OKB Soars to $54.7 Post 42.4M Token Burn – Will $56 Be the Next Stop?

OKB just lit a fire under its market cap—torching 42.4 million tokens in a burn that sent prices rocketing to $54.7. Traders are now eyeing the $56 resistance like Wall Street eyes a bailout—equal parts hope and skepticism.

Token burns aren't magic (despite what some crypto bros claim), but this one's got momentum. The question isn't whether OKB's got gas—it's whether traditional finance is ready to admit it's not the only game in town anymore.

Why is OKB rallying?

The recent price uptick is rallying for two major reasons. For starters, OKX has completed its 28th token burn, removing 42.4 million OKB worth $2.26 billion from circulation.

This represents a 20% reduction in the total circulating supply, which is 300 million tokens. This burning, which is a part of OKX’s strategy to reduce supply and raise scarcity, had a positive impact on OKB’s movement.

This burn activity creates a supply shock, thus sending the altcoin’s price surging. Often, a reduced supply while demand rises or remains constant leads to higher prices.

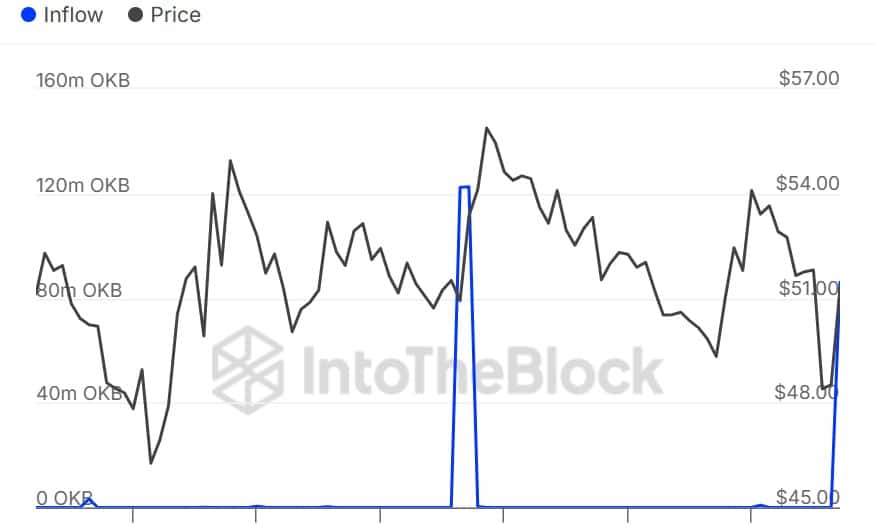

Secondly, OKB whales have made a strong comeback in the market. In the previous day, whale capital inflow had declined to hit zero, signaling total whale absence in the market.

Source: IntoTheBlock

However, over the past day, whales returned, scooping 86.13 million tokens. When whales turn to accumulation after exiting the market, it signals newfound interest and conviction in an asset’s prospects.

These two conditions have left OKB in favorable conditions, setting the altcoin up for more gains on its price.

Can the altcoin sustain recent gains?

According to AMBCrypto’s analysis, OKB was seeing an upward momentum that slowly started to build amid rising buying pressure. Notably, the Exchange FLOW Balance declined to negative territory over the past two days.

Source: Santiment

A negative Exchange Flow balance indicates a higher outflow than inflow, reflecting massive accumulation. This is also true since the altcoin’s RSI made a bullish crossover.

As prices surged, OKB RSI recovered from a low of 30 to 57, signaling total buyer dominance in the market. Over the same period, another bullish crossover emerged on the altcoin Stoch.

Source: Trading View

A crossover on Stoch suggests that buyers returning to the market strengthened the altcoin’s upward momentum. This uptrend is likely to continue if these bulls hold on to the market and totally displace sellers.

Therefore, the prevailing market conditions suggest that OKB could continue with the uptrend to attempt $56 resistance. However, if sellers return to take profit after the recent rally, the altcoin will pull back to $49 again.

Subscribe to our must read daily newsletter