TRON Whales Flex Muscle as TVL and Sell Pressure Collide—Where’s TRX Headed Next?

Whale activity spikes while Total Value Locked (TVL) wobbles—TRX traders brace for impact.

Sell pressure mounts like a Wall Street banker’s bonus expectations. Will TRON’s price defy gravity or buckle under the weight?

Market watchers eye key levels as the network’s heavy hitters play tug-of-war with liquidity. No crystal balls here—just cold, hard on-chain data.

One thing’s certain: in crypto, the house always wins… until it doesn’t.

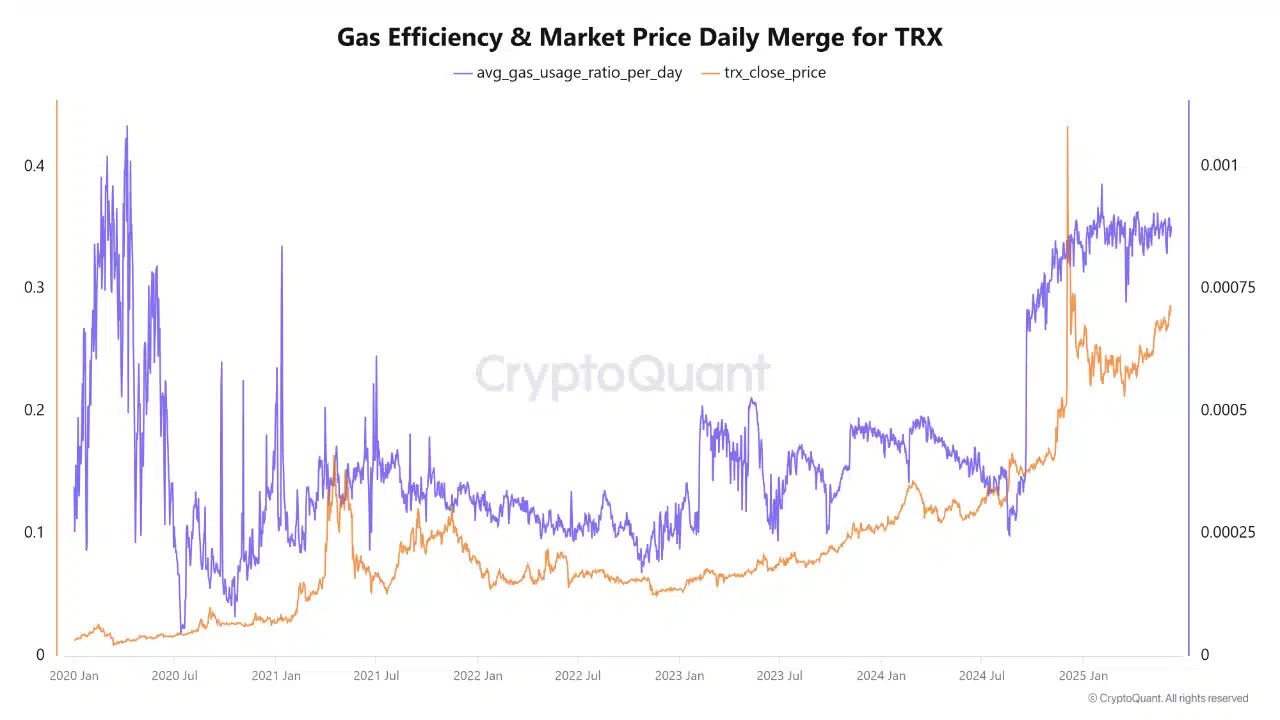

Source: CryptoQuant

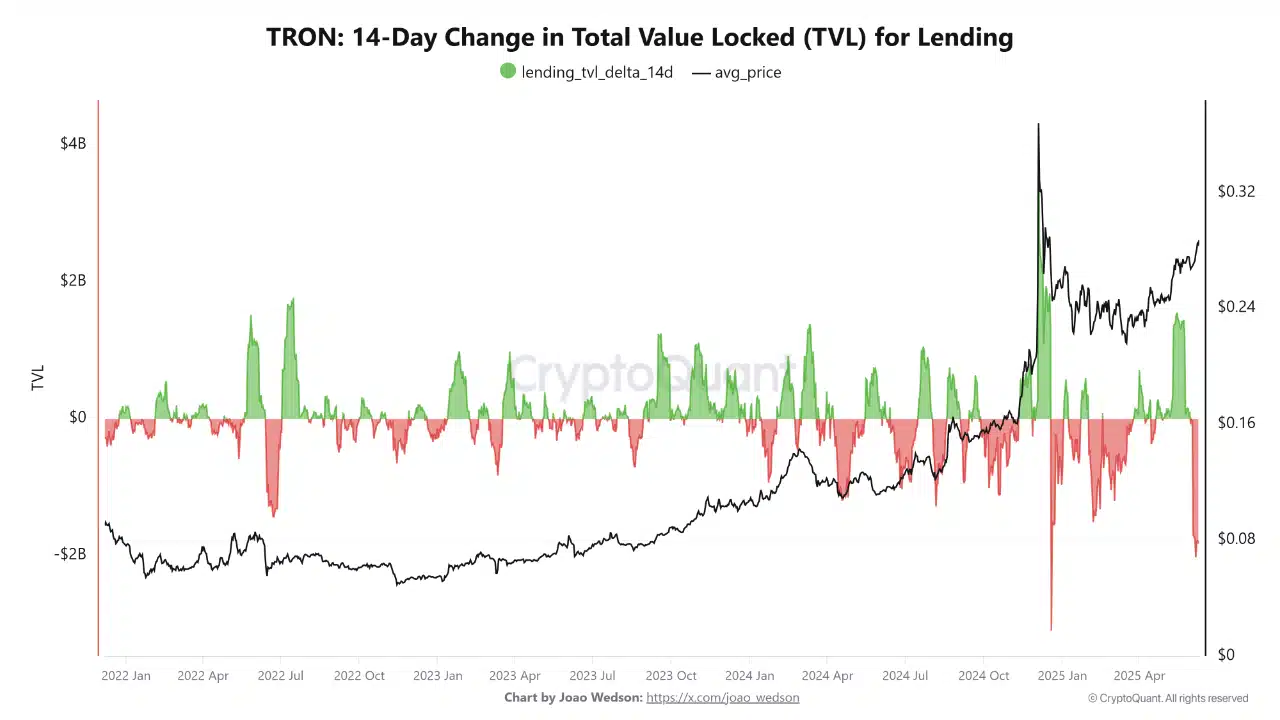

Is the lending TVL crash an early warning for bulls?

TRON’s lending sector has witnessed a sharp $2 billion decline in total value locked, pushing the 14-day delta deeply into negative territory.

This drop is particularly striking, given TRX’s upward price movement during the same period. Historically, lending TVL contractions have aligned with market uncertainty or capital rotation.

Therefore, the ongoing divergence raises red flags. It may reflect shrinking borrower demand or broader structural concerns within the TRON ecosystem.

Although the price has stayed strong, sustained capital outflows from lending protocols could eventually weigh on investor confidence and spark volatility.

Source: CryptoQuant

Will sell pressure undermine TRX’s bullish momentum?

Despite TRX’s price hovering near breakout territory, the 90-day cumulative taker volume delta was skewed towards sell orders at press time.

This suggested that market sells have been outpacing aggressive buys – A sign of possible distribution. Historically, rallies led by passive flows without strong taker demand often lost steam quickly.

Therefore, unless buying volume flips dominant, the prevailing rally may struggle to gain traction. Such an imbalance could underscore the importance of watching spot market behavior closely.

Source: CryptoQuant

Are whales and investors silently preparing for a bigger move?

While taker data revealed hesitation, on-chain distribution painted a different picture. Whale wallets increased their holdings by 10.17%, while mid-tier investors added 41.19% over the past 30 days.

Retail holders, by contrast, showed only marginal growth. This trend indicated that sophisticated players may be positioning themselves ahead of a potential breakout.

Historically, rallies sustained by institutional accumulation tend to be more durable.

Source: IntoTheBlock

At the time of writing, TRX was trading at around $0.288 – Placing 92.39% of holders in profit. Such elevated levels of realized gains can support confidence, but it may also encourage short-term profit-taking.

When nearly all participants are “in the money,” upside momentum often slows down as sell pressure builds near key resistance zones.

Is TRX ready to escape its multi-month trading range?

TRX has spent months consolidating between $0.25 and $0.29, creating a tight horizontal range. At press time, the price was testing the upper band of this zone, with the RSI nearing 65.

A clean breakout above $0.29 could trigger renewed upside, potentially reclaiming previous highs. However, this scenario depends on strong volume confirmation and sustained network demand.

Without those signals, the price may continue to oscillate within the established range or face rejection from resistance.

Source: CryptoQuant

TRX’s latest uptrend found support in whale accumulation and the hike in network activity. However, the drop in lending TVL and persistent sell-side taker pressure could introduce risk.

TRX must decisively flip $0.29 into support with strong buyer presence to validate the bullish setup and escape its long-standing consolidation range.

Subscribe to our must read daily newsletter