Dogecoin Surges: Can DOGE Smash Through $0.19 Resistance in 2025?

Dogecoin's trading volume spikes as memecoin mania refuses to die—but this isn't 2021 anymore.

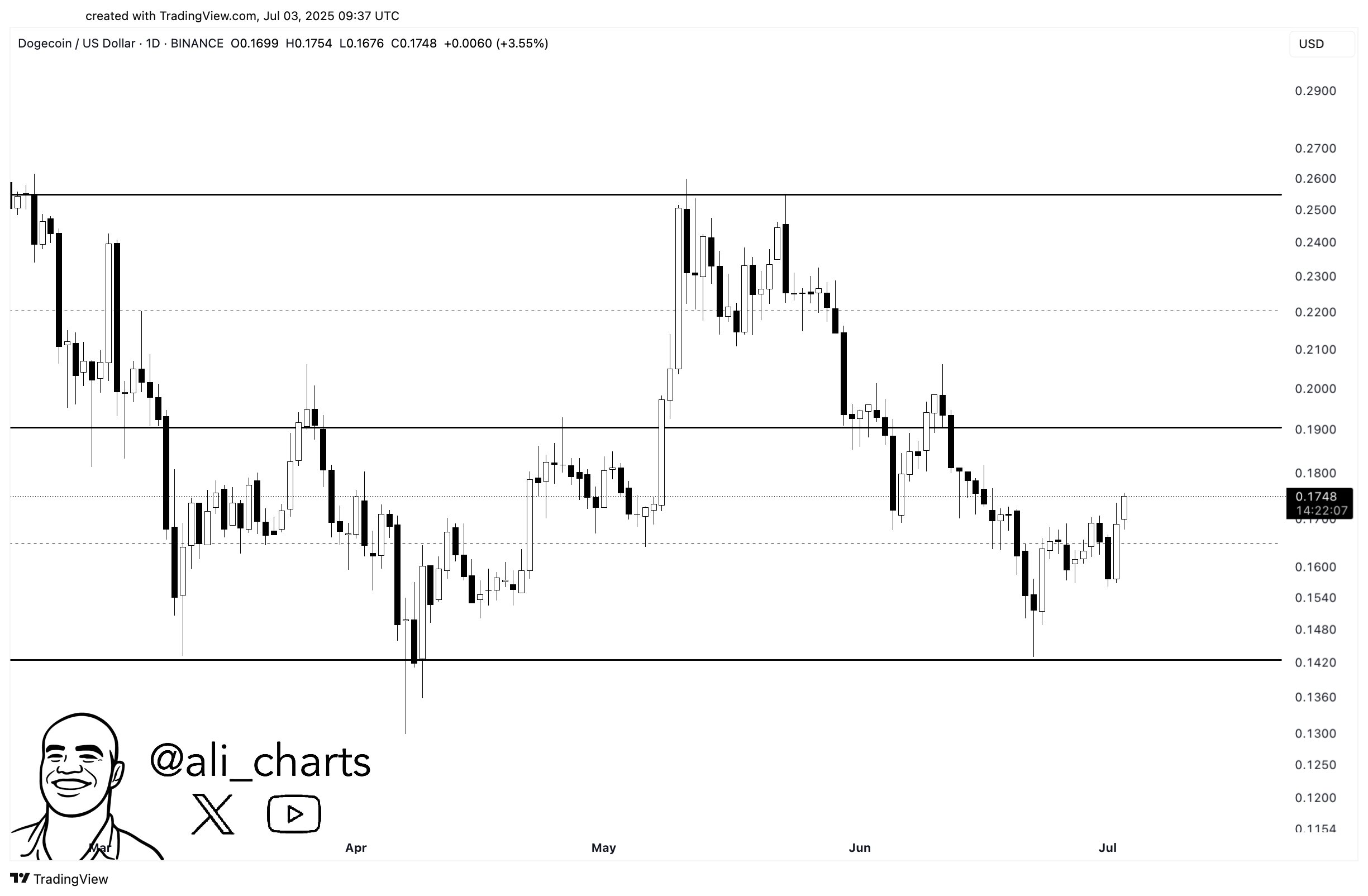

The $0.19 level looms large as both technical barrier and psychological milestone for DOGE holders. On-chain data shows whales accumulating, while retail traders chase the Elon-fueled nostalgia play.

Key factors driving momentum:

- Exchange inflows/outflows suggesting accumulation phase

- Relative strength holding above key levels

- Futures open interest creeping up

Will it hold? Technicals say maybe. Fundamentals say... wait, since when did DOGE traders care about fundamentals? The real question is whether crypto's favorite joke currency can outlast the current hype cycle—and how many bagholders get left smiling or crying when the music stops.

Source: X/Ali

Strong enough to flip resistance?

DOGE’s price has surged from the $0.13–$0.15 demand zone, with bullish pressure gaining traction. The Stochastic RSI has crossed above 80, indicating potential continuation of the upward trend.

However, a descending resistance line NEAR $0.19 still caps price advancement. A daily candle close above this trendline could signal a breakout, triggering further bullish momentum.

Until then, Doge remains in a technical squeeze between historic support and dynamic resistance.

Therefore, bulls must sustain buying pressure to challenge this overhead barrier and maintain short-term momentum toward $0.26.

Source: TradingView

Whale activity returns as spot inflows flip strongly positive

After weeks of persistent outflows, Dogecoin recorded a net inflow of $8.23 million at the time of writing, signaling renewed whale confidence.

This influx marks a significant shift in on-chain behavior, suggesting large holders are once again accumulating.

Historically, such inflows have aligned with bullish reversals or mid-term rallies. Therefore, this positive netflow supports DOGE’s recent technical bounce and could help sustain the move toward $0.19.

However, if inflows wane again, price strength may be short-lived. For now, on-chain whale activity reflects improving sentiment.

Source: Coinglass

Dogecoin can unlock more upside by…

Dogecoin’s MVRV Z-score has rebounded to 0.355 after dipping to near-historic lows in late June.

This metric, which measures holder profitability relative to market value, suggests DOGE is recovering from undervaluation.

Although the score remains below bullish thresholds, the ongoing climb indicates that downside risk is diminishing. This shift could encourage sidelined participants to reenter, adding to upward price pressure.

However, MVRV remains a lagging indicator, and price must break key resistance levels to validate sentiment. Still, the improving Z-score adds bullish weight to DOGE’s outlook.

Source: Santiment

Why is network activity losing steam again?

Despite the recent price rebound, Dogecoin’s on-chain activity has slowed sharply. Daily active addresses fell to 33.7K, while transaction count dropped to 14.8K as of the 3rd of July.

This marks a steep decline from the spike on the 22nd of June, when both metrics exceeded 500K. Such a contraction in usage suggests waning retail interest, potentially weakening momentum behind the current rally.

However, DOGE’s price has historically led activity, not followed it. Hence, if the current bullish push continues, network engagement could lag briefly before reaccelerating.

Source: Santiment

Will DOGE hit $0.19 and break out?

Dogecoin’s confluence of strong support, rising derivatives engagement, and renewed whale inflows creates a favorable setup for continued upward movement.

However, success depends on whether bulls can push through the descending resistance near $0.19. While the MVRV Z-score and netflows point to improving sentiment, low network activity tempers expectations.

If DOGE breaks above resistance on strong volume, the path toward $0.26 opens up. Until then, momentum hangs in the balance, and bulls must remain active to sustain the rally.

Subscribe to our must read daily newsletter