SPX6900 Soars 18% – Traders Beware: This Hidden Risk Could Wipe Out Gains

SPX6900 rockets up 18%—another day, another crypto pump. But before you FOMO in, here's the catch.

Hidden landmines in the rally

Liquidity craters when you need it most. Whale wallets are moving—and not in your favor. That 18% gain? Could vanish faster than a DeFi rug pull.

Risk management or recklessness?

Leverage traders are piling in like it's 2021. Exchange reserves are thinning. One black swan event and SPX6900 becomes SPX3000—ask anyone who survived May 2022.

Pro tip: Bulls make money, bears make money, pigs get slaughtered. And Wall Street 'advisors'? Still trying to short Bitcoin with your pension fund.

SPX6900 Futures wake up as prices surge

Riding this recovery wave, SPX soared to a local high of $1.26 before easing slightly. At press time, it hovered NEAR $1.24, up 18.78% over 24 hours.

That wasn’t the only number that jumped.

SPX recorded an 85.8% surge in trading volume to reach $161 million. Such a massive surge in volume signals increased activity either on the sell or buy side.

Source: CoinGlass

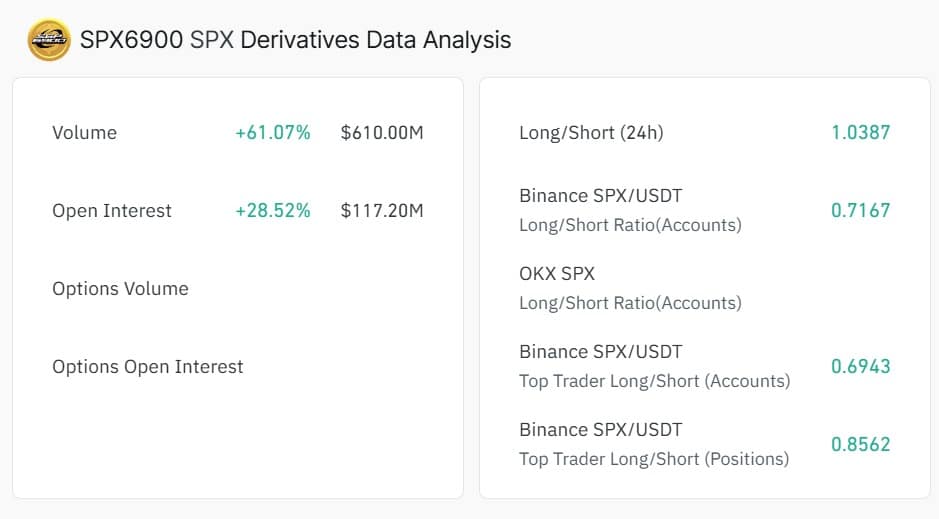

Interestingly, most of this activity stemmed from the derivatives market. SPX6900’s Open Interest (OI) ballooned 28.52% to $117.2 million, signaling a flood of new contracts.

Such an uptick in OI implies that as prices started to rise, investors rushed into the market to take strategic positions.

In fact, the Long/Short Ratio stayed above 1, confirming that a majority of traders held long bets.

Market signals aren’t in sync

Although SPX6900 prices, volume, and activities in the futures have surged, it seems key market players are not convinced. This is so because SPX6900 investors are aggressively selling.

Source: Santiment

After the price recovered over the past day, most of the holders turned to profit-taking.

Looking at the Exchange FLOW Balance, it remained positive at around 25.8k.

A positive value here suggests that investors and holders are selling more than they are buying. Thus, there is more Flow into exchanges than outflow, which could result in higher selling pressure.

Source: CoinGlass

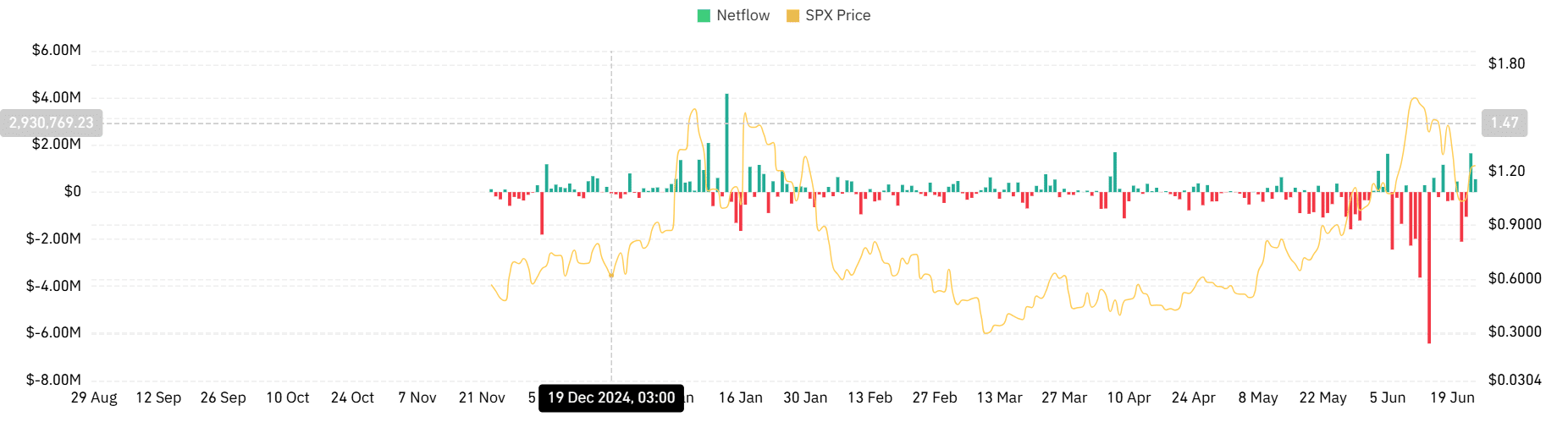

On top of that, Netflow also flipped positive. This suggests that while prices climbed, investors offloaded nearly 7 million SPX tokens.

Even more striking was the plunge in the Stock to Flow Ratio. On the 23rd of June, the memecoin’s SFR stood tall at 21 billion. At press time, it was barely clinging to 11K.

Such a significant drop in SFR indicates a higher supply while demand is low. If demand fails to keep up, lower scarcity leads to price drops.

Source: Santiment

So…what now? $0.95 or $1.5?

Despite the dramatic rebound, there’s a visible tug-of-war between speculators and sellers. While short-term traders jumped in amid wider market relief, long-term conviction seems shaky.

Unless bulls can maintain a daily close above $1.20, the rally risks losing steam. If sellers stay dominant, SPX may revisit $0.95 support.

But if momentum holds and $1.2 flips into firm support, SPX could charge toward $1.5 next.

Subscribe to our must read daily newsletter