Bitcoin Whale Drops $26M Bomb—Is $107K the Next Stop?

A single Bitcoin whale just moved $26 million worth of BTC—sparking speculation that a push past $107K might be imminent. Market watchers are torn between bullish euphoria and the usual Wall Street eye-roll at crypto's volatility.

Could this be the catalyst for the next leg up, or just another overhyped blip? Either way, traders are strapping in—because when whales swim, the market ripples.

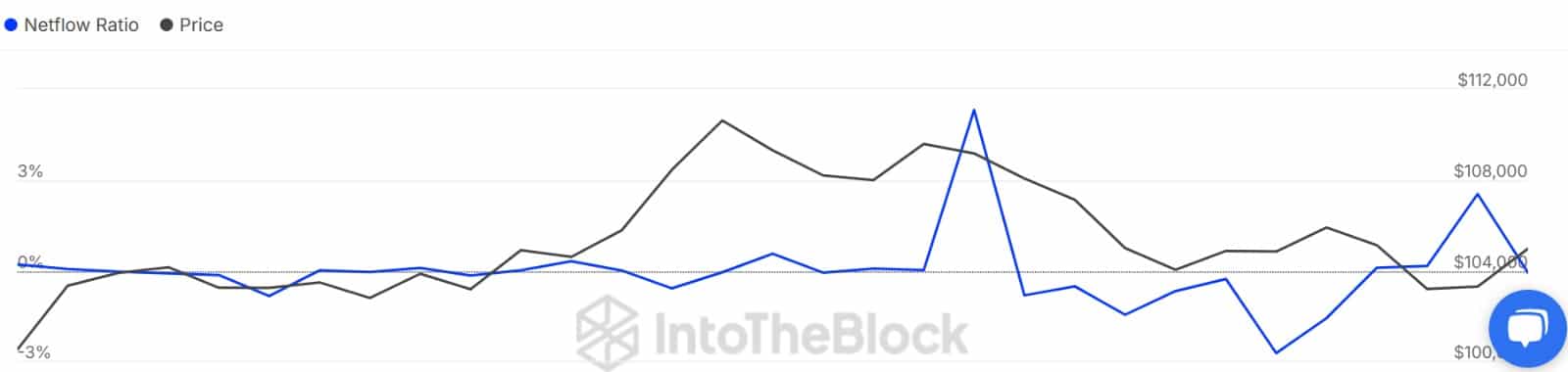

Whales are pulling BTC from exchanges

Source: IntoTheBlock

When we look at overall whale behavior, this group is aggressively accumulating.

According to IntoTheBlock, the Netflow Ratio of Large Holders has dropped to the negative zone, hitting -0.05.

In plain terms, whales aren’t sending coins to exchanges to sell. Instead, they’re moving them out — a sign of conviction.

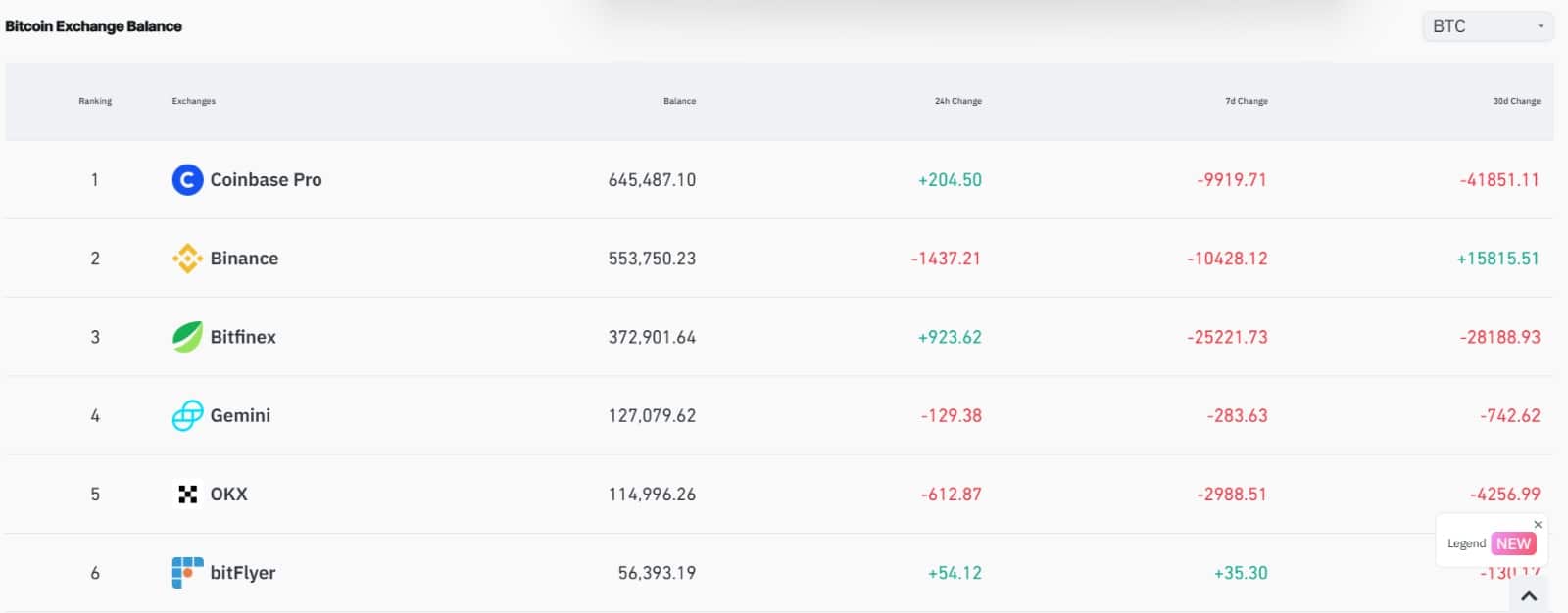

Source: CoinGlass

This aligns with broader Exchange Balance data.

According to CoinGlass data, over the past week, about 67,854.33 Bitcoins have left centralized exchanges.

In detail, 25,368.42 BTC flowed out of Bitfinex in the past 7 days, and 10,291.95 BTC flowed out of Binance.

Finally, 9,867.35 BTC flowed out of Coinbase, signaling high demand for the crypto. This demand is evidenced by the fact that the Taker Buy Sell Ratio has remained positive for two consecutive days.

Source: CryptoQuant

When this metric holds above 1 and positive, it suggests that buyers are dominating the market. Inasmuch so, buyers have scooped 8.68k BTC over the past two days, with the market recording a positive delta.

What’s next for Bitcoin? – Momentum or correction

According to AMBCrypto’s analysis, Bitcoin is seeing buying momentum reawaken.

Although BTC has struggled on its price charts, whales and retail investors are convinced of the market and remain optimistic.

Historically, a high demand for bitcoin has preceded higher prices. For instance, when BTC rallied to the recent ATH, buyers accumulated 65.9k BTC within 48 hours.

If the market maintains this momentum, BTC could finally break above the $107K resistance and retest the $109K zone — a level that has rejected buyers twice before.

Having said that, if buying pressure fades, the vacuum could be quickly filled by sellers. In that case, BTC risks dropping below the $104K support and slipping as low as $101,436.

Subscribe to our must read daily newsletter