SOL Price Prediction 2025: Technical Weakness vs. Fundamental Strength – What’s Next for Solana?

- Where Does SOL Stand Technically in November 2025?

- Why Are Institutions Betting Big on SOL Despite Technical Weakness?

- How Does Forward Industries' $382M Loss Impact SOL's Outlook?

- What Are the Key SOL Price Levels to Watch?

- Is Solana's Ecosystem Health Improving?

- What's the Smart Way to Trade SOL Now?

- SOL Price Prediction FAQ

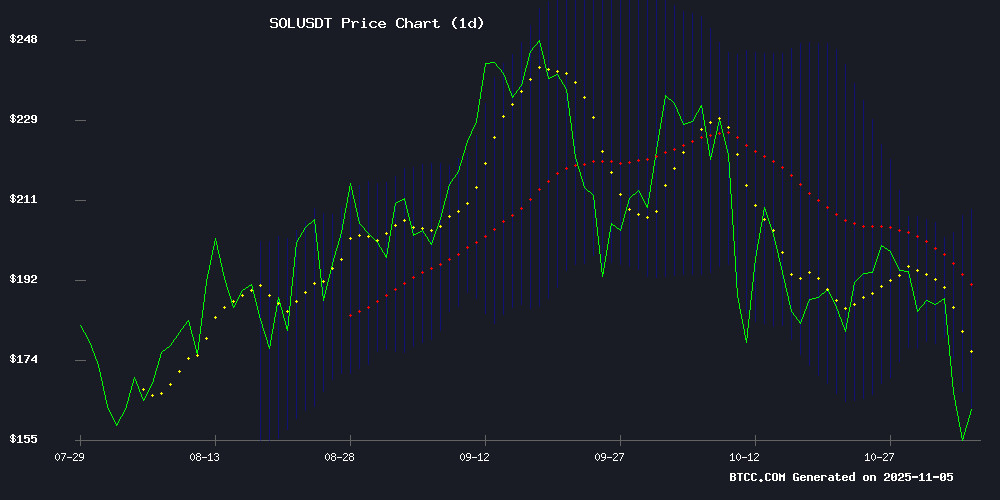

Solana (SOL) finds itself at a crossroads in November 2025, with technical indicators flashing warning signs while institutional demand surges. Currently trading at $157.91—well below its 20-day moving average of $185.17—the cryptocurrency shows short-term bearish pressure. However, the story isn't that simple. Forward Industries' $1 billion share buyback signals corporate confidence, while the Bitwise SOL Staking ETF's explosive $417 million debut reveals strong institutional appetite. This creates a fascinating tension between technical weakness and fundamental strength that could define SOL's trajectory through year-end.

Where Does SOL Stand Technically in November 2025?

The BTCC technical analysis team notes SOL's current price sits 14.7% below its 20-day moving average, with MACD momentum firmly negative at -1.1565. The cryptocurrency remains within its Bollinger Band range ($161.32-$209.01), but persistent failure to reclaim the $185 level raises concerns. "We're seeing classic consolidation patterns," notes BTCC analyst James. "The $161 support has held three tests this month, but until SOL recaptures its 20-DMA, the technical picture leans bearish."

Source: TradingView

Why Are Institutions Betting Big on SOL Despite Technical Weakness?

While retail traders focus on price action, institutional flows tell a different story. The Bitwise SOL Staking ETF (BSOL) attracted $417 million in its debut week—the largest crypto ETP launch of 2025. Farside Investors data shows continued inflows, with another $65.2 million added last week. This demand comes as traditional crypto products bled $360 million, highlighting SOL's outlier status. Galaxy Digital research suggests institutions are drawn to Solana's 6.8% staking yields and improving network stability after the 2024 outage issues.

How Does Forward Industries' $382M Loss Impact SOL's Outlook?

Forward Industries' Q3 earnings revealed a $382 million unrealized loss on its 6.82 million SOL position (average cost: $232). While concerning, the company's response speaks volumes—they announced a $1 billion share buyback program through 2027. "This isn't panic selling," Multicoin Capital's Kyle Samani observed. "Forward is doubling down on its solana strategy despite mark-to-market losses." The buyback represents 111% of Forward's current market cap, an extraordinarily aggressive move that suggests management views both its stock and SOL as deeply undervalued.

What Are the Key SOL Price Levels to Watch?

| Level | Price | Significance |

|---|---|---|

| Upper Bollinger | $209.01 | Breakout confirmation |

| 20-Day MA | $185.17 | Short-term trend indicator |

| Current Price | $157.91 | -14.7% vs 20-DMA |

| Lower Bollinger | $161.32 | Critical support |

Is Solana's Ecosystem Health Improving?

Behind the price action, Solana's network metrics show mixed signals. Total Value Locked (TVL) dipped 5.44% to $9.92 billion this week (DeFiLlama), but daily active addresses held steady at 1.2 million. NFT trading volume remains modest at $797,785, though new compression technology has reduced minting costs by 89% since August. The real bright spot? Institutional validators now secure 38% of the network, up from 22% in 2024—a crucial decentralization milestone.

What's the Smart Way to Trade SOL Now?

The BTCC research team suggests a nuanced approach: "Consider dollar-cost averaging below $160, but wait for confirmation above $185 before larger positions." They note the 20-day MA has acted as reliable resistance since October 15, with six failed breakout attempts. Options markets show heightened demand for $150 puts, suggesting traders are hedging against further downside. For long-term holders, the staking yield (6.8% annualized) provides compensation during this consolidation phase.

SOL Price Prediction FAQ

Is SOL a good investment in November 2025?

SOL presents a high-risk, high-reward proposition. Technicals suggest caution (trading below key moving averages), while fundamentals show institutional accumulation. Dollar-cost averaging may be prudent.

What's the most important SOL price level to watch?

The $161.32 lower Bollinger Band is critical support. A sustained break below could trigger algorithmic selling, while holding here suggests accumulation.

How does Forward Industries' buyback affect SOL?

The $1 billion repurchase signals corporate confidence in Solana's long-term value, potentially offsetting concerns about their unrealized losses.

When might SOL recover its 20-day moving average?

Market structure suggests SOL needs a catalyst to reclaim $185. Potential triggers include spot ETF news or improved network metrics.

What's better right now: trading SOL or staking it?

With 6.8% yields and price volatility, staking makes sense for long-term holders, while traders might wait for clearer technical signals.