Solana’s price to $600? Trader makes bold projection DESPITE $2.5B unlock

- A crypto trader is projecting SOL’s likely run to $600 in two months

- An unlock of over $2.5 billion in March could dent the altcoin’s market sentiment

Undoubtedly, Solana [SOL] has been this cycle’s highlight, fronting a 13x after rallying from $8 to nearly $300 in a record 18 months. In fact, some asset managers, like Bitwise, have projected the altcoin could top $750 by the end of the cycle.

That’s not all though. Bob Loukas, a renowned crypto trader, has joined the fray with a bold prediction of $600 in two months.

“My read on $SOL, feels like pressure building and once released, could run very quickly (

For context, Solana is now the fastest and cheapest blockchain, compared to Ethereum. It has eclipsed Ethereum on key fronts apart from TVL (total value locked) – A trend that Delphi Digital believes could make it flip ETH in 2025.

Another milestone confirmed the chain’s traction – Outpacing Ethereum’s monthly stablecoin growth.

Source: Artemis

Solana’s $2.5 billion unlock

However, the Solana community might face a hard time ahead of the upcoming unlock. Between February and April, over 14M SOL tokens will be unlocked.

In March, 9.7M SOL tokens, worth $2.5 billion, will be released to the supply. And, the sentiment might be negatively affected. One user stated,

“February is the biggest one yet, then March triples February’s unlock with $2.5B of cheaply purchased SOL finally available to sell. This is while influencers who switch conviction plays daily call for $1000 as every SOL meme relentless bleeds out.”

Source: X

One of the top SOL supporters, Gumshoe, reiterated the same outlook and castigated the ‘influencers’ calling for a $1k cycle top. He said,

“The biggest risk for the unlocks is that if we are not in a macro uptrend, $SOL will probably underperform on bounces and dumps. Unlocks or not, calling for $SOL $1K is stupid and irresponsible. It shouldn’t be taken seriously unless we talk about a multi-year timeframe (>5 years).”

However, the analyst added that the unlocks (2.7% of supply) will be sold over time and not immediately.

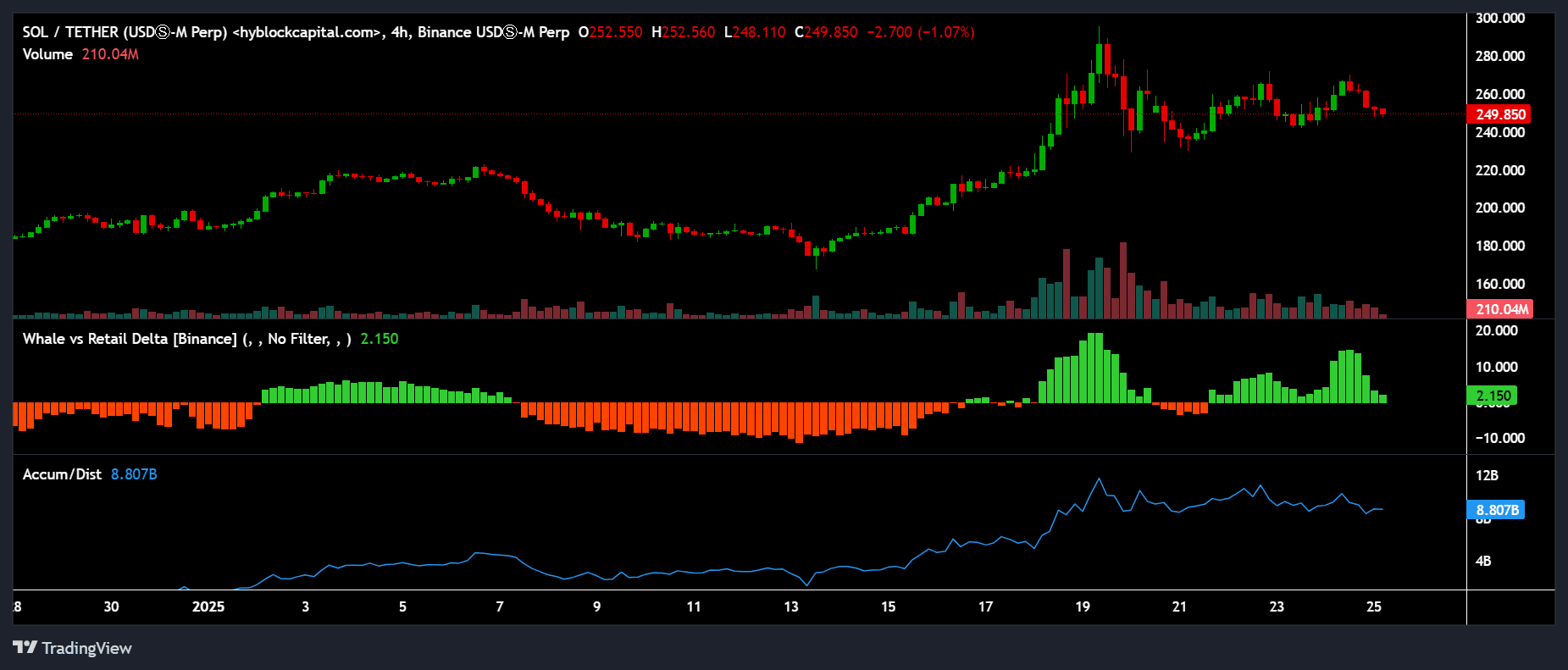

In the meantime, whales have trimmed their exposure in the Futures market – Signaling a likely muted price action over the weekend.

Source: Hyblock

This was illustrated by the declining Whale vs. Retail delta (dropping green bars). In most cases, a fall in whale exposure (red) has always correlated with SOL’s price pullbacks.

Additionally, there seemed to be a spike in distribution, further reinforcing that large players booked profits from the latest jump to the $295-level.

Take a Survey: Chance to Win $500 USDT