Leverage, Liquidity & Longs: The Stealth Altcoin Rally Brewing Under the Radar

Crypto''s sleeping giants are stirring—and the leverage-fueled pump could catch markets off guard.

Liquidity Tsunami Meets Leverage

Altcoin order books are thinner than a DeFi protocol''s security audit. When liquidity surges into these shallow pools, even mid-cap tokens rocket like meme coins on Elon''s Twitter feed.

Longs Piling Up in the Shadows

Perps traders are loading up on altcoin futures like 2021 never ended. The difference? This time, the smart money''s positioning before retail FOMO kicks in—classic ''buy the rumor, sell the news'' with extra steps.

The Setup Nobody''s Talking About

While Bitcoin maximalists obsess over ETF flows, altcoin leverage ratios are quietly hitting levels that''d make a 3AC risk manager blush. All it takes is one catalyst—a Fed pivot, an exchange listing, or just good old-fashioned greed—to trigger the cascade.

Remember: in crypto, the biggest rallies always start when everyone''s looking the other way. Just don''t be the bagholder when the music stops—Wall Street''s quant funds certainly won''t be.

Crowded longs hint at imminent market rebalancing

While spot prices remain subdued, the perpetual market is gearing up like something big is coming.

Across the board, over 70% of altcoins are seeing a strong long bias, and on Binance, the big players aren’t holding back. High-cap assets have, on average 60%+ of traders leaning long.

However, this isn’t just random optimism. Instead, it looks more like strategic risk-taking.

Simply put, after last week’s brutal liquidation cascade, traders seem to be betting on a near-term market rebalancing, eyeing a potential short squeeze.

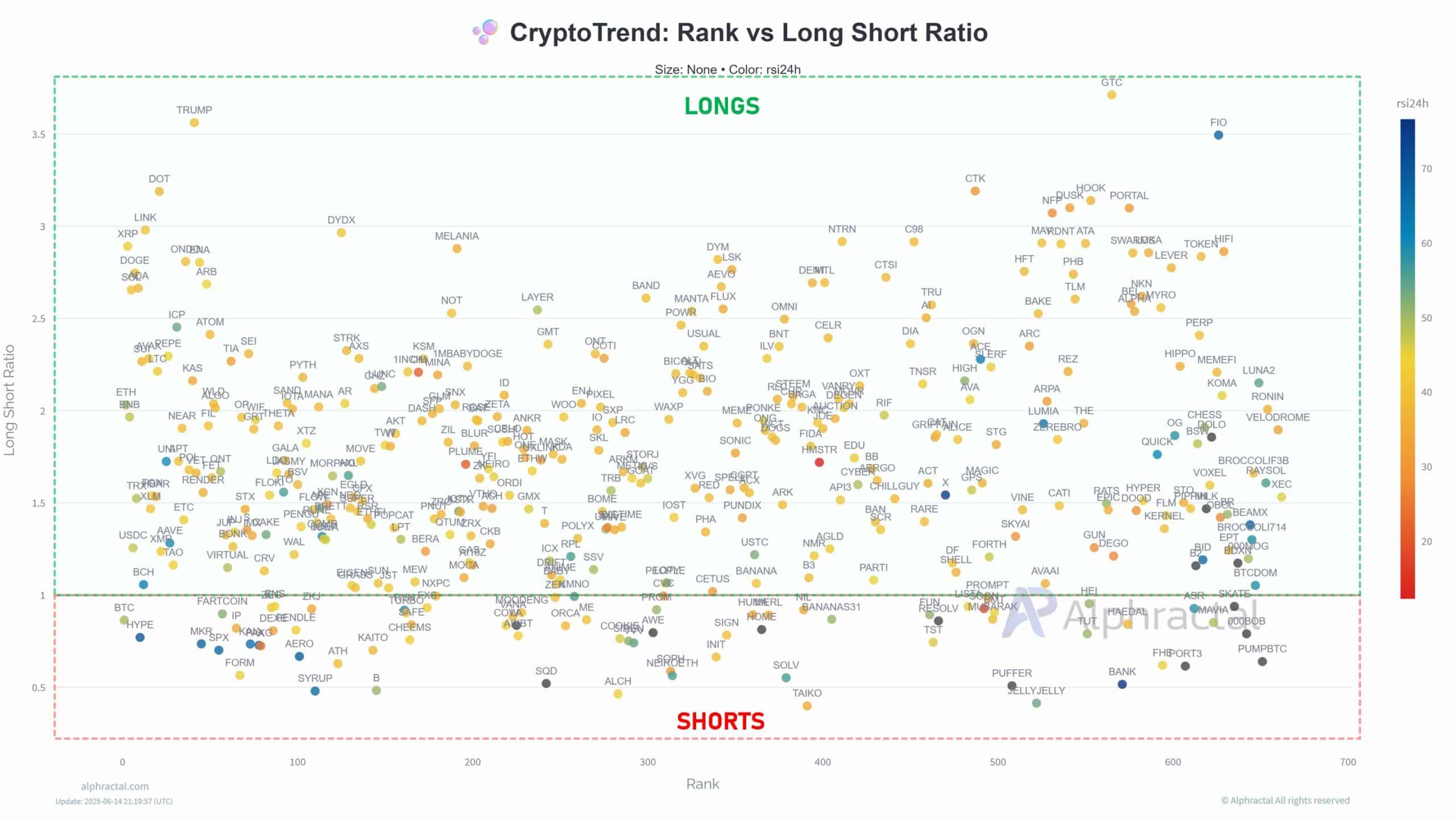

The chart below shows the Y-axis tracking the Long/Short Ratio, with a cluster of altcoins sitting well above 1.0, clearly signaling that traders lean heavily long beneath the surface.

Source: Alphractal

That’s a bold move considering the recent volatility. What if bitcoin breaks down toward $100k? That’s the scenario short-sellers are likely positioning for, opening the door for late-arriving shorts to press the downside.

Still, if the market holds steady and shrugs off the chop, those late shorts could get squeezed hard. That’s exactly what the bulls seem to be betting on with all this long exposure across alts.

Given the circumstances, it’s a coin flip at this stage, and whichever side plays it smarter will set the tone for the next move.

Market positions for a strategic altcoin rally

With Bitcoin dominance back above 65%, it’s clear that altcoins are still taking their cues from BTC. If Bitcoin heads back down to $100k, chances are alts will follow suit.

The last drawdown proved it. While BTC dropped 9.6% from its ATH, ethereum [ETH] posted a sharper 10.25% correction.

The reason? – Elevated long exposure across altcoins amplified downside pressure.

Source: TradingView (ETH/USDT)

However, AMBCrypto recently flagged a key structural shift in the current cycle that makes Bitcoin’s full retrace to $100k less probable.

If BTC stabilizes, altcoins could not only stage a relief rally but potentially lead the rebound, especially if a short squeeze accelerates upside momentum.

That’s why this “dip” might not be something to fear. Instead, it could be a smart entry point for those looking to catch the next MOVE early.

Subscribe to our must read daily newsletter