Solana ETF Mania Peaks: Should You Go All-In on SOL Before the Window Closes?

Wall Street's latest crypto crush is here—Solana ETFs are stealing the spotlight as institutional money circles the blockchain speedster. But is this a golden ticket or just another case of 'buy the rumor, sell the news'?

The SOL surge: How high can it really go?

Traders are piling into SOL derivatives like it's 2021 again, betting big on SEC approval. Meanwhile, Bitcoin maxis are grinding their teeth loud enough to drown out the memecoin shills.

Smart money moves vs. dumb money FOMO

While VCs quietly accumulate positions through OTC desks, retail investors are YOLO-ing into leveraged longs. Because nothing says 'sound investment strategy' like chasing 100x on a token that crashed 95% last cycle.

The final countdown: Institutional adoption or imminent rug pull?

With Grayscale filing paperwork and BlackRock's CEO 'accidentally' tweeting a SOL moon emoji, the stage is set. Either we're witnessing Web3's next infrastructure play—or the most elaborate exit liquidity scheme since Celsius.

DTCC listing shows forward momentum for Solana ETF

VanEck’s proposed spot Solana ETF (VSOL) has officially been listed on the Depository Trust & Clearing Corporation (DTCC) under its “active and pre-launch” category.

While the ETF cannot yet be created or redeemed, the listing makes it eligible for electronic trading and clearing; pending a final green light from the U.S. SEC.

Source: DTCC List of ETFs Active and Pre-Launch

Although approval is not guaranteed, the DTCC registration adds momentum to the growing field of ETF issuers. Bloomberg ETF analyst James Seyffart commented on the development, saying,

“I wouldn’t be completely shocked if we see approvals for Solana ETFs in the next month or so. But I also wouldn’t be surprised if we have to wait until the final deadline in October. Timeline unknown. At the end of the day — the SEC is engaging and that’s a good sign.”

The odds are high

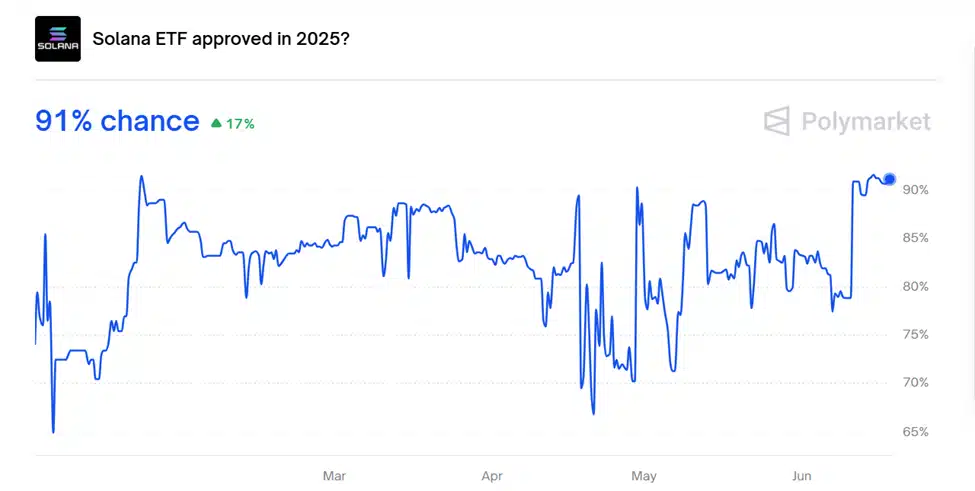

Market confidence in a Solana ETF is climbing fast. According to Polymarket, traders now assign a 91% chance that a spot Solana ETF will be approved in 2025; a 17% jump in just days.

Source: Polymarket

While the SEC has already approved Bitcoin and ethereum spot ETFs, Solana is emerging as the next likely candidate, supported by its robust developer activity, fast transaction speeds, and expanding DeFi ecosystem.

Combined with recent CME futures approvals, the stage is being set for SOL’s mainstream financial debut.

SOL struggles despite ETF momentum

Despite growing Optimism around the Solana ETF, SOL’s price action remained under pressure. At press time, SOL traded at $147.26, down 0.24% on the day.

The RSI was NEAR 42, showed weakened momentum while close to oversold territory. Meanwhile, the MACD indicator showed a bearish crossover, with the signal line positioned above the MACD line, confirming downward pressure.

Source: TradingView

While ETF news may be bullish long-term, short-term price recovery could face resistance unless broader buying demand returns.

Subscribe to our must read daily newsletter