

However, traders should watch these key levels:

- Support: $3,000 (psychological), $2,704 (20-day MA)

- Resistance: $3,205 (Bollinger upper band), $3,500 (2024 high)

FAQ: Your Ethereum Questions Answered

What's driving Ethereum's price surge in July 2025?

The combination of massive institutional accumulation (over $1.65B monthly), technical breakout potential, and growing stablecoin/DeFi activity is creating perfect conditions for ETH's rally.

Which companies hold the most Ethereum?

SharpLink Gaming leads with 310,000 ETH, followed by BitMine (163,000 ETH) and BTCS Inc. (recent $44M purchase). Even the Ethereum Foundation holds less than SharpLink at 241,000 ETH.

Is Ethereum a good investment in 2025?

While past performance doesn't guarantee future results, ETH's fundamentals appear stronger than ever with institutional adoption accelerating. However, always do your own research and never invest more than you can afford to lose.

What price targets are analysts watching?

Key levels include $3,500 (near-term), $4,000 (Tom Lee's late 2025 target), and ultimately the all-time high of $4,880. Support holds at $3,000 and $2,704.