Solana Stalls as Whale Dumps 240K SOL – Is a Price Panic Justified?

Solana hits a speed bump—just as a crypto whale unloads a staggering 240,000 SOL. Market watchers brace for impact.

Whale alert: Who's cashing out?

The sudden dump—worth roughly $24M at current prices—has traders scrambling. Is this a blip or the start of a deeper correction?

Behind the sell-off: Rumors swirl about institutional profit-taking, while retail investors play musical chairs with stop-loss orders. Classic crypto.

Price check: SOL's 30-day chart now looks like an EKG reading—just what you'd expect when 'smart money' treats the market like their personal ATM.

Bottom line: In crypto, whales move markets. But whether this spells trouble or just noise depends on one question—who's buying the dip?

Are large entities dumping Solana?

According to Lookonchain, a whale wallet unstaked 1 million SOL—worth $139 million—nine days ago. Since then, the whale has sold 240,000 SOL valued at $35 million.

Such aggressive selling typically signals weakening market conviction. In this case, it suggests that whales are losing confidence in the altcoin’s outlook.

Source: CryptoQuant

That said, whales are not only selling, but also taking a step back in the market. When we examine Solana’s Spot Average Order Size, it seems whales have totally disappeared.

With existing whales selling, alongside disappearing big whale orders, it indicates that large entities are increasingly bearish.

Retail is feeling different, though

Interestingly, while Solana whales are selling, small-scale traders are taking the accumulation path. Solana’s Netflow declined to negative territory after two consecutive days of positive netflow.

Source: CoinGlass

According to CoinGlass data, Solana’s Spot Netflow has dropped to -19.69 million at press time. When Netflow drops to negative, it typically indicates accumulation and declining sell-side risk.

This kind of market behavior has historically preceded upward continuation, especially when markets are on the verge of a potential trend shift.

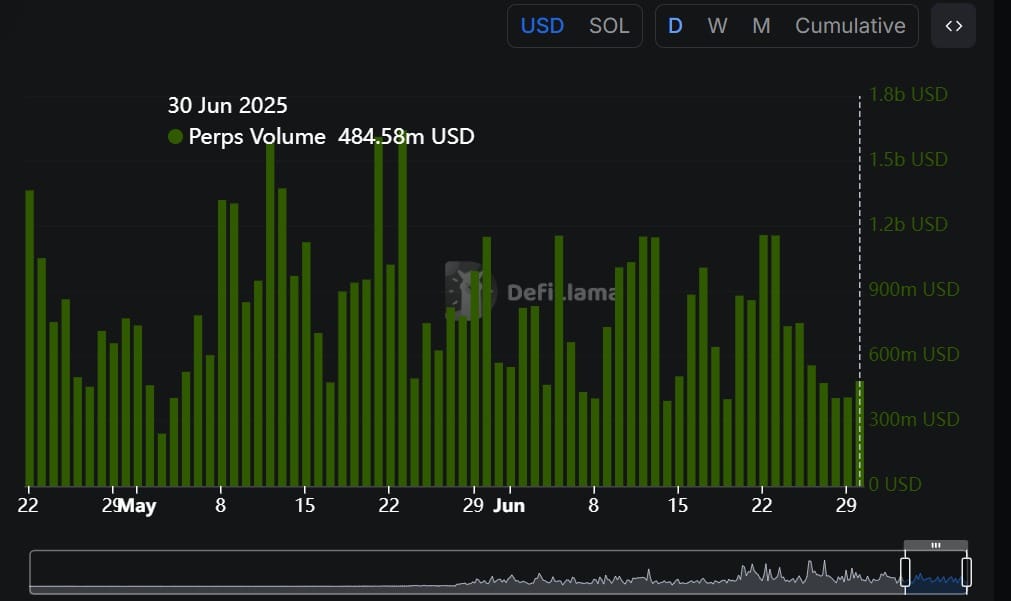

Source: Defillama

Beyond exchange activity, Futures markets are picking up steam again.

After a four-day decline, Perpetual Futures Volume has rebounded to $484 million at the time of writing.

A spike in Perpetual Volume typically indicates growing speculative interest, with traders opening Leveraged long or short positions. This surge suggests a rise in short-term trading activity and heightened market engagement.

Should you worry?

According to AMBCrypto, while some whales are selling, there’s no strong evidence of widespread institutional or large-scale whale dumping in SOL at the moment.

This selling appears to be part of a broader trend of rotation and profit-taking, rather than panic exits. In fact, many whales seem to be adopting a wait-and-see approach.

Recent price retracements are likely just healthy market corrections, and overall sentiment remains bullish. As a result, Solana is expected to recover.

If retail investors continue to accumulate, SOL could reclaim $154 and aim for $159.

However, if retail sentiment shifts, and they begin selling as well, the price could drop below the $149 support level, potentially leading to a further decline toward $140.

Subscribe to our must read daily newsletter