Bitcoin’s Soaring Value: Is It Now Too Expensive to Trade? The Truth Uncovered

Bitcoin's relentless climb has traders asking: has it priced itself out of the market?

The liquidity crunch no one's talking about

As BTC flirts with new ATHs, retail investors face brutal spreads—while whales keep stacking. Exchanges love the volatility, but your order book? Not so much.

When 'digital gold' starts feeling like Fort Knox

Miners cash out less, hodlers cling tighter, and that 1 BTC psychological barrier does weird things to market psychology. Meanwhile, Wall Street's 'experts' still can't decide if it's an asset or a currency—classic.

The irony? The more valuable Bitcoin becomes, the harder it gets to actually use as money. Satoshi would be proud... or rolling in his anonymous grave.

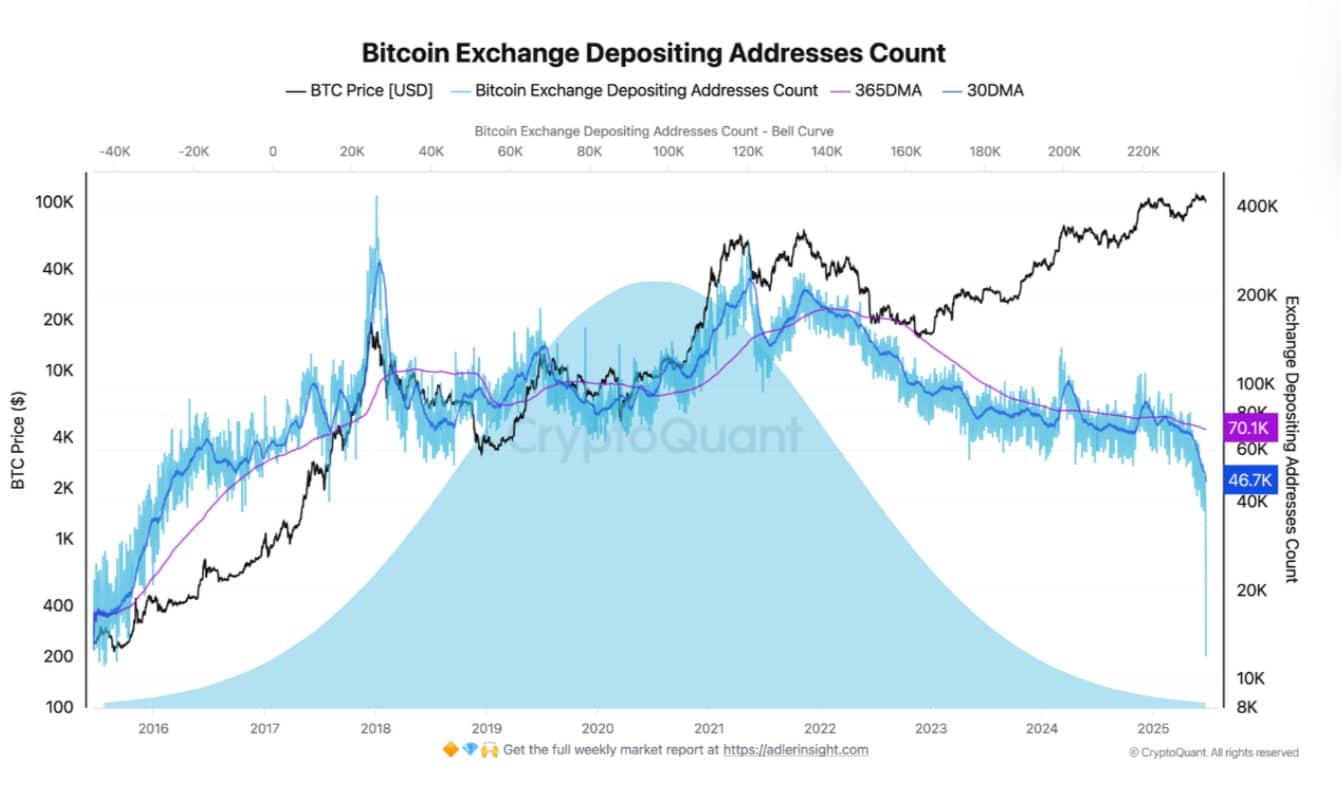

Bitcoin exchange deposits hit historical low

According to CryptoQuant, the number of addresses depositing to exchanges has significantly decreased.

Source: CryptoQuant

The 30-day moving average stood at just 48,000. Meanwhile, the daily count dropped to around 37,000. To put this into perspective, between 2015 and 2021, the yearly average hovered NEAR 180,000.

Naturally, this isn’t just a blip.

Source: CryptoQuant

The longer-term 365-day moving average has also dropped to 70,100, while the 10-year mean still sits higher at 90,000. These data points confirm a sustained decline, not just cyclical noise.

As these addresses decline, so has the number of depositing transactions.

Bitcoin’s Exchange Depositing Transactions hit a 12,000 low recently, marking the weakest level since mid-2023. Even now, the metric struggles to regain altitude, sitting near 13,000.

What does this mean? In short, less BTC is moving to exchanges, and that’s a major tell.

Scarcity meets conviction

Source: CryptoQuant

Bitcoin’s scarcity is at an all-time high as the Stock to FLOW Ratio surges to 59.4k. When scarcity surges to such high levels, it signals growing BTC accumulation.

Importantly, this spike in scarcity has occurred even as BTC continues to trade above $100K, showing that holders are unfazed by the price and possibly waiting for more.

With these changes in the market, the question is, what’s behind it?

Factors behind declining exchange deposits

One clear catalyst is the rise of Bitcoin spot ETFs. These instruments allow investors to gain exposure without moving BTC on-chain, reducing the need for direct exchange deposits.

Moreover, retail traders have been less active in this cycle. Thus, investors are now choosing to hold bitcoin as savings or treasury reserves rather than actively trading it.

Subscribe to our must read daily newsletter