Bitcoin Hodlers Defy Global FUD: Why Diamond Hands Are Still Winning in 2025

While traditional markets flinch at every shadow, Bitcoin investors keep stacking sats like it''s 2021. Here''s how crypto''s true believers are weathering the storm—and why Wall Street still doesn''t get it.

The Unshakable Cohort

Exchange outflows hit 18-month highs as whales move coins into cold storage. Retail wallets under 1 BTC continue growing despite CNBC''s best efforts to scare them off.

Liquidity Games

Tether''s printing press takes a breather, yet BTC/USD refuses to revisit its 2023 lows. Somebody forgot to tell the market it''s supposed to crash when the Fed tightens.

Institutions: Late as Usual

Goldman''s ''digital asset'' team finally admits their clients are asking about Bitcoin—just as miner rewards halve again. Classic hedge fund timing.

The real panic? Watching your fiat savings decay while that orange coin you mocked in 2020 now buys a house. Stay salty, bankers.

Bitcoin investors are in a wait-and-watch mode

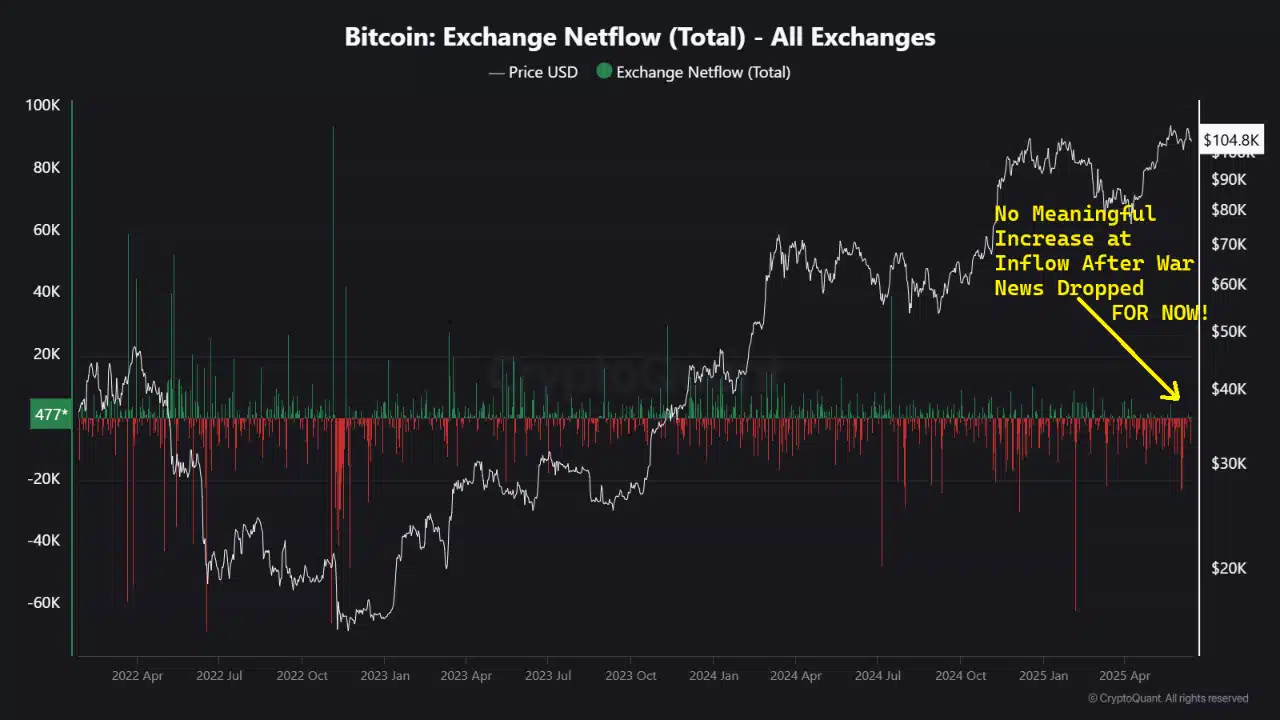

Source: CryptoQuant Insights

In a post on CryptoQuant Insights, user CryptoMe observed that the change in netflows has not been high. There has been no significant positive change in the netflows, which meant no high inflows as holders realized profits and exited the market.

This lack of selling, for now, may be a positive sign that investors might not be panicking.

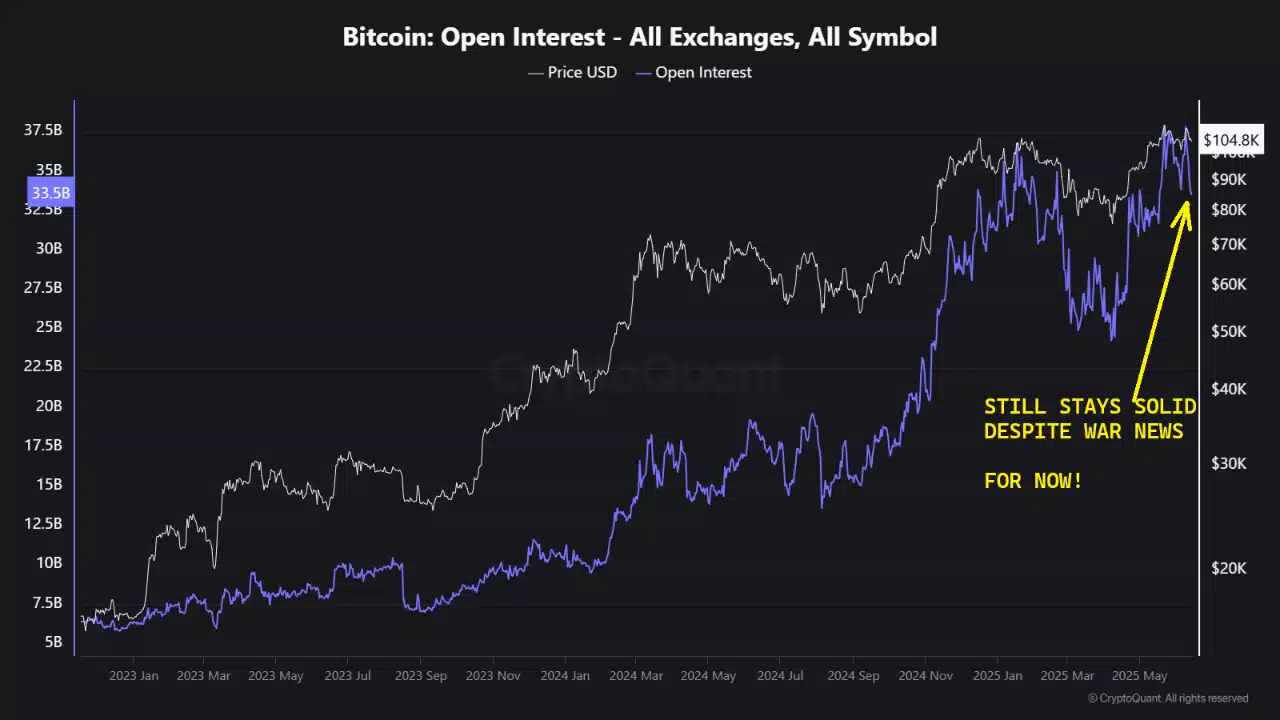

Source: CryptoQuant Insights

The Open Interest on centralized exchanges did not show a large drop. The correction from $110k to $105k saw long liquidations, which meant long positions were forcibly closed, explaining a good chunk of the OI drop.

However, it was not a large-scale sell-off. High OI levels meant speculative interest has been notably high, despite the fear and uncertainty in the market. It may be another sign that investors are in wait-and-watch mode right now.

Source: Axel Adler Jr on X

In a post on X, crypto analyst Axel Adler Jr noted that the press time reading was at 46%, just below the neutral threshold of 50%.

To resume the uptrend it saw previously in June, the index must climb beyond 60%-65%. This WOULD need sustained demand and capital influx.

Source: BTC/USDT on TradingView

The 1-day chart revealed that a bearish bias was warranted for bitcoin in the coming days. There was a long southward wick last Friday, whose low at $102.6k could be revisited soon. The CMF revealed that selling pressure was dominant, with the Awesome Oscillator suggesting that downward momentum was prevalent.

Overall, market participants should expect short-term volatility. However, in the face of FUD, the strength of the holders has been encouraging. It might be smart for retail investors to adopt this wait-and-watch stance as well.

Subscribe to our must read daily newsletter