BONK Explodes with 98% Volume Surge—But Is a Reversal Coming?

Memecoin madness strikes again as BONK rockets to a 98% volume spike—traders are either printing money or walking the plank.

### The Pump Before the Dump?

Another day, another memecoin defying gravity. But with parabolic moves come parabolic risks. Liquidity’s flooding in, but smart money’s already eyeing the exits.

### The ‘IF’ Hanging Over BONK

If history’s any guide, retail’s late to the party—again. The reversal odds? Higher than a crypto bro’s leverage. Watch for the dominoes to fall when the whales cash out.

Funny how ‘98% surges’ always seem to precede ‘98% corrections’ in this casino. Just saying.

Bonk buyers make a strong comeback

After taking a step back in the market amidst higher selling pressure, buyers returned to displace sellers.

According to Coinalyze, BONK saw 309 billion in buy volume against 182 billion in selling volume on the 29th of June.

Source: Coinalyze

Of course, this resulted in a +127 billion Buy-Sell Delta—a clear signal of aggressive spot demand.

Such a high buying spree reflects newfound demand as investors returned to buy the dip.

Source: CoinGlass

Amidst increased accumulation, the memecoin’s Netflow turned negative, reaching -765k at press time.

When more tokens leave exchanges than enter, it typically reflects accumulation and declining sell-side risk.

This kind of behavior, historically, has often preceded upward continuation, especially during local trend shifts.

Derivatives follow the action

Interestingly, when we examine derivatives, we find that these buyers entered the market to take strategic positions, particularly long ones.

Source: Coinglass

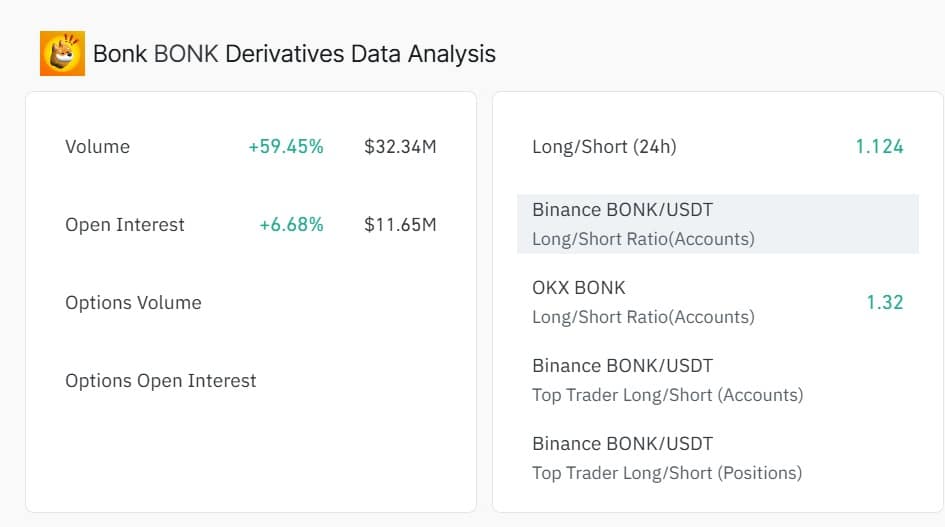

BONK’s Open Interest jumped 6.68% to $11.65 million, while Volume surged 59.45% to $32.34 million, confirming increased participation in futures.

At the same time, the Long/Short Ratio hit 1.124, reflecting a tilt toward long positioning.

Typically, a higher demand for long positions, alongside rising Open Interest, implies that investors are bullish and are betting on prices to rise.

Momentum indicators flash but…

According to AMBCrypto, BONK saw a sharp upswing as buyers re-entered the market with strength.

As a result, the memecoin’s Stochastic RSI surged to 89, signaling overbought conditions.

Likewise, the Relative Vigor Index (RVGI) climbed to -0.0332, reinforcing the presence of strong bullish momentum.

Source: TradingView

That said, when oscillators heat up like this, they often hint at one of two things: sustained breakout or whiplash reversal.

If buying continues, BONK could reclaim $0.000015 with relative ease. But if bulls hesitate or run out of fuel, the coin might retrace toward its recent base at $0.000013.

Subscribe to our must read daily newsletter