Ethereum’s Perfect Storm: How Surging Adoption and Scarcity Could Trigger the Next Mega Rally

Ethereum's gearing up for a potential breakout—and this time, the fundamentals might actually justify the hype.

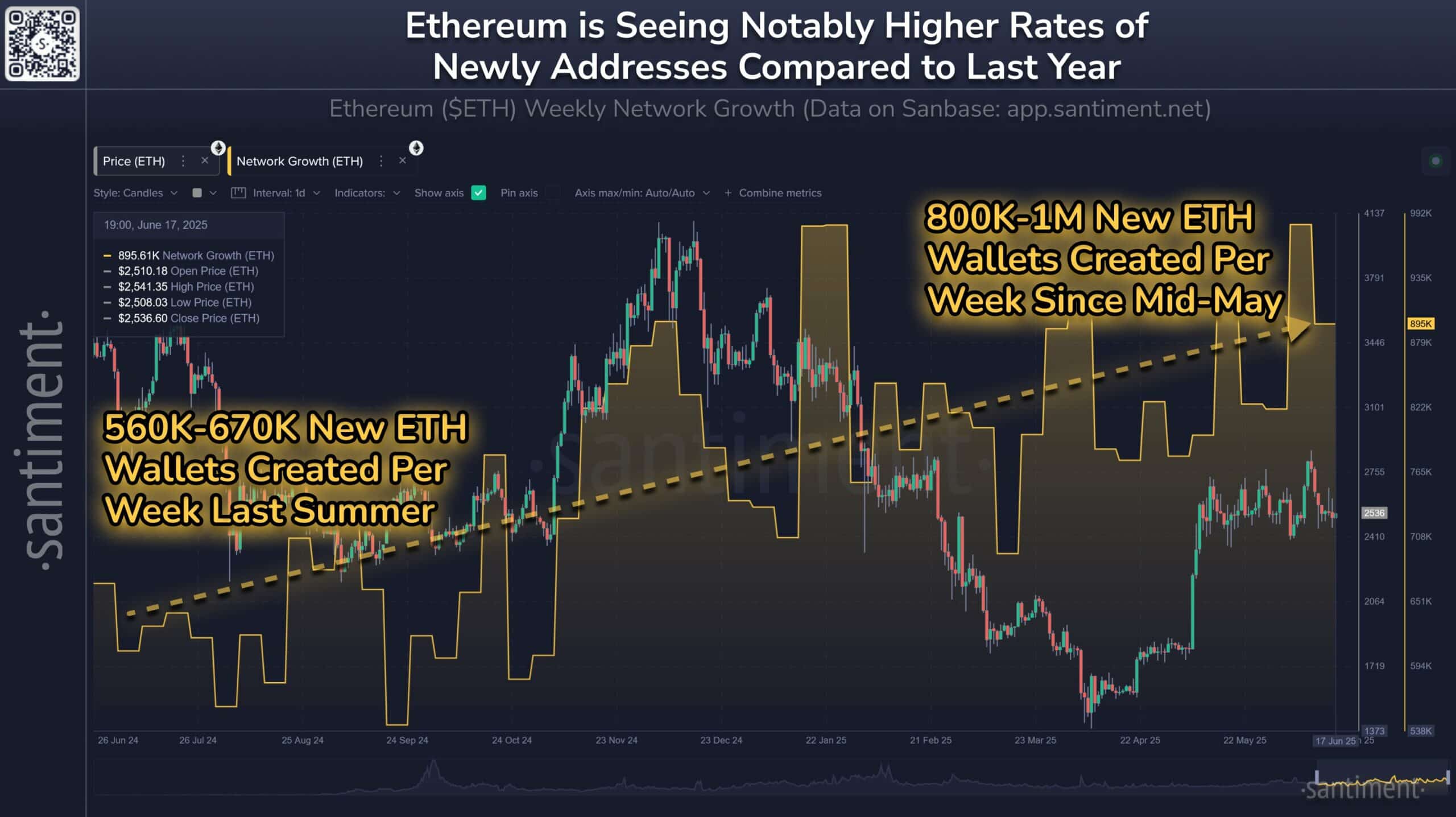

The Adoption Flywheel Kicks In

Mainstream institutions are finally building on-chain rather than just talking about it. DeFi protocols are swallowing traditional finance whole, and NFTs aren't just for bored apes anymore—they're becoming ticketing systems, property deeds, and even legal contracts.

The Scarcity Engine Starts Roaring

With EIP-1559 burning fees like a furnace and staking locking up supply, Ethereum's circulating inventory keeps shrinking. Meanwhile, Wall Street's still trying to figure out how to short it without getting rekt.

The Bottom Line

When the suits and the degens finally agree on something, you'd better pay attention. Ethereum's not just flipping switches—it's rewriting the entire financial playbook. (And yes, your bank manager still thinks it's 'just a bubble' while quietly DCA-ing into ETH.)

Source: Santiment/X

Are whales quietly returning to accumulate ETH?

Large holder netflows have reversed sharply over the past week, rising by over 7,400% after weeks of muted activity. This spike followed a prolonged period of negative flows, which may have signaled distribution or repositioning.

Now, the renewed inflows could mean growing confidence among whales. This trend also seemed to coincide with steady price support, possibly reflecting strategic accumulation.

Additionally, this whale behavior could precede a supply crunch if the trend continues. Therefore, the latest accumulation trend by large holders may signal the start of a more bullish phase.

Source: IntoTheBlock

Will Ethereum’s price break free from its consolidation pattern?

ETH has remained locked in a range between $2,396 and $2,833, respecting an ascending channel structure.

Despite multiple attempts, bulls have struggled to breach the $2,833 resistance, while bears have failed to break below the $2,396 support. This price compression reflects indecision, but something like this often precedes explosive movement.

At the time of writing, the Stochastic RSI was low – Implying an incoming reversal if buying pressure increases. Until a breakout occurs, the price will likely oscillate in this tight zone. However, growing fundamentals may soon tip the balance.

Source: TradingView

Is ETH shifting from short-term hype to long-term value?

Finally, ETH’s short-term holder activity, measured by the 0–1 day Realized Cap HODL Waves, saw a decline after weeks of sharp spikes. This suggested that recent buyers may be exiting or taking profits, reducing short-term volatility and easing sell pressure.

At the same time, ETH’s Stock-to-Flow ratio surged to 43.2—its highest in months—indicating growing scarcity as new issuance slowed down.

This combination of fading speculative behavior and rising long-term value metrics could set the stage for a more sustainable upward move.

If long-term demand persists, ETH may soon break its current price ceiling and shift firmly into accumulation territory.

Source: Santiment

Is Ethereum gearing up for a breakout beyond $2,800?

Ethereum’s on-chain strength is becoming increasingly difficult to ignore. With new wallet creation accelerating, whales returning, and scarcity metrics like Stock-to-Flow spiking, the fundamentals may be aligning for a potential rally.

While the price remains trapped within a defined range, the rising network activity and declining short-term holder momentum could soon shift the balance. If bullish pressure holds, ETH may break past $2,800.

Subscribe to our must read daily newsletter