BTC Price Prediction December 2025: Navigating Market Consolidation Amid Institutional Shifts

- Where Does Bitcoin Stand Technically in December 2025?

- What's Driving Bitcoin's Mixed Market Sentiment?

- How Are Institutional Players Positioning Themselves?

- What Are the Key Price Influencers Right Now?

- Is Bitcoin Still a Good Investment in This Market?

- BTC Price Prediction FAQs

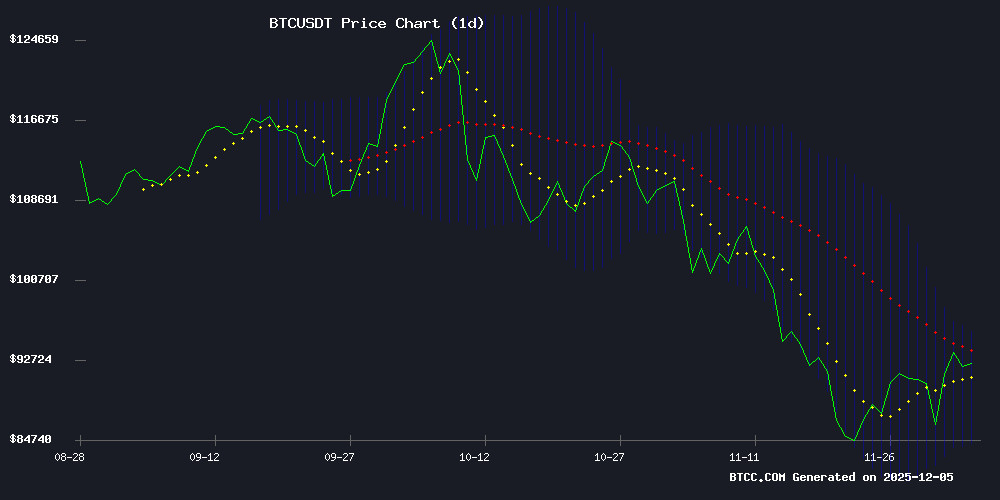

As we approach the end of 2025, bitcoin finds itself at a critical technical crossroads. Trading at $89,056.38 on December 6, BTC is testing key support levels while institutional players make bold moves behind the scenes. This analysis combines technical indicators with fundamental developments to paint a complete picture of Bitcoin's current state and potential future trajectory. From Matrixport's massive withdrawal to Wall Street's growing interest, we'll examine all factors influencing BTC's price action in this pivotal moment.

Where Does Bitcoin Stand Technically in December 2025?

Bitcoin's technical setup presents a classic case of market indecision. As of December 6, 2025, BTC is trading just below its 20-day moving average ($89,799.91), which often serves as a crucial sentiment indicator. The MACD shows bearish momentum at -3446.91, but the price remains comfortably above the lower Bollinger Band at $84,286.51.

Source: BTCC Market Data

The BTCC research team notes: "This consolidation pattern typically precedes significant moves. A decisive break above the 20-day MA could trigger fresh bullish momentum, while failure to hold current levels might see a retest of stronger support zones around $80,000."

What's Driving Bitcoin's Mixed Market Sentiment?

Current market psychology reveals a fascinating dichotomy. On one hand, we're seeing short-term fear indicators:

- Fear & Greed Index at 25 (Extreme Fear)

- Reports of "capitulation" among retail traders

- Fading hopes for a seasonal year-end rally

Yet simultaneously, institutional activity tells a different story:

| Institutional Move | Amount | Significance |

|---|---|---|

| Matrixport Binance Withdrawal | 3,805 BTC ($352.5M) | Largest single withdrawal in months |

| Twenty One Capital NYSE Listing | 43,500 BTC ($4B) | 3rd largest corporate BTC holder |

How Are Institutional Players Positioning Themselves?

The institutional landscape shows both strategic accumulation and notable shifts:

The Jihan Wu-founded platform withdrew a staggering 3,805 BTC from Binance on December 4. Such large exchange outflows typically signal long-term holding intentions rather than short-term trading.

Twenty One Capital's upcoming NYSE listing (ticker: XXI) represents a watershed moment. With $4 billion in BTC holdings, it's becoming the third-largest corporate Bitcoin treasury after Strategy and MARA.

Michael Saylor's company has dramatically reduced its Bitcoin purchases in 2025 - from 134,000 BTC monthly in late 2024 to just 9,100 BTC by November. This 93% drop raises questions about institutional demand cycles.

What Are the Key Price Influencers Right Now?

Several critical factors are shaping Bitcoin's price action as we close out 2025:

Miner Economics Becoming Critical

JPMorgan analysts note Bitcoin is trading NEAR miner production costs ($90,000), creating a precarious balance. With electricity price fluctuations adding $18,000 to costs per $0.01/kWh increase, inefficient miners may soon capitulate.

Short-Term Holder Pain

Glassnode data shows recent buyers are realizing losses at levels comparable to the 2022 FTX collapse. However, unlike that event, we're not seeing distressed sales from major institutions - a crucial distinction.

Regulatory Developments

Malaysia's crackdown on illegal mining (14,000 rigs seized, $1.1B in stolen electricity) highlights ongoing global regulatory pressures that could impact network dynamics.

Is Bitcoin Still a Good Investment in This Market?

The investment case for Bitcoin remains compelling but requires nuanced understanding:

Expect continued volatility. The technical setup suggests potential for either direction, with key levels at $84,286 (support) and $89,799 (resistance).

Historically, capitulation events like we're seeing now often precede significant rallies. Institutional accumulation suggests smart money is positioning for the next cycle.

The fundamental case strengthens with each institutional adoption milestone. Fidelity CEO Abigail Johnson's recent endorsement of Bitcoin as an "emerging savings asset class" reflects growing mainstream acceptance.

As always with crypto, this article does not constitute investment advice. The market remains highly speculative, and investors should only risk what they can afford to lose.

BTC Price Prediction FAQs

What is Bitcoin's current price and key levels to watch?

As of December 6, 2025, Bitcoin trades at $89,056.38. Key levels include support at $84,286 (lower Bollinger Band) and resistance at $89,799 (20-day MA).

Are institutions still buying Bitcoin?

Yes, but patterns have changed. While Strategy has slowed purchases, other players like Matrixport and Twenty One Capital are making significant moves, suggesting a rotation rather than wholesale exit.

How does current miner activity affect Bitcoin's price?

With BTC trading near estimated production costs ($90,000), miner selling pressure could increase if price drops further. However, hashrate adjustments may help rebalance the network.

What's the significance of the Fear & Greed Index at 25?

This "Extreme Fear" reading often coincides with market bottoms, though timing is unpredictable. It suggests maximum pessimism may already be priced in.

Should I buy Bitcoin now or wait for a lower price?

This depends on your strategy. Dollar-cost averaging can help navigate volatility, while waiting for a clear breakout might suit more conservative investors. Consider your risk tolerance.