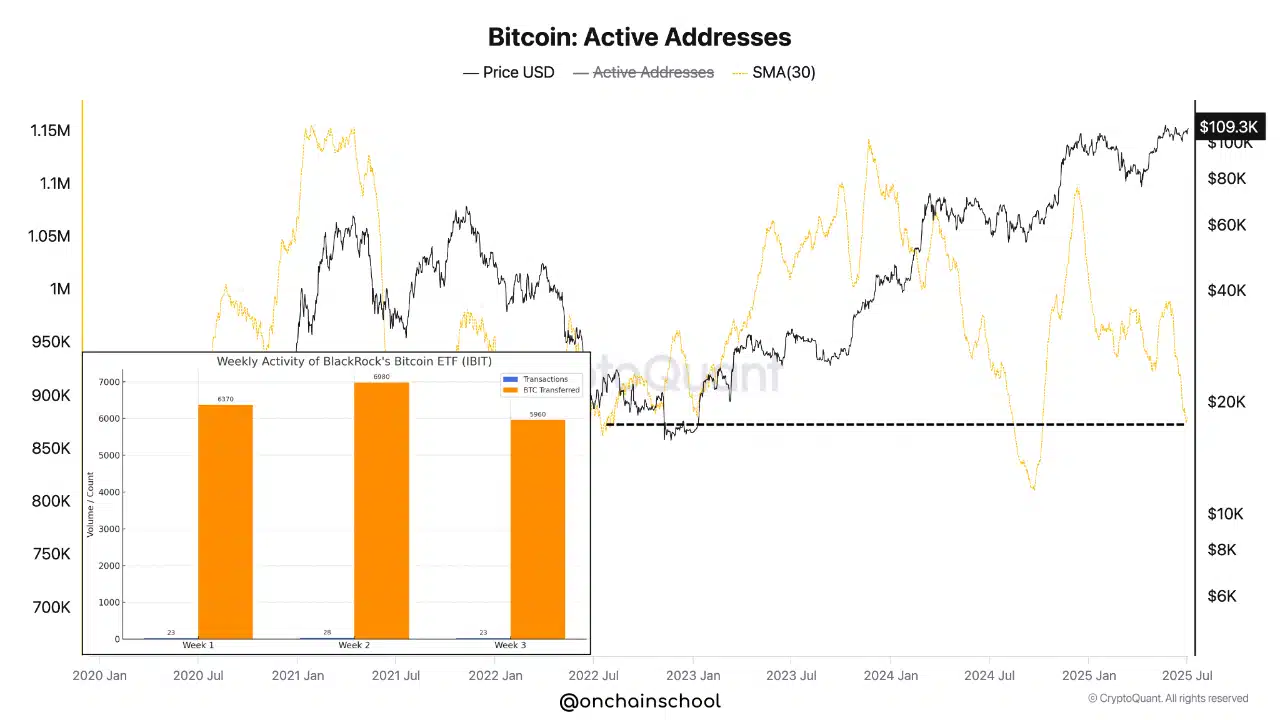

Bitcoin’s Market Cycle Shifting? Critical Insights for 2025

Bitcoin doesn’t ask for permission—it rewrites the rules. As we hit mid-2025, whispers of a fractured market cycle grow louder. Here’s why TradFi dinosaurs should pay attention.

The Halving Hangover

Four years used to mean everything. Now? Post-2024 halving price action defies textbook patterns—no lazy 18-month accumulation, no predictable euphoria. Miners shrug; hodlers stack.

Institutional Whiplash

Spot ETFs brought Wall Street’s suits to the party. Their algo-driven buys crash cycles into quarters, not decades. Volatility gets institutionalized—ironic for an asset meant to escape their clutches.

Macro Versus Magic Internet Money

Fed rate cuts collide with Bitcoin’s supply shock. Result: A chart that gives TA purists nightmares. When fiat printers and cryptographic scarcity fight, bet on the math.

Wake-up call: Cycles don’t die—they evolve. Adapt or watch your portfolio become relic like a 2017 Bitconnect meme.

Source: CryptoQuant

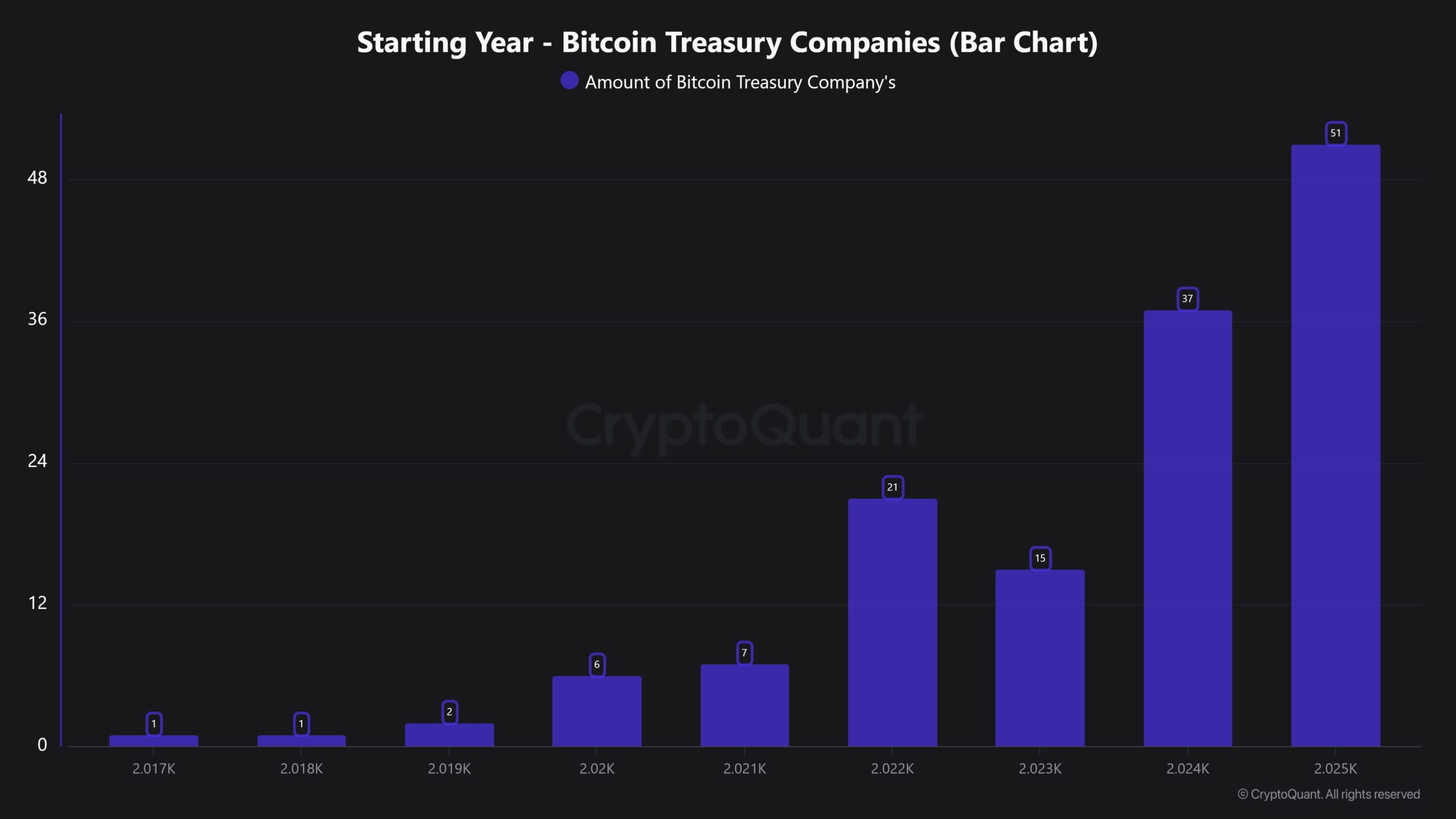

Is corporate BTC adoption redefining market cycles?

The surge in companies adding bitcoin to their treasuries reveals growing institutional conviction. As of 2025, 51 firms have integrated BTC into their balance sheets—nearly doubling from two years ago.

This consistent year-over-year increase, highlighted in CryptoQuant’s treasury bar chart, demonstrates strong strategic positioning by corporations.

While retail traders rely on price swings, institutions now appear to be accumulating for long-term exposure. Thus, Bitcoin is evolving from a speculative asset to a macro hedge, reshaping market dynamics and reinforcing its store-of-value narrative.

Source: X/CryptoQuant

Are miners hinting at strength, with lower sell pressure?

Despite a 68.51% daily rise in the Miners’ Position Index (MPI), the metric remained negative, at press time, signaling that overall miner outflows are still below the yearly average.

Historically, negative MPI levels suggest miner confidence in future price appreciation. If miners anticipated a correction, more coins WOULD likely be sent to exchanges.

However, this reluctance to sell, even amid rising activity, suggests miners are holding firm. This posture adds subtle but critical support to the ongoing price action, reducing near-term overhead supply.

Source: CryptoQuant

Are BTC holders booking profits or simply rotating positions?

The Net Realized Profit and Loss (NRPL) ROSE 7.43%, signaling moderate profit realization.

Still, this activity seems measured rather than aggressive. Instead of a full-blown exit, holders appear to be trimming gains as Bitcoin approaches psychologically significant levels.

This behavior indicates discipline in the market, where participants are locking in returns while keeping exposure intact.

It also reflects a maturing ecosystem where profit-taking is no longer synonymous with bearish pivots. Therefore, recent sell-offs seem more tactical than fear-driven.

Source: CryptoQuant

Are long-term holders losing faith or just repositioning?

Coin Days Destroyed (CDD) also climbed 3.04%, showing a slight uptick in activity from long-held coins.

This movement does not indicate panic, as the increase remains relatively mild. Long-term holders may be reallocating or taking selective profits without exiting the market entirely.

Therefore, the sentiment from this cohort remains broadly optimistic.

As long as CDD remains moderate, confidence among seasoned investors continues to anchor the bullish trend. This measured behavior supports the notion of long-term market sustainability.

Source: CryptoQuant

Is the BTC derivatives market signaling the next wave?

At the time of writing, BTC’s derivatives activity surged notably, with trading volume up 22.34% to $94.2 billion and Open Interest rising by 6.71% to reach $76.76 billion.

Notably, options volume spiked 58.01%, pointing to increasing speculative momentum.

This growing leverage participation could amplify both volatility and price discovery. However, such enthusiasm also reflects a stronger conviction among market participants.

Therefore, derivatives data suggest traders are positioning for further upside rather than preparing for a reversal, adding fuel to BTC’s current trajectory.

Source: CoinGlass

Conclusively, BTC’s rise near $110K comes with muted on-chain signals but growing institutional adoption, restrained miner selling, and rising derivatives’ momentum.

This evolving market structure suggests BTC’s price may now respond more to off-chain capital flows than to traditional network metrics, potentially marking a new era of quieter but more powerful rallies.

Subscribe to our must read daily newsletter