XRP Price Forecast 2025: Will It Hit $9.6 or $33? Technical Breakdown & Institutional Catalysts

- What's the Current Technical Picture for XRP?

- How Are Institutional Developments Impacting XRP?

- What New Utility Does Flare Network Bring to XRP?

- Where Are the Key Support and Resistance Levels?

- What Are the Two Potential Price Scenarios?

- How Does XRP's Native Stablecoin Change the Game?

- What's Next for XRP Ledger Development?

- Why Is Trading Volume Declining Despite Positive News?

- Frequently Asked Questions

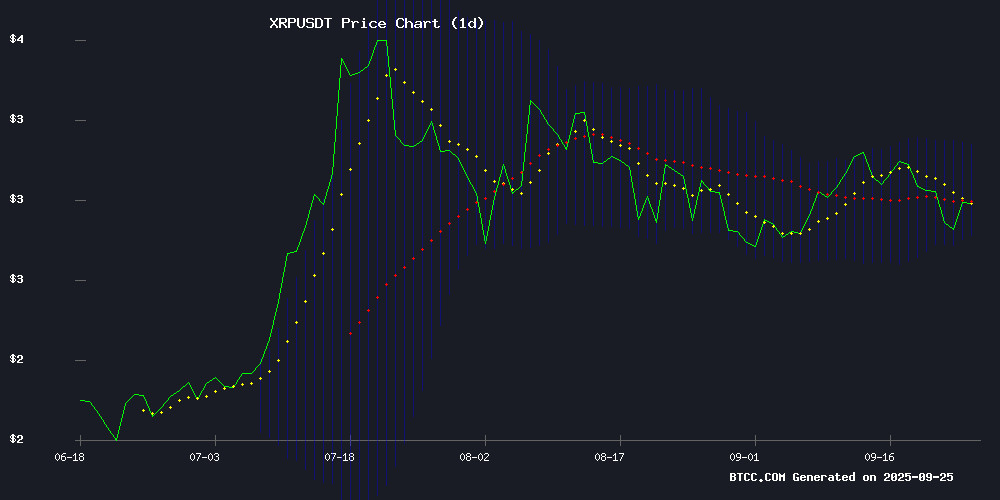

As of September 25, 2025, XRP finds itself at a critical juncture - trading at $2.8342 while caught between bullish institutional developments and bearish technical signals. The cryptocurrency shows consolidation below its 20-day moving average ($2.9722) with Bollinger Band support at $2.7886, creating a classic "make or break" scenario. Market analysts are divided between two potential outcomes: a conservative $9.6 target if institutional adoption accelerates versus an ambitious $33 projection should XRP replicate its 2021 breakout pattern. This analysis examines the competing forces shaping XRP's trajectory, from BlackRock partnership rumors to RLUSD stablecoin expansion and the new Flare Network integration.

What's the Current Technical Picture for XRP?

XRP's price action tells a story of consolidation with potential brewing beneath the surface. The digital asset currently trades at $2.8342, stubbornly below its 20-day moving average of $2.9722 - typically a bearish signal in traditional technical analysis. However, the MACD histogram paints a more nuanced picture with its positive reading of 0.0404, suggesting underlying momentum might be building despite the surface-level stagnation.

Source: BTCC Trading Platform

Source: BTCC Trading Platform

The Bollinger Bands reveal an interesting dynamic - with XRP testing the lower band at $2.7886 (potential support) while the upper band sits at $3.1558. "We're seeing textbook consolidation patterns here," notes a BTCC market strategist. "The $2.78 level has held three tests this month, which builds confidence in that support. But until we see a decisive break above the 20-day MA, traders should remain cautious."

How Are Institutional Developments Impacting XRP?

The fundamental case for XRP has strengthened considerably in recent weeks, creating an intriguing tension with its technical weakness. Two major developments stand out:

First, Ripple CEO Brad Garlinghouse's cryptic comments about a potential BlackRock partnership sent shockwaves through the XRP community. While details remain unconfirmed, the mere suggestion of collaboration with the world's largest asset manager ($9.5 trillion AUM) could validate XRP's use case in institutional cross-border payments.

Second, the RLUSD stablecoin has quietly become a market force, surpassing $741 million in circulating supply after an $11 million mint. Its daily trading volume now exceeds $150 million - a remarkable 20% turnover rate that demonstrates real-world adoption. This growth positions RLUSD as a credible competitor in the $150 billion stablecoin market.

What New Utility Does Flare Network Bring to XRP?

The launch of FXRP v1.2 on Flare Network's mainnet marks a watershed moment for XRP's DeFi capabilities. This innovative FAsset system allows XRP holders to:

| Feature | Impact |

|---|---|

| Yield Farming | Earn passive income on XRP holdings |

| DEX Trading | Access decentralized exchanges without selling XRP |

| Stablecoin Minting | Create collateralized stablecoins using XRP |

With an initial minting cap of 5 million tokens, Flare has implemented a measured rollout to ensure system stability. The overcollateralized model (secured by independent agents and Flare's oracles) provides robust protection against volatility - crucial for institutional participants.

Where Are the Key Support and Resistance Levels?

XRP's price recovery has stalled NEAR critical technical levels that traders are watching closely:

- Immediate Support: $2.85 (bullish trend line on hourly charts)

- Critical Support: $2.7886 (lower Bollinger Band)

- First Resistance: $2.95 (psychological level)

- Major Resistance: $2.9620 (61.8% Fibonacci retracement)

Market data from TradingView shows XRP's recent rebound from $2.680 outperformed both Bitcoin and ethereum - a rare occurrence that suggests selective capital rotation into the asset. However, the 27.67% drop in daily trading volume to $5.43 billion raises concerns about sustainability.

What Are the Two Potential Price Scenarios?

Analyst Egrag crypto has outlined two compelling scenarios based on historical patterns and current market dynamics:

This projection assumes XRP replicates its 2021 performance when it rallied 414% after retesting the 21 EMA. Applied to current levels, this WOULD imply a move to approximately $9.6. The catalyst would likely be successful implementation of Ripple's institutional DeFi roadmap combined with steady RLUSD adoption.

The more ambitious forecast requires a "perfect storm" of factors: BlackRock partnership confirmation, accelerated XRP Ledger adoption for tokenized assets, and a broader crypto market rally. This would mirror XRP's 2017 parabolic move when it gained over 36,000% in one year.

How Does XRP's Native Stablecoin Change the Game?

The debut of XRP Ledger's first native stablecoin represents a strategic pivot toward institutional DeFi. Unlike algorithmic stablecoins, RLUSD employs a collateralized debt position (CDP) model that's proven more resilient during market stress.

Ripple President Monica Long revealed that DBS Bank and Franklin Templeton are already using RLUSD for tokenized asset trading - a strong endorsement from traditional finance. The stablecoin's integration with BlackRock's $2 billion BUIDL fund creates a direct bridge between XRP and real-world assets like U.S. Treasuries.

What's Next for XRP Ledger Development?

Ripple's recently published roadmap focuses on three institutional-grade features:

- Multi-Purpose Tokens (MPTs): Launching in October 2025 to simplify asset representation without smart contracts

- Native Lending Protocol: Slated for XRPL Version 3.0.0 (expected Q4 2025)

- Privacy Features: Enhanced confidentiality for institutional transactions

These developments position XRPL as a potential hub for tokenized traditional assets - a market projected to reach $16 trillion by 2030 according to Boston Consulting Group.

Why Is Trading Volume Declining Despite Positive News?

The 27.67% drop in daily trading volume despite multiple positive developments presents a puzzle. Several factors may explain this divergence:

- Regulatory uncertainty lingering from the SEC lawsuit

- Institutional players accumulating positions OTC rather than on exchanges

- Retail traders shifting focus to newer altcoins like BlockDAG

As one trader on BTCC's platform noted, "The volume contraction reminds me of early 2021 before XRP's big move. Sometimes the market needs time to digest good news before reacting."

Frequently Asked Questions

What is the current XRP price as of September 2025?

As of September 25, 2025, XRP trades at $2.8342 with a market capitalization of $171.25 billion, according to CoinMarketCap data.

What are the key support and resistance levels for XRP?

Key levels include support at $2.7886 (lower Bollinger Band) and resistance at $2.9620 (61.8% Fibonacci level), with the 20-day moving average at $2.9722 acting as a crucial pivot point.

How does Flare Network benefit XRP holders?

Flare's FXRP v1.2 enables XRP to be used in DeFi applications like yield farming and DEX trading without selling the underlying asset, significantly expanding its utility.

What's the significance of RLUSD stablecoin?

RLUSD provides XRP with a native stablecoin for settlements and DeFi operations, with its $741 million supply and integration with BlackRock's BUIDL fund signaling institutional adoption.

What are the two main price scenarios for XRP?

Analysts project either a conservative $9.6 target (based on 2021's 414% rally) or an ambitious $33 scenario requiring perfect alignment of institutional adoption and market conditions.