Ethereum Whales Double Down – Strategic Accumulation or Panic Buying at Peak Prices?

Whale wallets are swallowing ETH at levels that would make retail investors sweat. Is this the smart money betting big on Ethereum''s next leg up—or just FOMO masquerading as conviction?

The Whale Feeding Frenzy

On-chain data shows massive buy orders executing well above recent support levels. These aren''t nibbles—we''re talking nine-figure positions moving the market.

Pricey Convictions

While analysts debate whether this is accumulation or desperation, one thing''s clear: when whales play, the market listens. Their timing? Either brilliant or disastrous—the blockchain ledger won''t lie in 6 months.

The Retail Dilemma

Meanwhile, Main Street investors face the age-old crypto question: follow the whales and risk catching falling knives, or watch from the sidelines and risk missing the next rally? As always on Wall Street (and now Blockchain Street), someone''s about to be proven very right—or very poor.

Whales sell, then buy back at a premium

One such case was observed by Onchain monitors where a whale sold 30,000 ETH worth $78.63 million to realize a profit of $6.72 million.

However, after ETH surged past $2,800, this whale bought back just one day after selling.

According to Spotonchain, this whale has decided to buy back 16.5k ETH worth $46.4 million from Wintermute at a higher price of $2,818.

The whale made this purchase at a higher price after selling at an average price of $2,621. When large entities decide to purchase an asset at a higher price, it reflects strong conviction and rising demand.

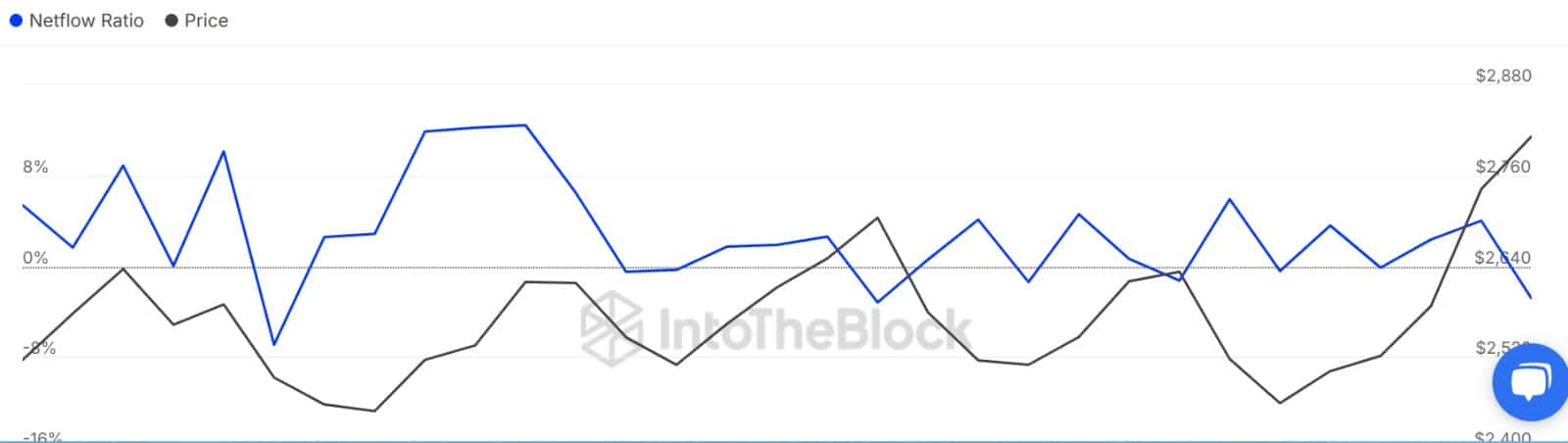

Source: IntoTheBlock

The return of whale activity wasn’t isolated.

Large Holders Netflow to Exchange Netflow Ratio hit -2.83, a two-week low. This sharp dip signals more ETH flowing into cold storage than into exchanges—a classic sign of accumulation.

Source: IntoTheBlock

Additionally, more than 140,000 ETH, worth approximately $393 million, have been withdrawn from exchanges, marking the largest one-day withdrawal in over thirty days.

This further reinforces our observation of the broad-based demand for Ethereum, with both whales and retailers entering to accumulate the altcoin.

ETH retraces, as profit-takers step in

Despite rising demand, Ethereum’s price dropped 1.76% over the last day to $2,756.

While whales stocked up, retail profit-taking began kicking in, evident in the shift in Exchange Netflow.

Source: CryptoQuant

The Netflow Ratio flipped positive again, meaning exchange inflows are outpacing outflows, hinting that many investors are cashing out while prices remain elevated.

This back-and-forth reflects an ongoing tug-of-war.

While ETH is leaving exchanges, it’s also entering, signaling uncertainty on whether the rally will stick.

If this stalemate persists, ETH may stay boxed within the $2,400–$2,700 range. For any sustained breakout toward $3,000, sellers must cool off.

Only once profit-taking slows can bulls seize momentum and push ETH to its short-term target.

Subscribe to our must read daily newsletter