Bitcoin’s Next Rally: Boring? Maybe. Bullish? Absolutely.

Forget fireworks—Bitcoin’s next move might be a slow burn, but the trajectory screams upside.

The Stealth Bull Run

No hype, no memes—just relentless accumulation. Institutional wallets are plumping up like a hedge fund’s expense account.

Why ‘Boring’ is the New Black

Volatility’s taking a nap? Good. The market’s maturing—trading like a blue chip, not a degenerate casino (well, mostly).

The Cynic’s Corner

Wall Street’s ‘adopting’ crypto the same way it ‘adopts’ innovation—after sucking out all the fun and slapping on a management fee.

Bottom line: Sleepy price action doesn’t mean sleepy gains. Buckle up.

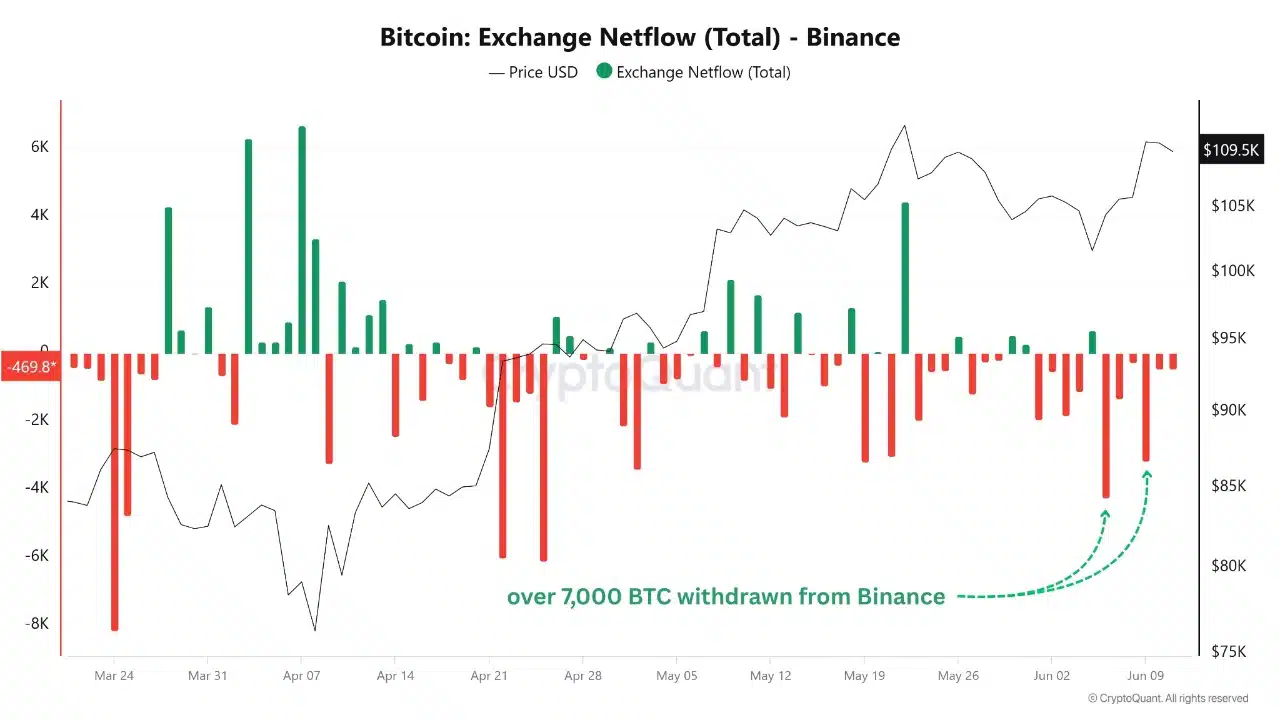

Binance sees over 7,000 BTC in outflows

Bitcoin’s recent strength is supported by a visible shift in exchange behavior, particularly on Binance.

Since the 6th of June, more than 7,000 BTC have been withdrawn from the exchange, as reported by a CryptoQuant report.

Source: CryptoQuant

This trend, marked by a cluster of red netflow bars, shows rising preference among investors to self-custody their holdings; typically a sign of reduced short-term selling intent.

As BTC exits centralized platforms, available supply thins out, often foreshadowing a supply squeeze. When paired with rising price action, such withdrawals can strengthen bullish momentum by limiting downside liquidity.

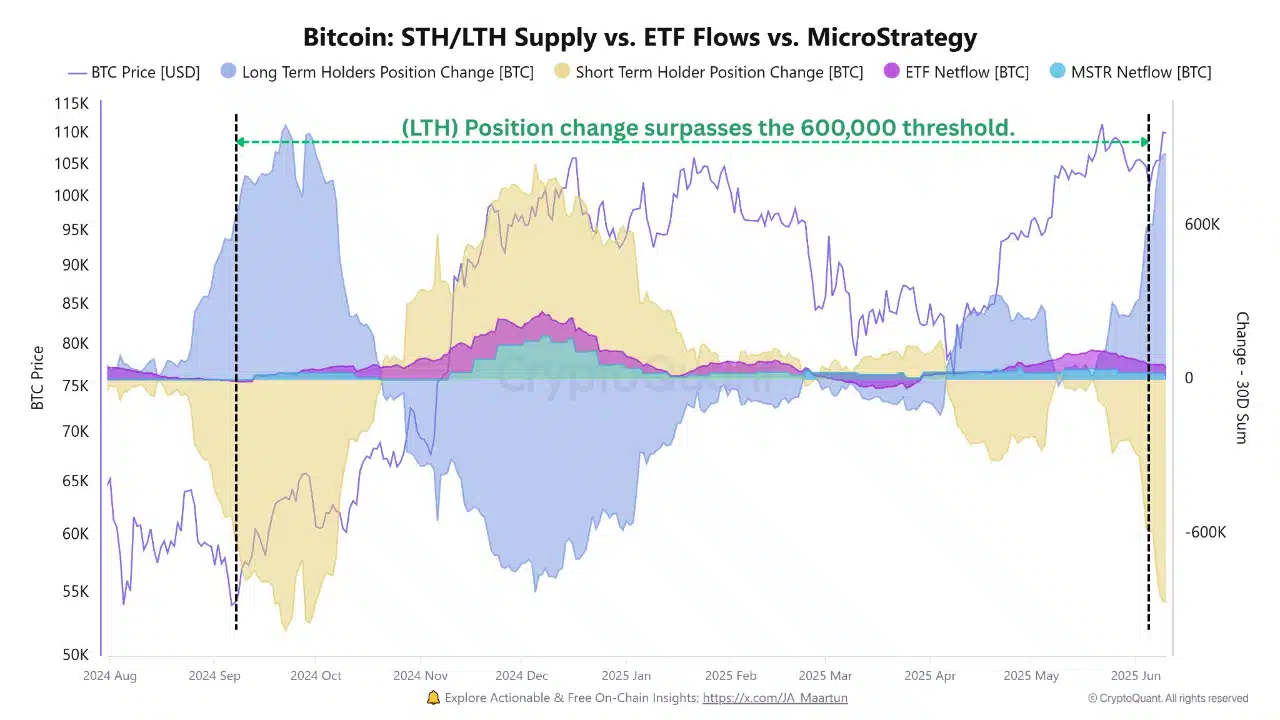

LTHs take the wheel

LTH position change has soared past the 600,000 BTC mark for the first time since September 2024; an aggressive accumulation phase by investors with a long-term outlook. This MOVE creates a sturdier market foundation.

Source: CryptoQuant

In contrast, STH activity has remained muted. These weaker hands — often prone to panic selling — are largely absent, further reducing downside volatility risk.Are we entering Bitcoin’s next bullish leg?

With fewer coins sitting on exchanges and more in the hands of LTHs, the sell-side pressure appears limited. Institutional flows and ETF inflows remain steady in the background, adding further support.

While short-term volatility can’t be ruled out, the structural trends suggest that the path of least resistance is upward.

As accumulation continues and supply tightens, market conditions are aligning for a potentially extended bull cycle.

Subscribe to our must read daily newsletter