Ethereum’s Market Dominance Jumps 12% – So Why Can’t ETH Break $2K?

Ethereum's dominance surges while its price stumbles—what gives?

Market watchers were caught off guard this week as Ethereum's dominance metric spiked 12%, yet ETH couldn't muster the strength to hold the psychologically crucial $2,000 level. The divergence paints a confusing picture for traders banking on altcoin season.

The great ETH paradox

While Ethereum continues eating competitors' lunch in the smart contract arena, its native token struggles with what crypto analysts call 'the curse of institutional expectations.' Turns out Wall Street's 'number go up' machines need more than just network dominance to keep pumping—who knew?

Price action tells the real story

The $2K resistance level has become Ethereum's personal glass ceiling. Every breakout attempt gets smacked down faster than a DeFi exploit. Meanwhile, the dominance metric keeps climbing—because nothing says 'healthy ecosystem' like your flagship asset refusing to budge while alternatives bleed out.

As the crypto market waits for ETH to either break through or break down, one thing's clear: in this economy, even blockchain's golden child isn't immune to the old 'buy the rumor, sell the news' routine. Maybe try telling your portfolio that 'fundamentals matter'—it'll laugh right through the losses.

Ethereum dominance growth continues

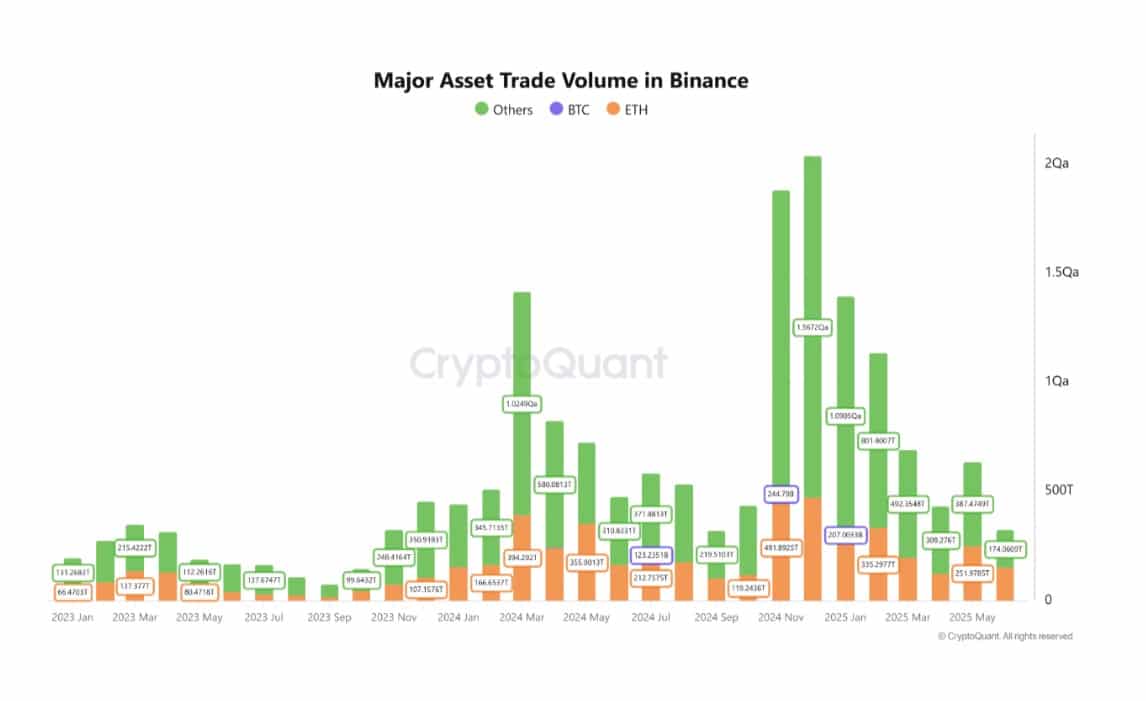

According to CryptoQuant, Ethereum has captured a significant share of the market based on data from January to May 2025.

This surge in ETH dominance is primarily driven by a significant drop in the volume of other altcoins.

Source: CryptoQuant

Contrary to market expectations, Ethereum’s trading did not drive the recent surge. From 2024 to 2025, ETH’s trading volume remained relatively steady, ranging between 300 trillion and 490 trillion.

In contrast, altcoin trading volume peaked at 1.5672 quadrillion in November 2024, but dropped sharply to 387.47 trillion by May 2025. The share of altcoin trades fell from over 1 quadrillion to below 400 trillion, reflecting a significant decline.

This trend suggests investors are pulling liquidity from riskier projects. Some of that capital appears to have been redirected into Ethereum, seen as a relatively safer alternative.

Source: CoinGlass

Therefore, Ethereum’s dominance is not primarily the result of its growth but rather the retreat of its competitors. Despite ETH failing to grow significantly, it remains highly favorable compared to other smaller coins.

When we look at Altcoin’s Season Index, it shows that the overall altcoin market has declined. This metric has declined from 88 to 12 between December 2024 and June 2025, signaling a weakening altcoin market.

Any impact on ETH’s price movement?

Although Ethereum dominance has surged significantly, its growth has been problematic. Since then, demand, on-chain activity have all struggled to keep up with the market.

Source: Santiment

At press time, Ethereum’s NVT ratio s surged to 1041, indicating significant network overvaluation.

This means on-chain activity is low relative to price, suggesting that current ETH prices may not be supported by organic demand.

Historically, such disconnects—where value outpaces actual network usage—often signal market tops and are followed by corrections.

If this trend continues, ETH could retrace to better align with real demand, pointing to a speculative market environment.

Despite Ethereum’s rising market dominance, long-term holders are still in the red.

Also, the MVRV Long/Short Difference remained negative, and has been so for the past four months, signaling persistent unprofitability for long-term ETH investors.

Source: Santiment

A negative value here suggests that short-term holders have higher unrealized profit than LTHS. For instance, those who acquired ETH between December 2024 and February 2025 are mostly sitting at a loss.

This implies that despite growing influence, ETH is not recording significant moves to the upside while other altcoins continue to dip. At the prevailing market conditions, ETH seems overvalued and has to retrace to meet actual demand.

If a retrace emerges, we could see ETH drop below $2k. However, if speculators continue to hold the market, Ethereum will continue with recovery and attempt to reclaim $2.5k.

Subscribe to our must read daily newsletter