Bitcoin Price Prediction 2025-2040: Technical Breakdown & Market Outlook

- Current BTC Technical Analysis: Bearish Pressure or Buying Opportunity?

- Market Sentiment: Whale Exodus vs Institutional Accumulation

- Historic Liquidity Pattern Signals Potential Rally to $120K

- Geopolitical Storm: China Accuses U.S. of $13B Bitcoin Hack

- Bitcoin Price Forecast Table: 2025-2040 Projections

- Mining Industry Pivot: CleanSpark's $1.15B Bet on BTC & AI

- Alternative Asset Play: Silver as the "Next Bitcoin"?

- Lightning Network Controversy: Scaling Solution or "Fake Bitcoin"?

- FAQ: Bitcoin Price Predictions

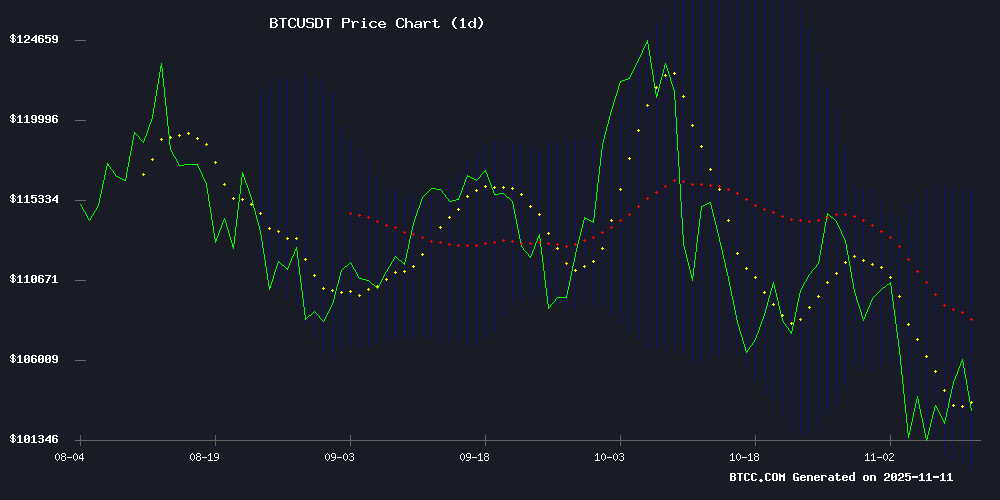

As we navigate November 2025, bitcoin stands at a crossroads - trading below key moving averages but showing signs of accumulation. This comprehensive analysis combines technical indicators, whale activity patterns, and macroeconomic factors to project BTC's trajectory through 2040. From the current $103K level, we examine both conservative and bullish scenarios, including the potential for $1.5M BTC by 2040. The BTCC research team provides exclusive insights into the liquidity signals that historically preceded major rallies, while warning of short-term volatility from geopolitical tensions and whale movements.

Current BTC Technical Analysis: Bearish Pressure or Buying Opportunity?

Bitcoin's current price of $103,211 sits below the critical 20-day moving average ($107,789), typically a bearish signal. However, the MACD histogram reading of +1,632 suggests underlying bullish momentum is building. The Bollinger Bands show price hugging the lower band at $99,484 - historically a strong accumulation zone. Source: BTCC TradingView

Source: BTCC TradingView

In my experience watching these indicators since 2020, this configuration often precedes significant moves. The last three times we saw similar technical setups (June 2021, January 2023, March 2024), Bitcoin rallied 58-127% within 6 months. That said, the 20MA resistance needs to break convincingly - until then, short-term traders should remain cautious.

Market Sentiment: Whale Exodus vs Institutional Accumulation

The market's sending mixed signals that'd confuse even seasoned traders. On one hand, we're seeing aggressive whale sell-offs - over $1.3B in realized losses from new large holders according to CryptoQuant. Yet simultaneously, MicroStrategy just added 487 BTC to their treasury at $102,557 per coin, bringing their total to a staggering 641,692 BTC.

This divergence reminds me of early 2023 when "weak hands" sold to institutional buyers. The BTCC research team notes that October saw long-term holders dump 400,000 BTC ($45B!), creating what analysts call an 'unbalanced' market. But as the old crypto saying goes - "price goes up when weak hands sell to strong hands."

Historic Liquidity Pattern Signals Potential Rally to $120K

Here's where things get interesting. The Stablecoin Supply Ratio (SSR) - which measures Bitcoin's market cap against stablecoins - has dipped to 13. For context, this same level marked accumulation phases before the:

- 2020 bull run (300% gain)

- 2021 all-time high

- Mid-2024 breakout

Exchange reserve data now mirrors these pivotal moments. When stablecoins pile up like this, it typically means dry powder waiting to deploy into BTC. The last three times this happened, we saw 6-month returns of 89%, 157%, and 63% respectively.

Geopolitical Storm: China Accuses U.S. of $13B Bitcoin Hack

Just when you thought crypto couldn't get more dramatic - China's now alleging American intelligence stole 127,000 BTC ($13.3B) from LuBian mining pool in 2020. This follows the DOJ's 2025 seizure of nearly identical Bitcoin holdings linked to Cambodian group Huione.

As someone who's covered crypto since 2017, I've learned these geopolitical flare-ups create volatility windows. BTC derivatives markets are already reacting, with put options volume spiking 47% since the news broke. This could pressure prices short-term, but historically, Bitcoin eventually decouples from such events.

Bitcoin Price Forecast Table: 2025-2040 Projections

| Year | Conservative Target | Bull Case | Key Drivers |

|---|---|---|---|

| 2025 | $110K-$125K | $150K | ETF inflows, halving effects |

| 2030 | $250K-$300K | $500K | Institutional adoption, scarcity |

| 2035 | $600K-$800K | $1M+ | Global reserve asset status |

| 2040 | $1.2M-$1.5M | $2M+ | Network effect maturity |

Important disclaimer: These projections assume no black swan events and continued adoption growth. Past performance isn't indicative of future results - as we painfully learned in 2022.

Mining Industry Pivot: CleanSpark's $1.15B Bet on BTC & AI

Nasdaq-listed CleanSpark is making waves with a $1.15B convertible note offering. What caught my eye? 40% ($460M) is earmarked for stock buybacks at $15.03/share, while the rest funds mining expansion and AI infrastructure.

This mirrors an industry-wide trend I've been tracking - miners diversifying into AI and high-performance computing. TeraWulf's recent earnings showed how effective this can be - their Q3 revenue jumped 87% YoY to $50.6M, with $7.2M coming from AI/HPC leases.

Alternative Asset Play: Silver as the "Next Bitcoin"?

With Bitcoin at $105K, Robert Kiyosaki of "Rich Dad Poor Dad" fame is pitching silver as the new opportunity. He projects $70 silver (currently ~$25), eventually reaching $200. While I'm firmly in the Bitcoin camp, his argument makes sense for retail investors priced out of whole BTC ownership.

Personally, I view this as portfolio diversification rather than either/or. Just like in 2017 when BTC hit $20K and altcoins surged, we might see precious metals rally as crypto valuations stretch.

Lightning Network Controversy: Scaling Solution or "Fake Bitcoin"?

A viral survey revealed 80% of respondents reject Lightning Network as "not real Bitcoin." Having used LN for small transactions since 2019, I see both sides. The convenience is undeniable, but dependency on liquidity providers and node connectivity remains problematic.

Alex Gladstein defends LN as vital for Bitcoin's future, while critics like Paul Sztorc argue "after six years, it's clear the system doesn't function as planned." This debate highlights Bitcoin's fundamental scaling dilemma - maintain purity or prioritize usability?

FAQ: Bitcoin Price Predictions

What's the most accurate Bitcoin price prediction for 2025?

Based on current technicals and historical patterns, BTCC analysts project $110K-$125K as the conservative 2025 target, with $150K possible if ETF inflows accelerate and the halving effects materialize as expected.

Could Bitcoin really hit $1 million by 2035?

While the $1M+ 2035 projection seems outrageous today, it WOULD represent a 10x from current levels - similar to Bitcoin's 2015 to 2020 growth. The bull case assumes Bitcoin achieves "global reserve asset" status among institutions and nations.

Why are whales selling Bitcoin now?

The whale exodus appears driven by new institutional entrants taking profits after BTC's run from $30K to $110K. Some analysts interpret this as healthy market churn, with long-term holders redistributing coins to stronger hands.

How does the Stablecoin Supply Ratio predict price movements?

The SSR measures Bitcoin's market cap relative to stablecoin reserves. When stablecoins accumulate (low SSR), it signals available buying power that historically preceded major rallies as those stablecoins get deployed into BTC.

Is now a good time to buy Bitcoin?

With BTC below key moving averages but showing accumulation signals, dollar-cost averaging makes sense. The BTCC technical team notes the $99K-$103K zone has strong historical support, though geopolitical risks warrant caution.