Bitcoin’s $105K Surge Was Inevitable – Here’s the Proof

Bitcoin just pulled off a $105,000 moonshot—and anyone paying attention saw it coming.

The Setup:

A perfect storm of institutional FOMO, supply shock, and macro tailwinds lit the fuse.

The Trigger:

When traditional finance finally admitted crypto wasn’t a 'fraud,' the dam broke. Cue the hedge funds scrambling like late-night degens chasing a meme coin.

The Aftermath:

Now we wait to see if Wall Street tries to take credit—or quietly dumps bags on retail (again).

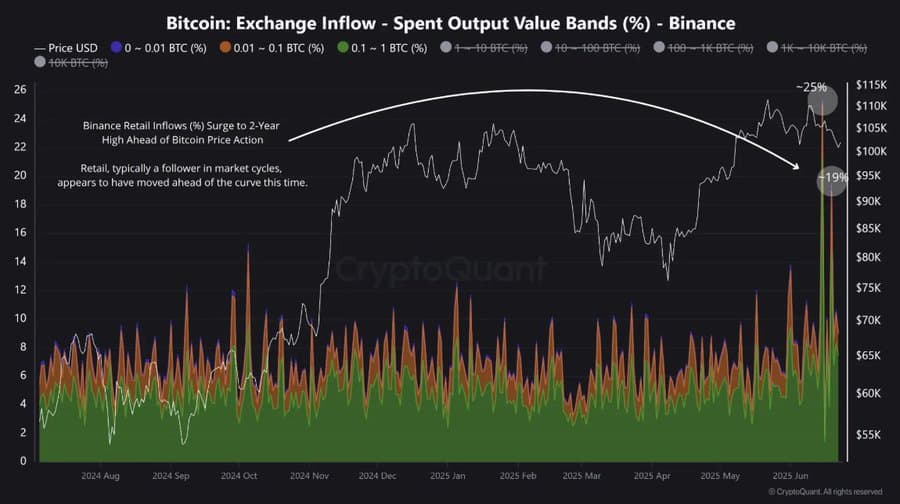

Binance traders pulled the trigger, but not in the way you think

According to CryptoQuant, Binance’s Retail Exchange Inflow – Spent Out Value Bands spiked to a 2-year high.

In fact, the spikes happened on the 15th of June and again on the 19th of June. That means it ROSE 25% and 19% respectively.

Both inflows preceded sharp drops in BTC price, including a fall to $98,286 on the 22nd of June.

Source: CryptoQuant

While retail often lags the market, this time they might’ve front-run the correction.

This kind of situation typically implies two things: a higher tendency for investors to sell their assets or hold them without trading, possibly transferring them outside Binance into private wallets.

Tether’s $2B mint floods HTX & BTC soaks it up

Just as BTC approached support, fresh liquidity arrived.

Per CryptoQuant, $2 billion worth of USDT was minted on the TRON [TRX] network, with $1.24 billion of that flowing directly into HTX Global—the largest single-exchange netflow in recent months.

Typically, when such significant minting occurs, bitcoin absorbs the bulk of it, with only minimal amounts flowing into altcoins.

Sure enough, BTC bounced sharply, gaining 4.54% over the next 24 hours.

Source: CryptoQuant

This indicates that both spot and derivatives investors are taking positions by buying the recent dip.

AMBCrypto also analyzed other indicators to assess whether Bitcoin’s upward trend WOULD continue or face another pullback.

Bitcoin’s spot market shows strong bullish signals

The Bitcoin Market Value to Realized Value (MVRV) Ratio, a key indicator of whether an asset is being bought or sold, showed that buying pressure is dominant.

The metric climbed to 2.212, trending higher from recent lows. That level, still below 3.7, often signals room for upside before overvaluation risk sets in.

Source: CryptoQuant

Similarly, the Bitcoin Spot Taker CVD (Cumulative Volume Delta) also supported the bullish outlook, placing BTC in a Taker Buy Dominant zone.

Source: CryptoQuant

Institutions weren’t late to the party either

Adding to this strength, AMBCrypto found that Bitcoin Spot Exchange-Traded Fund (ETF) traders are also accumulating BTC.

In the past 24 hours, ETF traders moved $350 million into Bitcoin, raising their total net asset value to $97.27 billion.

Source: CoinGlass

This major inflow signals that traditional institutional investors are aligning with the broader sentiment observed in the spot and derivatives markets, further increasing the likelihood of a sustained Bitcoin rally.

Subscribe to our must read daily newsletter