Bitcoin’s Demand Drought: Decoding the Pause Before BTC’s Next Big Move

Bitcoin hits a liquidity wall—traders yawn as volatility flatlines. Is this the calm before the storm or just another dead cat bounce in crypto's endless drama?

Where did all the buyers go?

Order books thin out like a hedge fund's ethics department. Retail traders are glued to meme coins while institutions play wait-and-see—classic casino psychology meets Wall Street's 'risk management' theater.

The technical tightrope

BTC's price chart looks like an EKG with no heartbeat. Key support levels hold...for now. But everyone knows the crypto rule: sideways action never lasts. The question isn't if it breaks—but which way.

Market makers lick their chops at the impending volatility. Meanwhile, your portfolio manager still thinks blockchain is something you use to secure bicycles.

Metrics indicates waning demand pressure

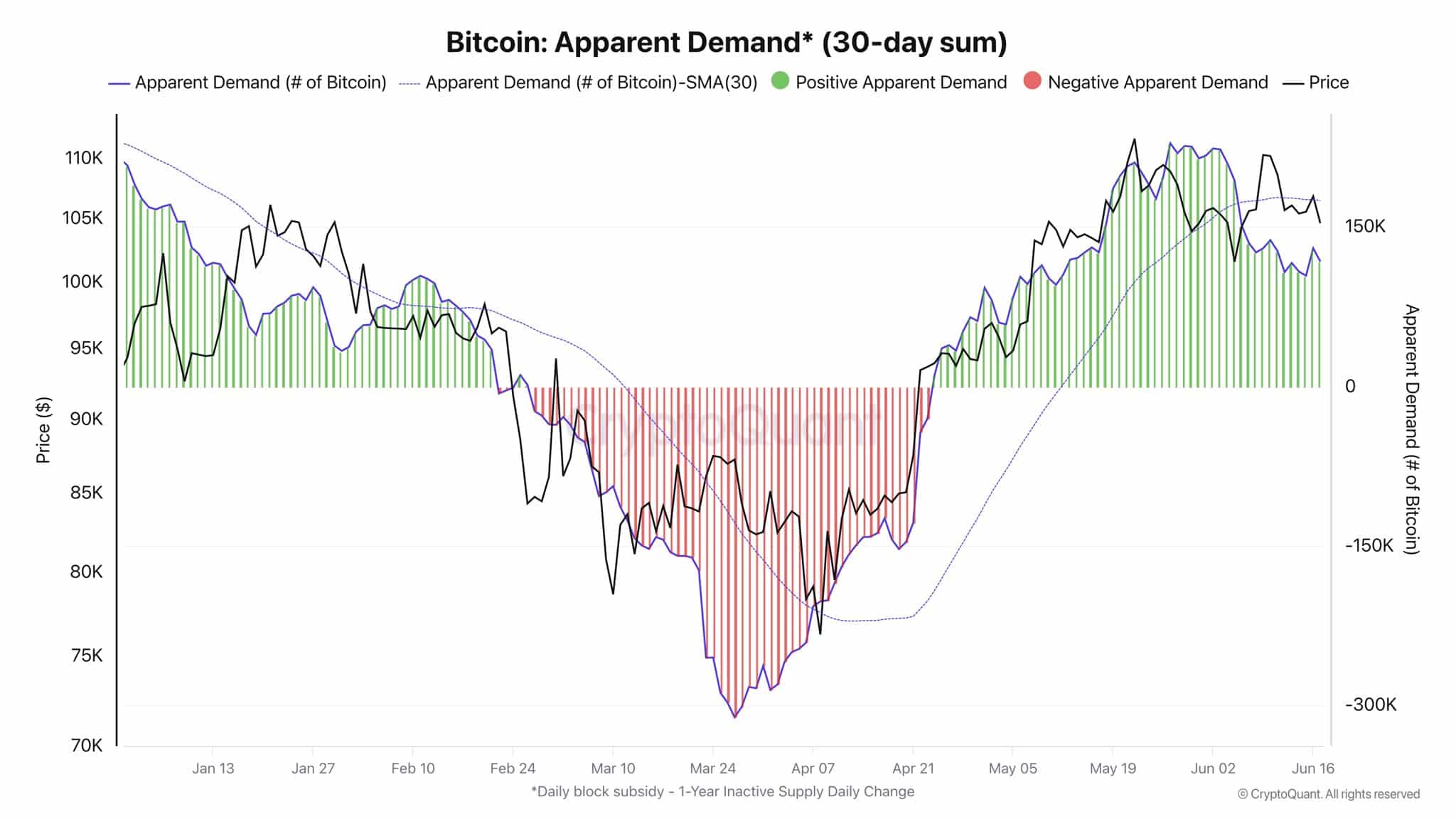

On-chain metrics support this view. AMBCrypto’s look at Bitcoin’s 30-day apparent demand indicated a slowly waning demand for the king coin.

The metric compares Bitcoin’s fresh supply with over 1-year dormant supply and ratio can serve as a proxy for market demand.

Since Bitcoin’s recent local top in early May, this ratio has been decreasing. Although it has not turned negative yet, the decline suggests that fresh BTC demand in the market has been fading over the recent few weeks.

Source: CryptoQuant

Support arises from holding behavior

Still, it is not all bearish. The steady decline in demand has failed to push the market into a sell-off. That is largely because of the firm holding action by the long-term holders.

Even as profit-taking crawl forward due to rising geopolitical tensions in the Middle East, HODLers refuse to budge.

The number of investors holding small coins, especially in the 10–100 BTC range, was approaching 32 million at press time.

This has kept the market in equilibrium. Selling pressure is present, but it is being mitigated by adequate buying interest to discourage sharp declines.

Source: IntoTheBlock

Market is balanced, but at a breaking point

Nothing holds forever. The current equilibrium courtesy, of the strong holders’ sentiment, could fade soon if the demand for BTC will not materialize.

Until then, Bitcoin’s price will likely remain at this spot of muted tension.

Subscribe to our must read daily newsletter