Polkadot’s Ecosystem in Crisis: Is DOT’s Collapse Signaling the End?

Polkadot’s once-thriving ecosystem shows cracks—DOT’s price tanks as developers jump ship. What went wrong?

Subheader: The Great Unraveling

Once hailed as Ethereum’s heir apparent, Polkadot now faces existential questions. Network activity dwindles, parachain auctions lose luster, and DOT’s market cap bleeds out faster than a DeFi exploit.

Subheader: Ghost Chain in the Making?

Empty developer forums. Abandoned GitHub repos. The ‘Internet of Blockchains’ risks becoming a cautionary tale—another ICO-era promise eaten by the crypto bear market.

Subheader: Last Gasps or Turnaround Play?

True believers point to Polkadot’s tech stack. Critics see another bagholder’s fantasy. Meanwhile, Wall Street sharks circle—always happy to profit from retail’s hopium.

Closing thought: In crypto, even ‘dead’ projects get zombie rallies. But resurrection requires more than blind faith and VC money.

Raised $500M and lost the plot: The rise and stall

With $500 million in funding, its core team pitched a bold vision to outpace ethereum as the go-to chain for developers.

Source: Token Terminal

But momentum faded after the launch of Parachains. Real usage stalled. Daily Active Users across major chains fell to 5,000 in 2025.

Developer interest, once strong, declined from 2,400 to 1,000.

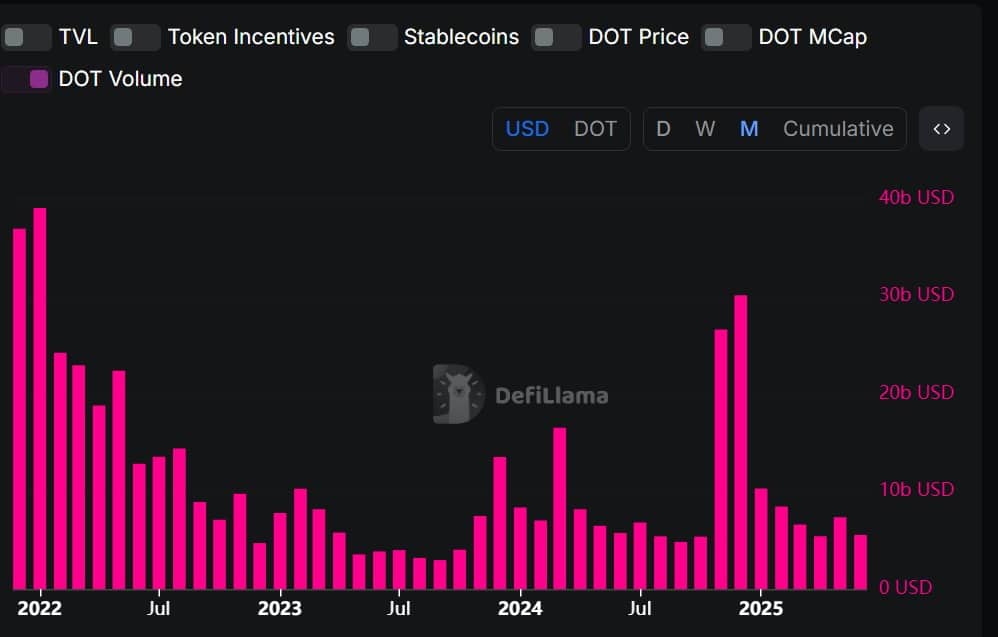

Capital fled as activity vanished

Source: DefiLlama

Amidst this decline in network usage, fresh capital stopped flowing, while existing investors exited the market.

As such, DOT’s Trading Volume has plummeted from 39 billion to 5 billion, indicating reduced on-chain activity.

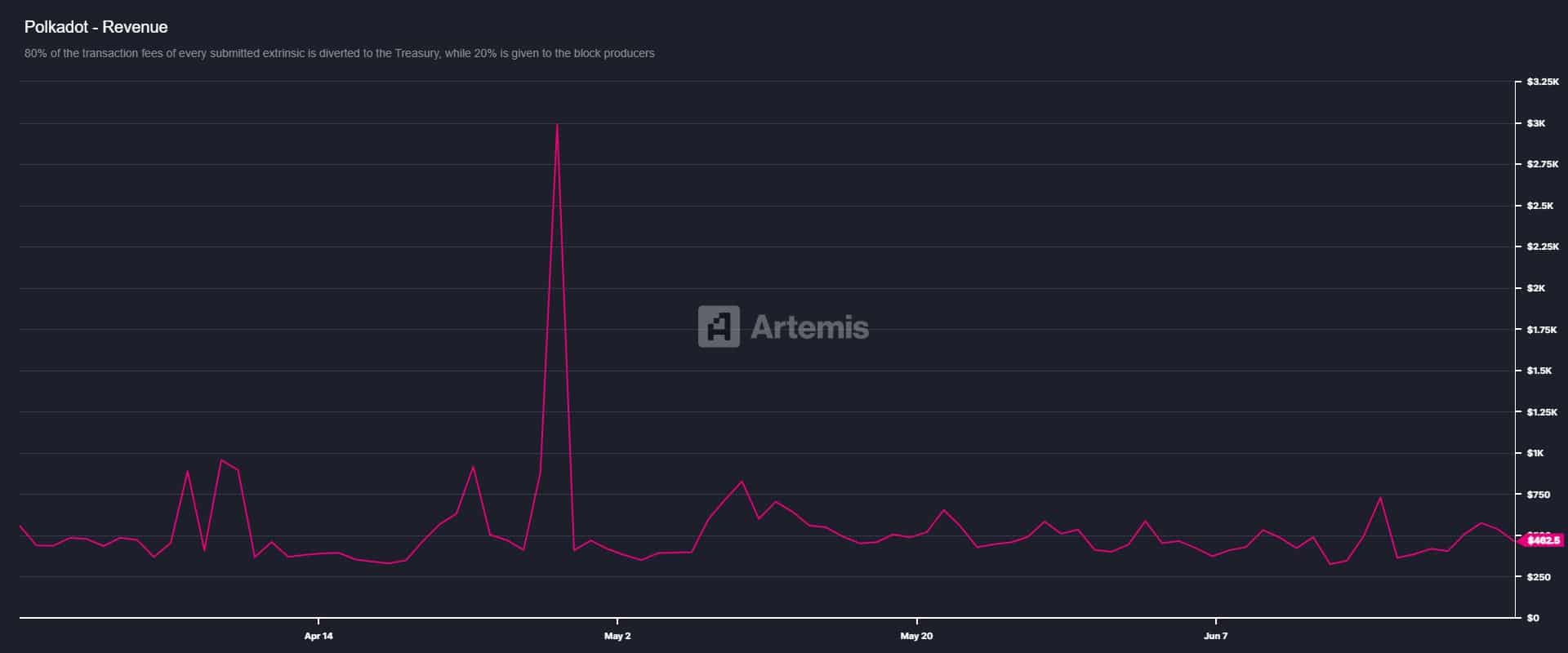

Revenue, too, evaporated. Polkadot generated just $462 and stayed below $1,000 for two consecutive months. That’s a red flag for a network once hyped as an infrastructure cornerstone.

Source: Artemis

Polkadot’s Circulating Market Cap Dominance sat at a meager 0.15%, cementing its slip into irrelevance amid competing chains. Investors responded by reallocating funds elsewhere.

No users, no devs, no future?

While DOT has continued to decline, other crypto assets are growing. In light of this, it’s a cause for concern as investors take a step back from the market.

Source: Messari

Can DOT recover, or is worse to come?

According to AMBCrypto’s analysis, Polkadot is experiencing unfavorable market conditions. These circumstances position DOT for potentially more losses on its price charts.

As of this writing, it traded at $3.3, down 26.8% in a month and 47.1% over the year.

Its RSI drifted toward oversold territory, signaling prolonged sell-side aggression. If sellers persist, DOT risks a fall to $3.0 support, then potentially $2.8.

Source: TradingView

Buyers WOULD need to step in soon to prevent deeper damage.

A bounce isn’t impossible. If sellers ease, DOT may attempt a push toward $3.6 resistance. But if it breaks below $2.6, the case for DOT being a “dead chain” might be more than just harsh commentary.

Subscribe to our must read daily newsletter