Ethereum Whales Dump $321 Million in 60 Seconds—But the Crypto War Isn’t Over

Whales just liquidated a quarter-billion in ETH faster than a Wall Street trader hitting the sell button on bad news. Here's why the market barely blinked.

Blood in the water? Not so fast.

While $321 million exiting Ethereum in one minute would've crashed lesser assets, ETH's price held firmer than a banker's handshake. The whales' coordinated sell-off screams 'profit-taking'—not panic.

The real battle? Keeping retail investors from folding. With institutional money flooding crypto, these volatility spikes are just growing pains. As one fund manager quipped: 'If you can't handle 60-second sell-offs, maybe stick to bonds—oh wait, those are crashing too.'

$321M in a minute?

According to CryptoQuant analyst Maartun, Ethereum witnessed a significant spike in selling pressure.

He observed that Ethereum’s Taker Sell Volume across all exchanges surged significantly, recording over $321.3 million in one minute.

That’s not a routine pullback. It marked intense sell-side aggression, with both whales and retailers contributing to the spike in volume.

Source: CryptoQuant

In fact, in total, ETH recorded $10.3 billion in Taker Sell Volume before cooling to $839.6 million. This level of activity often mirrors fear or aggressive profit-taking.

Of course, the panic wasn’t just reflected in trade volumes. ETH also recorded 1.2 million coins in Exchange Inflows, mostly from whales.

Source: CryptoQuant

Who’s buying what they’re selling?

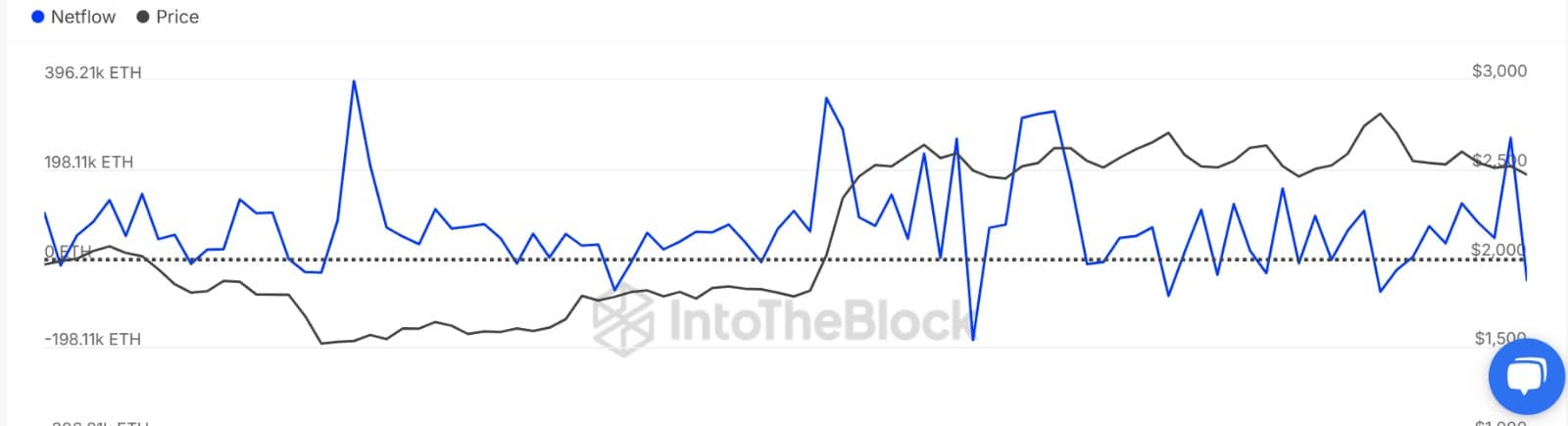

When we looked at Large Holders Netflow, the data indicated that whales sold 519k ETH while buyers scooped 471k ETH.

This leaves a negative netflow of -48.75k ETH, signaling a higher selling activity from Ethereum large holders.

Source: IntoTheBlock

Such negative Netflow, paired with rising inflows and elevated Sell Taker Volume, spelled out strong bearish sentiment. Either holders were locking in profits or scrambling to cut losses.

Buyers step in, but is it enough?

As expected, this surge in selling activity impacted ETH’s price movement. It briefly slipped from $2.5K to $2.3K. But that wasn’t the end of the story.

As of this writing, Ethereum recovered to $2,424. This mild rebound hints that some buyers saw an opportunity to buy the dip, absorbing the pressure and halting further downside, at least for now.

Wait for THIS tipping point!

Source: CryptoQuant

Interestingly, Exchange Netflow turned negative, with outflows beating inflows by about 3.4K ETH.

Simply put, Ethereum buyers have entered the market and absorbed the recently witnessed selling pressure. Yes, that is typically a bullish sign.

That said, the battle isn’t over. ETH has returned to a consolidation zone, where bulls and bears appear locked in a short-term stalemate.

Therefore, if the bulls can hold their positions, it will boost ETH to reclaim $2575, which is a key level to keep bullish momentum alive. Conversely, if sellers retake the market once again, ETH could dip to $2350.

Subscribe to our must read daily newsletter