XRP Futures Soar to $542M – Why Isn’t the Price Moving? Key Insights for Traders

XRP futures volume just blasted past $542 million—yet the price is stuck in neutral. What’s really going on behind the numbers?

Market mechanics at play: Liquidity floods in, but demand hasn’t caught up. Classic crypto irony—traders pile into derivatives while spot markets yawn.

Watch the leverage ratios: Open interest is climbing, but perpetual funding rates remain flat. Either this is a coiled spring… or a trap waiting to snap.

Pro tip: When futures and spot diverge this hard, smart money watches for squeezes. And yes, that includes the usual suspects—whales who love to ‘rebalance’ their portfolios at your expense.

Closing thought: Nothing moves markets like desperation—and right now, someone’s either accumulating or preparing to dump. Welcome to crypto’s perpetual casino.

CME Group’s XRP Futures breaks record

Naturally, XRP’s debut on CME wasn’t quiet.

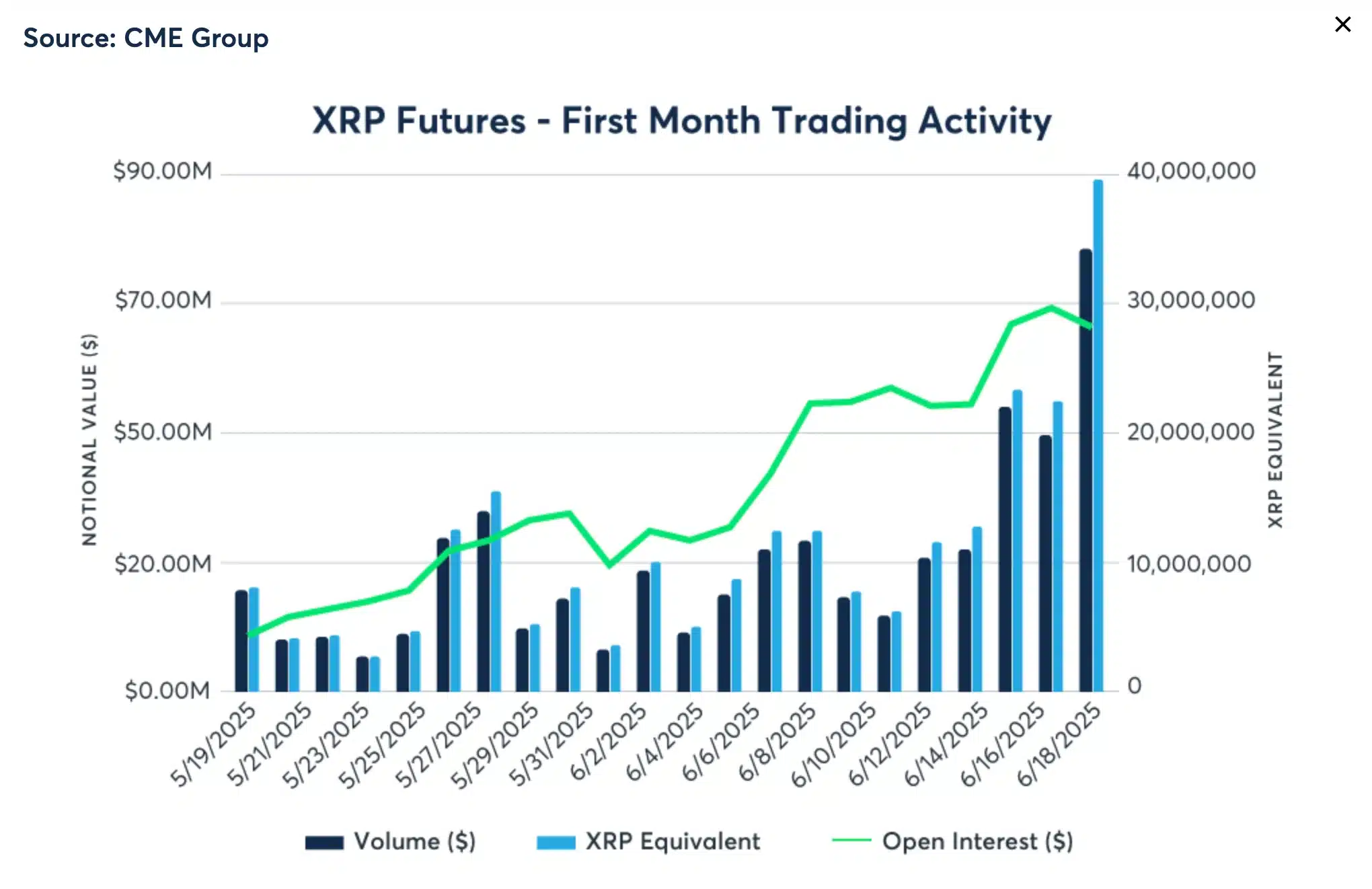

The very first day recorded $19.3 million in volume, with contributions from 15 institutions and four retail platforms.

In fact, within just one month of launch, CME Group’s XRP futures recorded an impressive $542 million in notional trading volume.

Source: CME Group

Interestingly, 45% of the trading activity came from outside North America, reinforcing XRP’s growing global appeal.

Open Interest also surged to $70.5 million, signaling continued investor confidence.

That being said, the launch of these contracts, which come in standard (50,000 XRP) and micro (2,500 XRP) sizes, adds to CME’s expanding crypto derivatives portfolio that already includes Bitcoin [BTC], ethereum [ETH], and Solana [SOL].

What lies ahead

On top of that, XRP’s fundamentals are gaining fresh attention this year.

Activity on the XRP Ledger has seen a noticeable uptick, with higher daily transactions and growing Active Addresses.

Ripple’s $1.25 billion acquisition of prime brokerage Hidden Road marked a strategic leap. It aims to integrate XRP into cross-margining between TradFi and digital assets.

Additionally, the launch of Ripple’s stablecoin, RLUSD, natively built on XRPL, has enhanced liquidity and transactional demand across the network.

Taken together, these moves have amplified XRP’s reputation as a scalable and efficient cross-border asset.

XRP price action

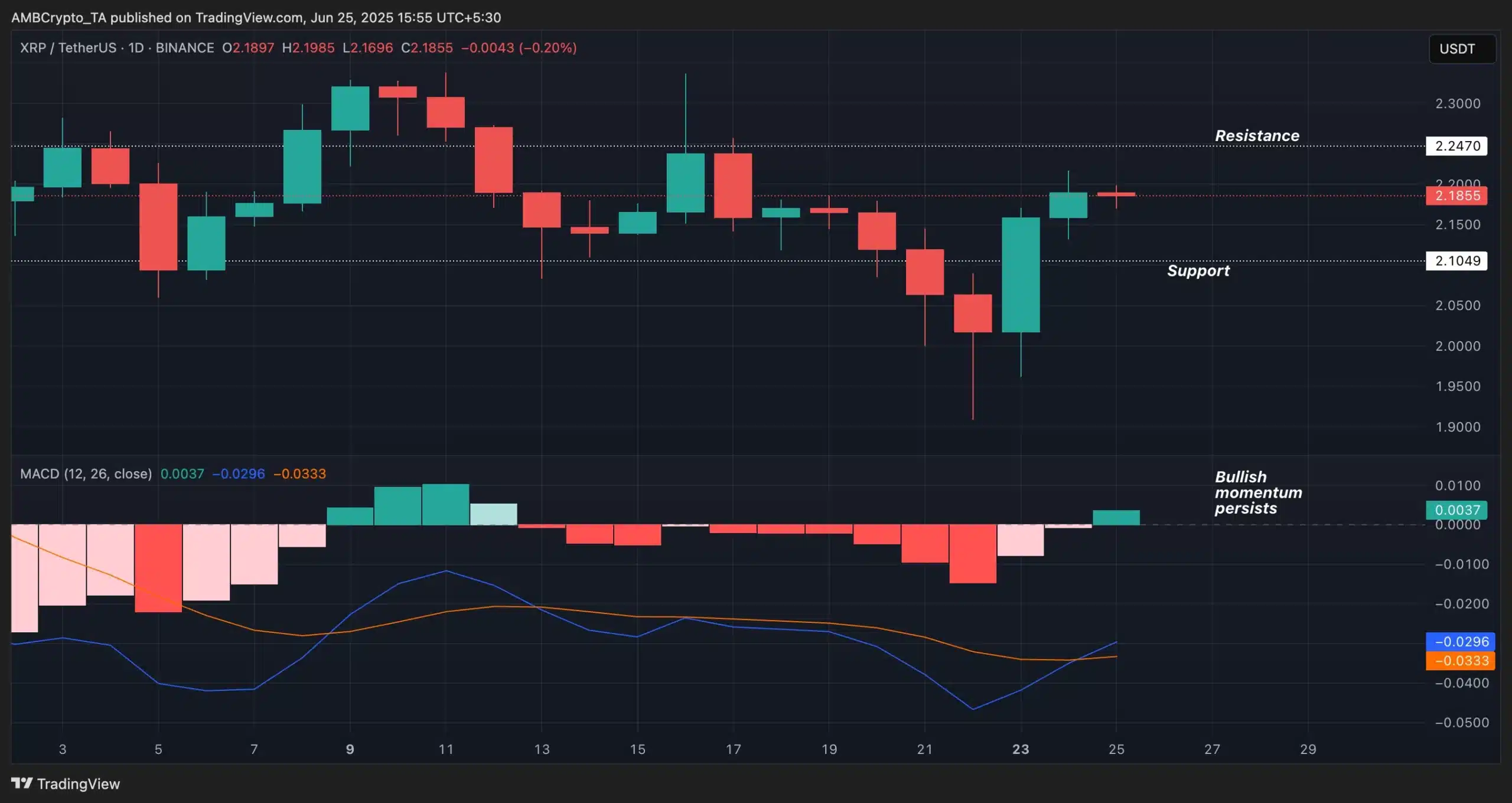

Meanwhile, although XRP slipped to $2.18, at press time, with a minor 0.33% drop in the last 24 hours, technical signals still point to ongoing bullish momentum.

Still, the MACD stayed above zero, and green histograms persisted, suggesting that bullish momentum hasn’t fully faded just yet.

Source: Trading View

However, the asset stands at a critical technical juncture.

Is this the top? Analyst raises a red flag!

In fact, some market voices are already urging caution.

Seasoned market analyst Peter Brandt has warned that XRP’s weekly chart may be forming a reverse head and shoulders pattern, typically viewed as a bearish indicator.

Therefore, if the price falls below $1.80, it could validate the pattern and hint at further downward pressure.

For now, XRP teeters on a knife’s edge, with its next MOVE likely to shape short-term investor confidence.

Subscribe to our must read daily newsletter