Crypto Stocks Surge on Ceasefire Hype – Sustainable Rally or Short-Lived Euphoria?

Crypto markets are mooning again—this time on geopolitical hopium. Bitcoin and altcoin-linked stocks ripped higher overnight as traders priced in a potential ceasefire agreement. But seasoned degens know: crypto moves fast, and narratives flip faster.

Pump first, ask questions later

Exchange tokens and mining stocks led the charge, with some names posting double-digit gains. The rally smells like classic buy-the-rumor behavior—the same pattern we saw during last year's fake ETF approval tweets.

Macro winds shifting?

If the peace deal holds, risk assets could get a sustained tailwind. But crypto doesn't need fundamentals—it thrives on volatility. Either way, hedge funds will extract their pound of flesh from retail traders chasing the pump.

Remember: in crypto, the only permanent ceasefire is when your portfolio goes to zero.

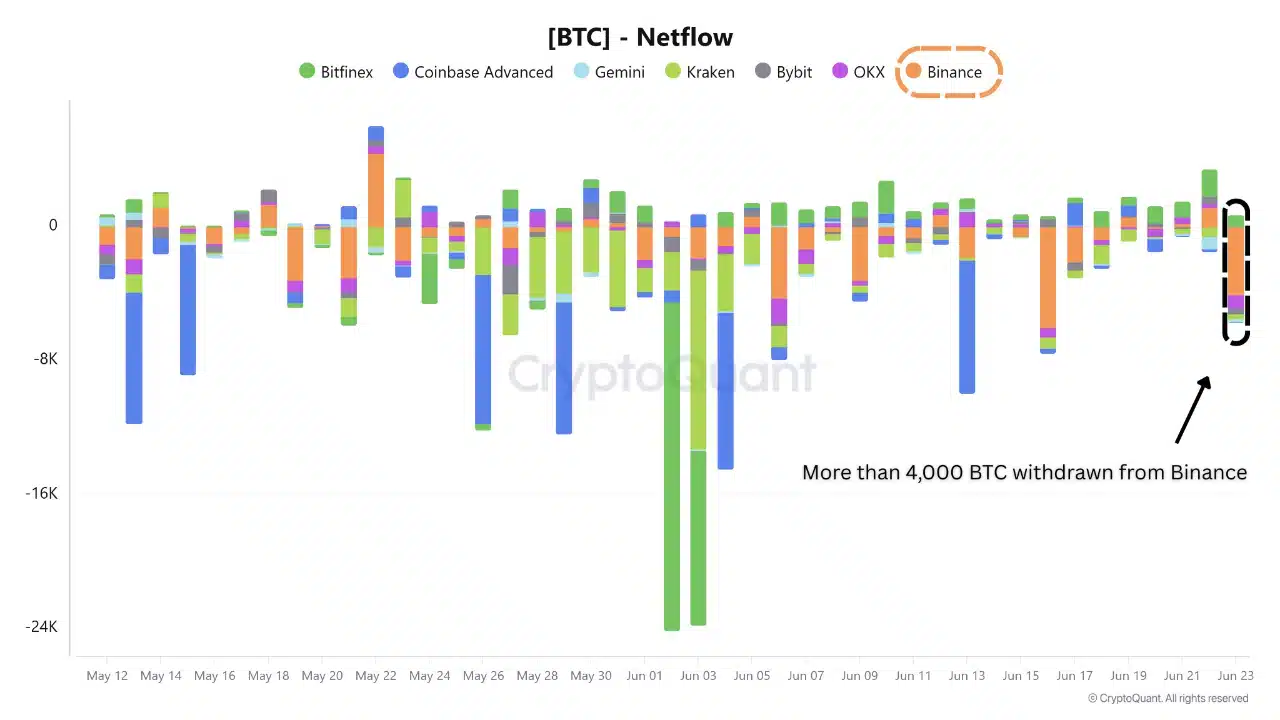

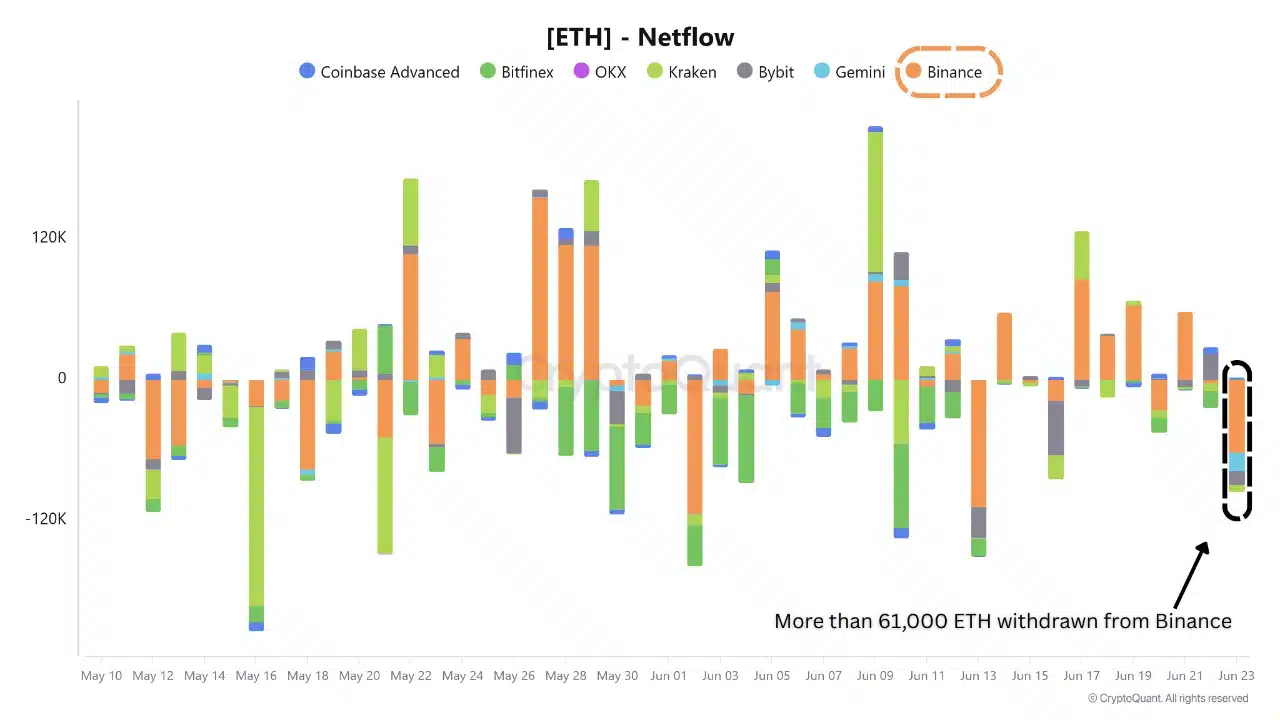

Massive Bitcoin and Ethereum outflows

Source: CryptoQuant

On the 23rd of June, Binance registered sharp outflows – more than 4,000 BTC and over 61,000 ETH – marking one of the largest single-day withdrawals in recent memory.

Source: CryptoQuant

As shown in CryptoQuant’s netflow charts, Binance was the primary driver of negative flow while other exchanges remained largely neutral. This highlights an exchange-specific MOVE likely tied to accumulation strategies.

The scale of these outflows suggests institutional or HNIs (High Net-Worth Individuals) repositioning away from short-term speculation.

This behavior is in line with rising confidence in market stability and a preference for self-custody; often seen in early-stage bull cycle positioning.

Ceasefire holds despite early tensions

The ceasefire between Israel and Iran began on shaky ground, with both sides quickly accusing each other of violations.

Israeli Defense Minister Israel Katz alleged that Iran launched missiles into Israeli territory, prompting a military response. Iran denied the accusations and, in turn, accused Israel of aggression.

President TRUMP urged both nations to show restraint and reiterated U.S. backing for the ceasefire.

Despite the tense start, the truce remains in effect, calming market nerves and potentially boosting risk sentiment across global and crypto markets.

Source: TradingView

Leading crypto assets responded to the improving sentiment, with Bitcoin and Solana [SOL] rebounding into positive territory.

In contrast, Ethereum and Binance Chain [BNB] remained relatively flat, signaling a selective market recovery and a tentative return of investor confidence.

Macro conditions strengthen

Source: Cryptoquant

The S&P 500 surged past the 6,000 mark for the first time since February 2025, showing investor confidence and a clear shift toward risk assets.

Simultaneously, West Texas oil prices plunged over 14%, a move that reinforces the global disinflation narrative.

Source: CryptoQuant

These indicators suggest a backdrop of easing geopolitical tensions, declining cost pressures, and strong growth appetite.

For crypto, this macro environment creates a favorable setup for accumulation—especially as digital assets increasingly mirror risk-on sentiment in traditional financial (TradFi) markets.

Subscribe to our must read daily newsletter