Bitcoin’s Price Surge, Miner Activity, and THIS Volatility Signal – What You Need to Know Now!

Bitcoin’s price is making waves again—but what’s driving the move? Miners are flexing their influence, and a key volatility indicator just flashed its most critical signal yet.

Here’s the breakdown:

The Miner Factor: Hash rate fluctuations and miner capitulation fears are back in focus. Are they dumping or holding? The market’s watching every move.

Volatility Alert: That obscure metric traders swear by? It just hit a level that historically precedes big swings. Buckle up.

Price Action: Bulls are pushing, but resistance looms. Meanwhile, Wall Street’s still trying to time the top—good luck with that.

One thing’s clear: Bitcoin’s playing by its own rules again. And as always, the ‘smart money’ is late to the party.

Bitcoin’s correlation with mining company market caps is falling!

According to Alphractal, Bitcoin’s correlation with crypto mining companies has declined significantly.

Often, when such a market scenario emerges, it alludes to looming volatility or a potential trend reversal on the charts in the short-term.

Source: Alphractal

Normally, as Bitcoin’s price and market cap rise, so do the market caps of mining companies such as Marathon. Thus, the two usually MOVE together as they are correlated.

This, because miners earn revenue from BTC, hold significant reserves, and are directly affected by it. That is why when bitcoin climbs, mining company stocks usually do too, and vice versa.

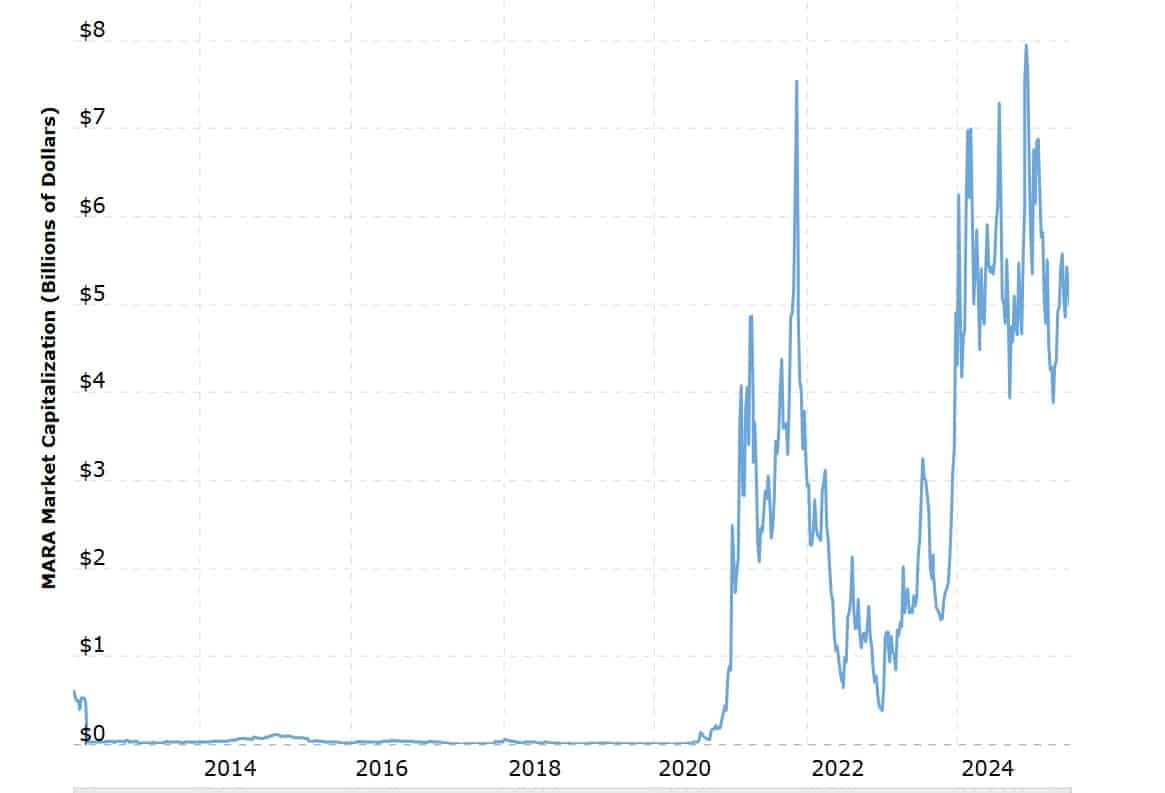

Source: MacroTrends

At the time of writing, this correlation seemed to be breaking down. For example – Since December 2024, MARA’s market cap has fallen from $7 billion to $5 billion.

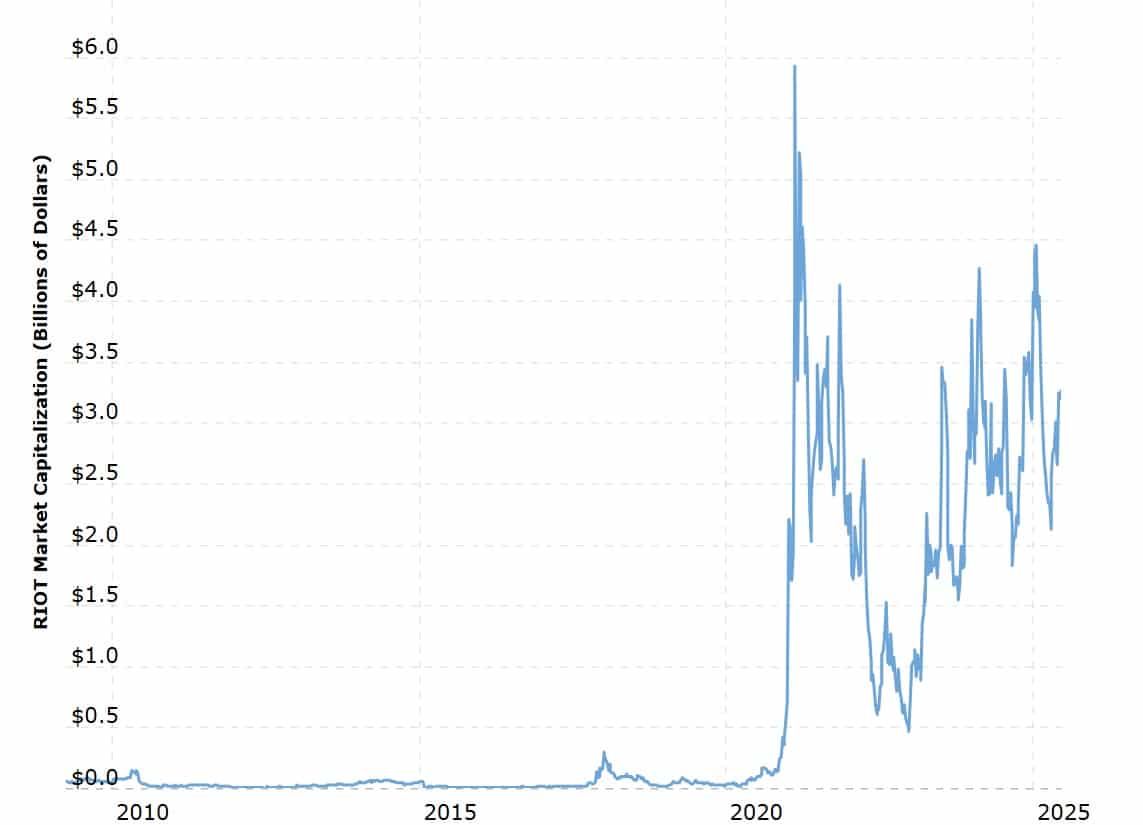

A similar pattern could be seen in the case of Riot Platforms, with its market cap dropping from $3.48 billion to $3.2 billion.

Source: MacroTrends

The aforementioned breakdown in correlation can also be evidenced by a look at the Miners’ Reserves. In 2025 alone, figures for the same fell from $1.81 million to $1.807 million.

What this means is that miners have been selling their BTC, which is likely the reason why their market value has been falling. When they offload and reduce their holdings, value will decline, despite higher prices.

Source: CryptoQuant

What does this mean for Bitcoin?

When Bitcoin’s price and mining stock values diverge, it could mean that the market is about to move fast. Under these circumstances, Bitcoin’s price can move either up or down.

Historically, this has also acted as a leading volatility indicator. Especially as miner behavior alludes to a shift in market health.

For example – During the COVID-19 crash, Bitcoin and miner values plunged together. The same happened in 2022, following the FTX episode, signaling a drop that marked a regime shift.

However, it’s still worth noting that this is not necessarily bullish or bearish, but simply a regime shift. Often, miner stocks tend to fall and rise before Bitcoin. Therefore, if the drop becomes significant, we could see BTC depreciating too.

Right now, Bitcoin may be decoupling because it’s entering a strong rally. All while macroeconomic conditions might not be favorable for mining companies.

Subscribe to our must read daily newsletter