🚨 $50M Telegram Crypto Scam Unmasked: These 4 Altcoins Were in the Crosshairs

Another day, another crypto scam—but this one’s got teeth. A $50M Telegram-based fraud scheme just got busted wide open, and four altcoins were its prime targets. Here’s the breakdown.

The Hook: How They Lured Victims

Promising ‘guaranteed returns’ (because those exist in crypto), the scammers used Telegram’s anonymity to push fake investment pools. Classic pump-and-dump, but with a side of identity theft.

The Targets: 4 Altcoins in the Spotlight

No names dropped yet—regulators are still untangling the mess—but insider chatter points to mid-cap tokens with shaky liquidity. Perfect prey for a quick rug pull.

The Fallout: Who’s Holding the Bag?

Retail investors, as usual. Meanwhile, the scammers are probably sipping margaritas on a non-extradition beach. Crypto’s Wild West era? Still thriving.

The Irony

Decentralization was supposed to cut out the middlemen. Instead, it just created smarter thieves. Stay skeptical, folks.

Coins were compromised in the OTC crypto scam

Fraudsters posed as over-the-counter (OTC) dealers, offering attractive token deals tied to vesting schedules. They targeted popular projects like SUI, NEAR, SEI, and Axelar [AXL]—tokens with strong liquidity and active communities that lent credibility to the scam.

Victims lost over $50 million after falling for these offers.

Crypto analyst Altcoin Alpha stated that promoters pushed the scheme in private Telegram groups. Prominent crypto whales and venture capitalists appeared to endorse it, giving the scam added credibility.

From November 2024 to January 2025, the operation appeared legitimate, with users posting profits and urging others to join.

However, it soon collapsed, revealed to be a classic Ponzi scheme, where new investors’ money was used to pay earlier participants.

In June, everything fell apart when token distributions suddenly stopped. The promoters vanished, offering vague excuses about travel or exchange issues.

What’s more?

The Telegram scam gained momentum during the early stages of the 2024 crypto bull run, kicking off with what appeared to be legitimate OTC deals.

Initially, tokens like The Graph (GRT), Aptos [APT], Sei [SEI], and SWELL were offered at steep discounts, up to 50%, attracting buyers with the allure of early access and vested allocations.

On-chain data confirmed the tokens’ presence in specific wallets, helping build credibility.

How did it come to an end?

The scam was publicly revealed on the 19th of June, when Aza Ventures, a key broker involved in the deals, announced it had been defrauded.

The firm identified an individual referred to as “Source 1” as the mastermind behind the global $50 million Ponzi scheme.

Aza Ventures stated that they know his identity, claiming he was an Indian national and the founder of a project currently listed on Binance.

However, they have chosen not to disclose his name, hoping to recover the stolen funds through private negotiation.

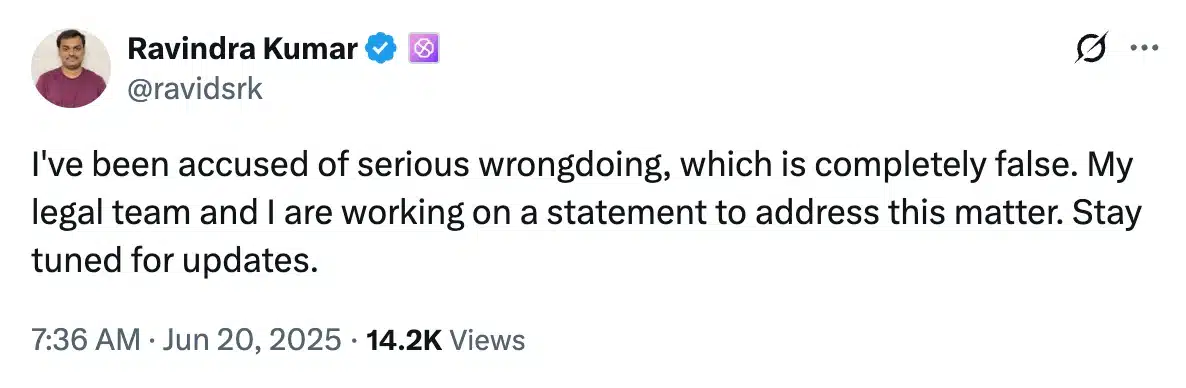

In parallel, blockchain analysts Altcoin Alpha and Crypto Sleith have alleged that Ravindra Kumar, the founder of Self Chain, was behind the scheme.

Kumar, however, has denied the accusations and promised to issue a public statement.

Source: Ravindra Kumar/X

Warnings were issued, but victims ignored them

By May 2025, subtle warnings about the Telegram OTC scam began to emerge. Many users ignored them amid steady profits.

Eman Abio from the sui team posted on X: “There is NO deal.” He urged users to avoid fraudulent OTC offers on Telegram.

Source: Altcoin Alpha/X

Similarly, Lucian Mincu, co-founder of MultiversX (formerly Elrond), amplified the warning. Yet, these alerts failed to gain serious traction.

Investors, swayed by earlier profits and endorsements from trusted figures, continued to participate. The allure of steep discounts and prior success stories drowned out the cautionary voices, allowing the $50 million scam to persist and expand.

Data sets on the rise in crypto crimes

Thus, as crypto-related crimes continue to evolve, a pressing question remains: how long can this trend persist unchecked?

On the 15th of January 2025, Chainalysis reported that illicit crypto addresses received $40.9 billion in 2024, down from prior years.

However, experts consider this figure conservative, as investigators continue uncovering more illicit wallets. This growing concern is now influencing market sentiment and behavior.

Impact on the price of altcoins compromised

In the aftermath of the $50 million Telegram scam, tokens like SUI, NEAR, and AXL saw noticeable 24-hour declines of 4%, 4.8%, and 1.88%, respectively, at press time.

Interestingly, SEI stood out with a 5.08% gain, defying the broader downtrend, according to CoinMarketCap.

Subscribe to our must read daily newsletter