AI Tokens Plummet 29% Despite Soaring Web3 Adoption – Decoding the Paradox

AI tokens are getting crushed—down a brutal 29%—while Web3 adoption hits escape velocity. What gives?

The Great AI Token Disconnect

Market sentiment’s flipped faster than a DeFi exploit. Everyone’s building AI-powered dApps, but the tokens? Freefalling like a meme coin post-hype cycle.

Web3’s Silent Takeover

Adoption metrics scream bull market—wallet growth, transaction volume, institutional inflows—all green. Meanwhile, AI token charts look like a cardiac arrest monitor. Classic crypto: fundamentals and price moving in opposite directions (thanks, as always, to leveraged degens).

The Cynical Take

Maybe the market finally realized attaching ‘AI’ to your whitepaper doesn’t magically print money. Unless you’re an VC exit-liquidity play, of course.

Web3’s rocket fuel isn’t lifting AI coins — yet

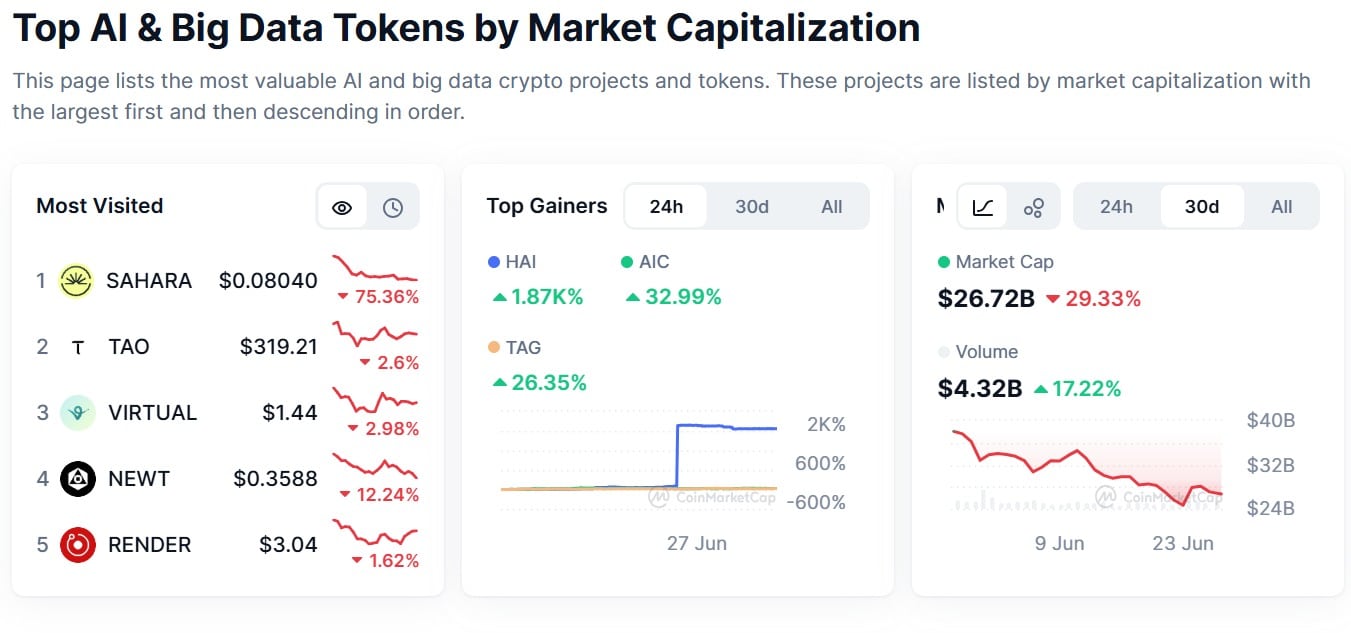

Over the past 30 days, the AI token market capitalization dropped by 29.33% to $26.72 billion. For starters, Bittensor [TAO] declined by 29% over the past month, recording losses across all the charts.

Equally, TAO’s Market cap declined by 4.24%, while the trading volume also dropped by 14%, reflecting strong downward pressure.

Source: CoinMarketCap

Near Protocol [NEAR] declined by 27.12% over the same period, with its market cap declining by 4.45%.

In fact, Artificial Superintelligence [FET] dropped by 25.68%, and RENDER [RNDR] dipped 32.8%. These losses recorded across the market signify a shift in investor behavior.

And yet, adoption metrics flash green

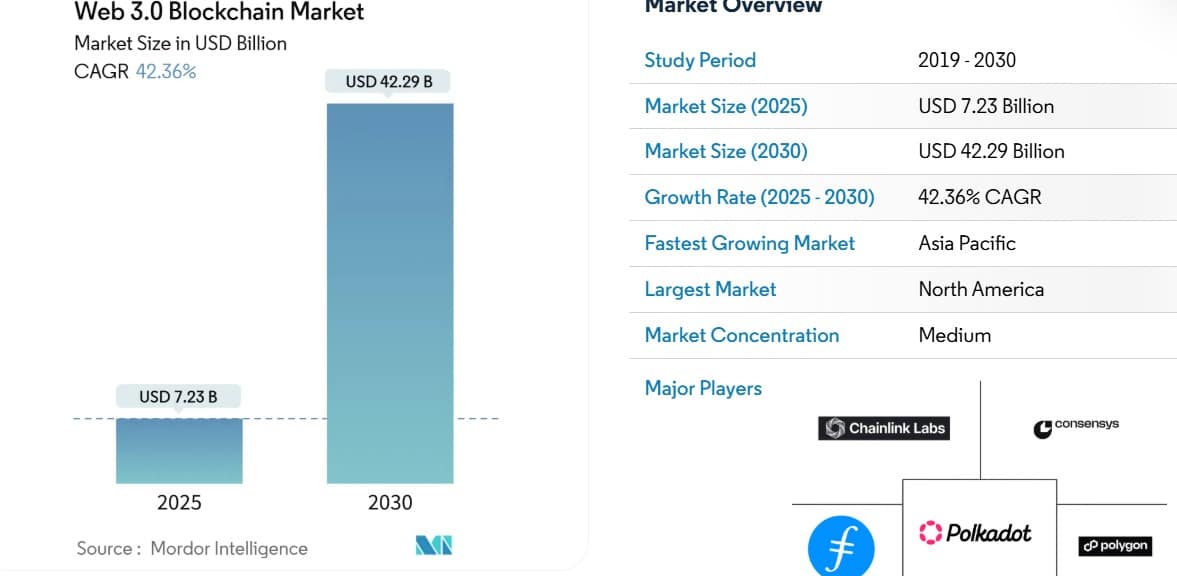

Interestingly, while AI coins are declining, Web3 adoption is skyrocketing. Web3 adoption is rapidly growing, driven by the perceived potential of decentralized technology.

Source: MordorIntelligence

The Web3 blockchain market is projected to grow from $7.23 billion in 2025 to $42.29 billion by 2030, per Mordor Intelligence.

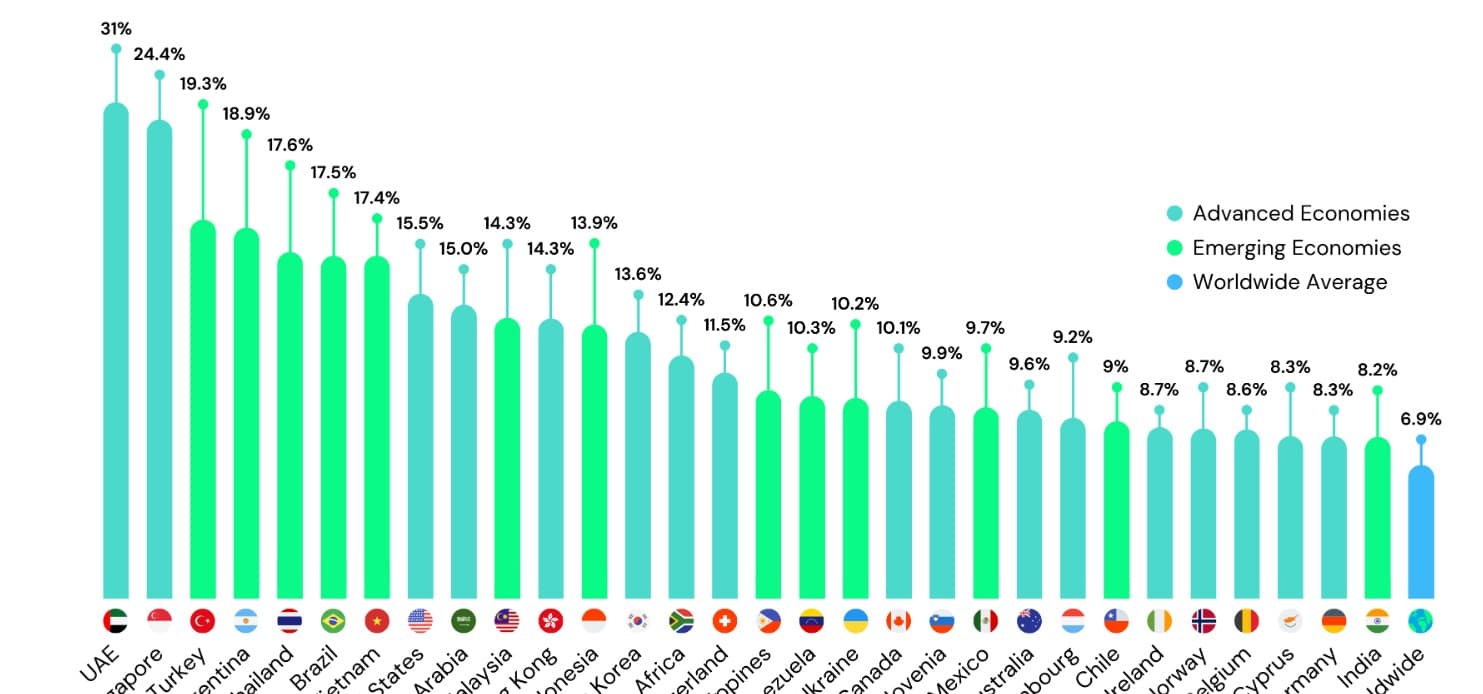

This continued growth reflects growing demand for the technology, especially in emerging economies. Additionally, crypto user growth surged to 659 million in 2024, up 14% YoY, according to Triple-A

Source: Triple-A

At the same time, the total market value of crypto-related assets has surged to $3.2 trillion. However, this is a drop from an all-time high of $3.8 trillion recorded in December 2024.

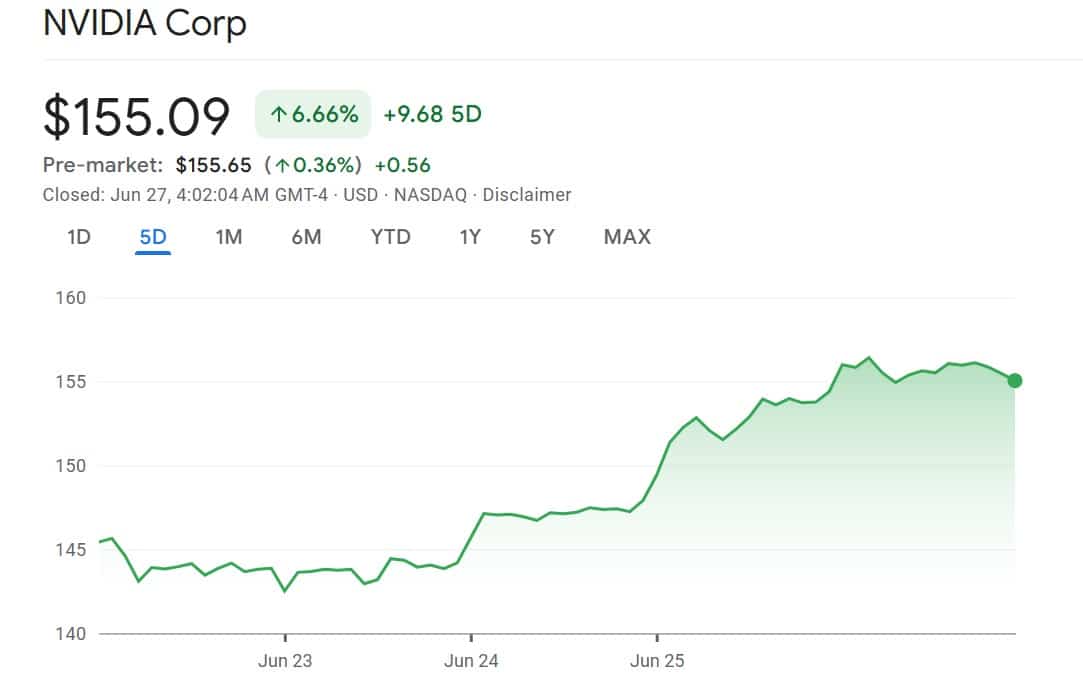

AI tokens decoupling from Nvidia stock

Nvidia’s stock closed at $155.09 on the 27th of June, up 6.66% over five days, with its Market Cap sitting at $3.78 trillion.

Source: Google Finance

Normally, such a sharp AI-related equity rally WOULD lift AI token sentiment too, but that link seems broken.

AI tokens no longer mirror Nvidia’s bullish trajectory, hinting at a new phase of decoupling between equities and tokens.

With this fading correlation, AI tokens appear more tied to broader crypto movements than to real-world AI leaders.

Their performance has aligned more with altcoin momentum than Nvidia’s gains, suggesting investor behavior is evolving.

Subscribe to our must read daily newsletter