TRX Bulls Eye $0.30 – But This Key Resistance Stands in the Way

TRON's TRX is flirting with a breakout – if buyers can smash through one critical barrier.

The crypto's been grinding toward $0.30, a psychological milestone that could trigger fresh FOMO. But charts show a stubborn resistance zone that's crushed rallies before.

Key levels to watch: A clean close above $0.25 opens the floodgates. Fail here, and we're back to watching traders pretend they 'believed in the project long-term.'

Volatility's the name of the game – buckle up.

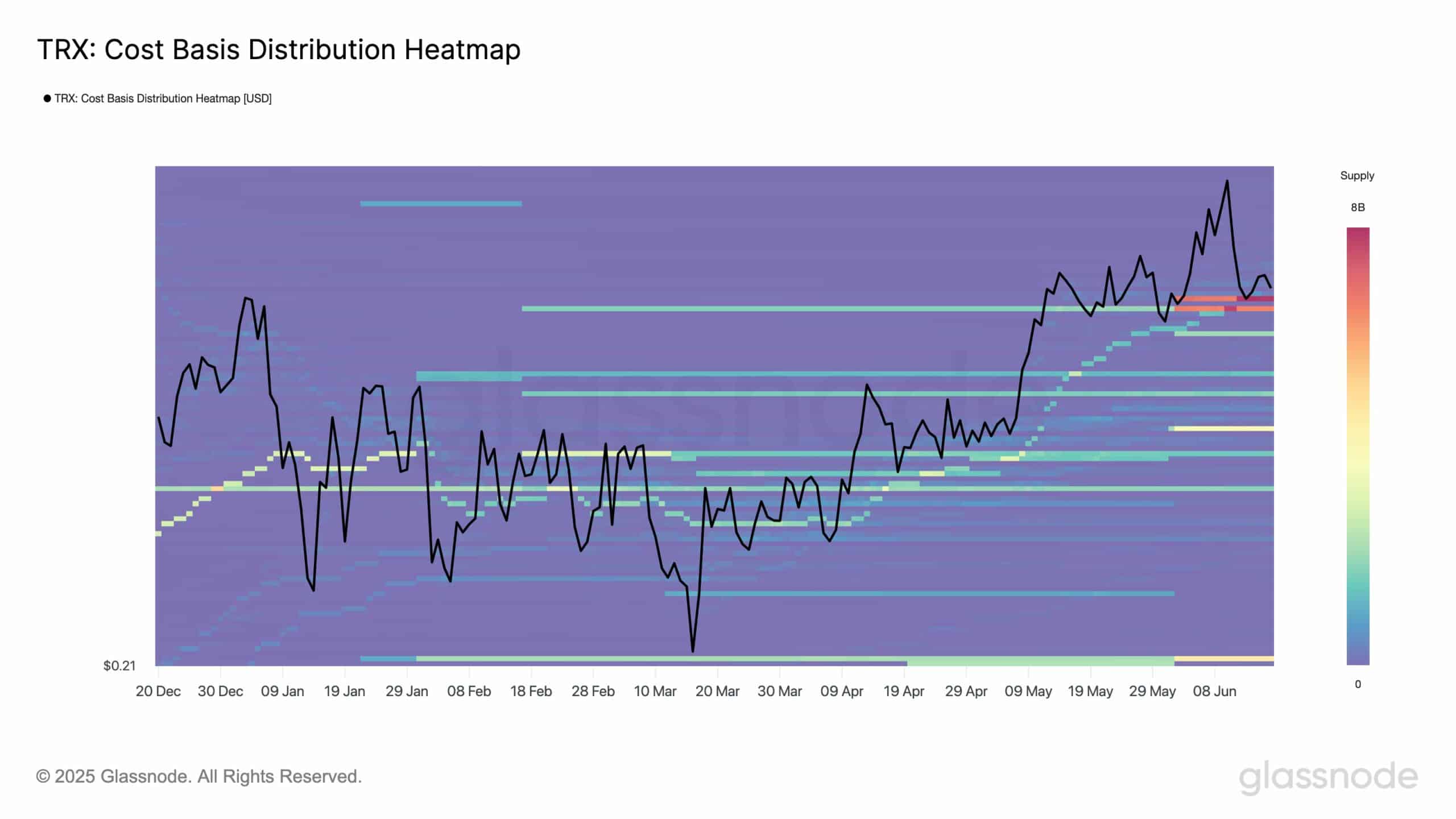

Source: Glassnode

Can TRX maintain its bullish trajectory above the trendline?

TRX has continued to trend above its ascending trendline that has held since March, maintaining its overall bullish structure.

Despite recent price pullbacks, the trendline and Fibonacci levels between $0.27 and $0.28 remain intact.

Moreover, the MACD line started to cross above its signal, hinting at a possible bullish momentum return.

This trendline has acted as dynamic support, and holding it WOULD be essential for a move toward the $0.30 resistance zone in the sessions ahead.

Source: TradingView

Most holders remain profitable, reducing sell pressure risk

At press time, IntoTheBlock data showed that 75.11% of all TRX addresses were “in the money,” totaling 70.47 billion TRX.

Additionally, 13.66% of wallets were “at the money,” sitting right within the key $0.267–$0.275 range.

Only 11.23% were facing unrealized losses. This distribution indicates that most holders are not under pressure to exit their positions.

With this structure, sell pressure could remain minimal, especially as TRX stays within or above the cost-basis cluster.

Source: IntoTheBlock

Whales and investors increase their TRX positions aggressively

The latest historical concentration data revealed a 9.59% increase in whale holdings over daily days. Even more significant is the 38.21% surge among long-term investor addresses.

Retail wallets grew modestly by 4.10%, showing less aggressive activity compared to institutional participants. This positioning highlights quiet accumulation by large entities.

If this trend persists, it could lay the groundwork for stronger price action once technical and macro conditions align more favorably.

Source: IntoTheBlock

New address growth points to expanding TRON network utility

Over the past week, TRON has seen a 32.15% rise in new wallet creation, coupled with a 2.68% uptick in active addresses.

At the same time, zero-balance addresses fell by 10.52%, implying better retention and actual usage. This trend reflects consistent onboarding of new users and signals improving fundamentals.

Continued expansion of the address base, especially alongside bullish investor behavior, often precedes strong mid-term price appreciation.

Source: IntoTheBlock

Was the recent sentiment spike a bullish trap or a signal?

Santiment’s Weighted Sentiment data shows a sharp surge above 7.5 followed by a quick reversal to −0.3.

This indicates that euphoric expectations emerged quickly before correcting, a pattern often seen before consolidations.

While sentiment spiked due to speculative excitement, it’s cooling off may have reset the market for a healthier move.

If Optimism returns and aligns with technical support, TRX could regain momentum with reduced risk of overheated positioning.

Source: Santiment

TRON continues to build strength just above a key support cluster, with over 75% of holders in profit and rising whale exposure. New address creation and declining sell pressure provide further reinforcement.

If the ascending trendline holds and sentiment recovers gradually, TRX could rally toward $0.29–$0.30 in the coming days.

Subscribe to our must read daily newsletter